How to Configure Magento 2 Barclaycard Payments Today?

Looking for a trusted payment gateway for your UK-based business? Magento 2 Barclaycard payments offer to overcome abandoned carts and customer payment hesitancy.

In this article, we will explain the features, extensions, and troubleshooting common issues.

Key Takeaways

-

Magento Barclaycard integration connects with the UK's trusted payment gateway.

-

Advanced security features protect transactions with 3D Secure authentication.

-

Many fraud detection systems check transactions using machine learning.

-

The configuration process requires PSPID credentials and proper security settings.

-

Common troubleshooting solutions address payment failures and 3D Secure issues.

-

Backend order management supports MOTO payments, refunds, and tracking.

-

Steps to Configure the Magento 2 Barclaycard Payment Extension

-

Troubleshooting Common Issues with the Barclaycard Payment Gateway

What is Magento 2 Barclaycard Integration?

Magento 2 Barclaycard integration is a payment gateway solution. It connects your e-commerce store with Barclaycard's ePDQ payment processing system.

Barclaycard is a leading payment gateway serving 48+ million customers across 50+ countries. Stores can accept Visa, Mastercard, American Express, Maestro, Diners Club, and JCB. Here are a few benefits:

-

Brand Recognition: Established reputation in the UK market.

-

Security Features: PCI DSS compliance and advanced fraud protection.

-

Customer Base: Access to the existing Barclaycard user network.

-

Global Reach: Operations in 40+ countries.

Key Security Features of the Barclaycard Payment Gateway

1. 3D Secure Authentication

-

Barclaycard's 3D Secure adds an extra verification step. It confirms the cardholder's identity during each transaction. The system creates a secure barrier between fraudsters and successful transactions.

-

The system needs customers to provide something they know and have. Customers first enter their standard card information during checkout. The system then prompts them to provide additional verification through their bank. This dual-layer approach makes unauthorized transactions difficult to complete.

-

Banks send one-time passwords (OTPs) to customers' phones during payment processing. Some card issuers need customers to enter their personal identification numbers instead. The verification method depends on the customer's bank and their account security settings.

-

Card issuers process 3D Secure requests through their secure authentication servers. The customer's bank verifies their identity using internal security protocols.

-

3D Secure authentication reduces fraudulent transactions and chargebacks. Statistics show a dramatic decrease in unauthorized card usage when 3D Secure is activated. Merchants experience fewer disputed transactions and chargeback fees.

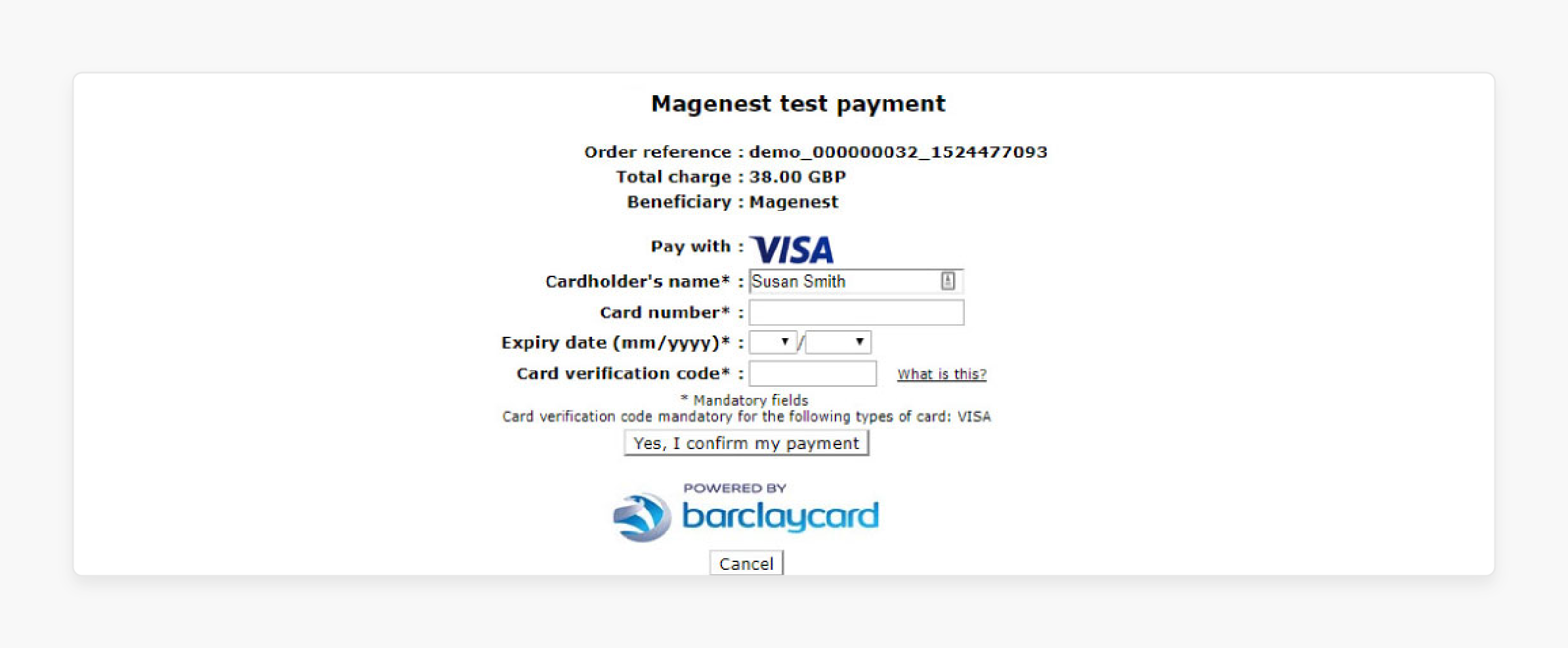

2. Card Verification Code (CVC) Protection

-

Barclaycard requires CVC verification for card authentication during every transaction. The system prompts customers to enter their card's security code. Merchants cannot disable this security need through configuration settings.

-

The payment gateway validates the three or four-digit security code during checkout. American Express cards use four-digit codes, while other major cards use three-digit codes.

-

The system checks this code against the card issuer's database in real-time. Invalid codes trigger immediate transaction rejection before processing begins.

-

Barclaycard's system cross-verifies the CVC against the card number and expiration date. All three data points must match the card issuer's records. This triple verification process catches stolen card numbers used with incorrect security codes. The system also validates that the card hasn't expired during the verification process.

-

The gateway rejects transactions when customers enter incorrect CVC information. Error messages appear without processing charges or authorization attempts. Magento customers receive clear instructions to re-enter their security code.

-

CVC verification provides enhanced protection against fraud with stolen card numbers. Fraudsters lack access to the physical card's security code. This verification method detects unauthorized transactions before they are completed.

3. SHA Encryption and Hash Algorithms

-

Barclaycard uses SHA-1 and SHA-2 passphrases to verify input and returned parameters. SHA-IN validates data sent from Magento to Barclaycard's servers. SHA-OUT verifies information returned from Barclaycard back to the merchant's system. These pass phrases act as digital signatures that confirm authenticity.

-

The payment gateway supports hash algorithms, including SHA-256 and SHA-512. Admins can select their encryption strength based on security requirements. SHA-512 provides stronger encryption than SHA-256 for better data protection. Both algorithms meet current industry standards for secure payment processing.

-

The system creates cryptographic signatures that ensure data remains unchanged. Each transaction receives a unique digital fingerprint based on its parameters. Barclaycard compares these signatures before and after data transmission. Any tampering or corruption triggers automatic transaction rejection.

-

Magento and Barclaycard systems verify transaction parameters in both directions. The system validates data received from Barclaycard using SHA-OUT verification. Barclaycard confirms incoming data from Magento through SHA-IN validation.

-

SHA encryption protects against hackers modifying transaction data during transmission. Encrypted signatures make it hard for attackers to alter payment information undetected. The system identifies manipulated data through signature mismatches.

4. Advanced Fraud Detection Systems

-

Barclaycard employs ML algorithms to check every transaction as it occurs. These intelligent systems analyze payment patterns and customer behaviors. The algorithms learn from old transaction data to improve detection accuracy.

-

The fraud detection system identifies unusual payment behaviors. It is through advanced pattern recognition and analysis. Algorithms flag transactions that deviate from normal customer spending habits.

-

Fraud detection mechanisms track transaction locations and timing to find impossible scenarios. The system flags buys made from different countries within short time periods. Velocity-based detection catches many rapid transactions that exceed normal customer behavior.

-

Each transaction receives an instant risk score based on many security factors. The system evaluates customer history, transaction details, and behavioral patterns within milliseconds.

-

The system blocks or flags transactions that exceed predetermined risk thresholds. High-risk payments stop before reaching the authorization phase.

-

Owners can adjust fraud detection sensitivity based on their specific business requirements. Custom thresholds allow businesses to balance security with customer convenience. Higher sensitivity catches more fraud but may block legitimate transactions.

-

The system has country-specific risk assessment and blocking capabilities. Merchants can restrict payments from high-risk countries or regions. Geographic blocking helps prevent fraud from known problematic locations.

-

Businesses can set custom transaction amount limits and frequency restrictions. The system monitors amounts against predetermined maximums for different customer types. Frequency monitoring catches unusual patterns, like many rapid purchases.

3 Popular Magento 2 Barclaycard Payments Extensions

| Extension | Key Features | Pricing |

|---|---|---|

| Mageplaza Barclaycard Extension | - Dual integration: ePDQ e-commerce & DirectLink - Supports Visa, Mastercard, AmEx, Maestro, Diners Club, JCB - Backend payment (MOTO) for phone/email orders - 3D Secure with enable/disable option - SHA-IN/SHA-OUT encryption - Min/max order total restrictions - Compatible with One Step Checkout - FREE Hyva compatibility - Magento API/GraphQL for headless commerce - Professional support & docs | Starting at $199 for the first year |

| Meetanshi Barclaycard Payments | - ePDQ Direct & hosted payment support - 3D Secure & CVC verification - Hash algorithms for security - Seamless checkout (Direct method) - Custom payment titles & config - PCI DSS compliance - Real-time processing & logs - Supports major credit/debit cards - Sandbox mode for testing - Compatible with Magento 2.4.7-p1 & GraphQL | $149.00 |

| Magenest ePDQ Payment Gateway | - DirectLink with SCA compliance (PSD2) - 3D Secure support - Backend payment (MOTO) - CVC & fraud protection - Access to 50+ markets - Customizable payment page design - Enhanced brand via Barclaycard - Compatible with Magento 2.4 (v1.5.3+) - Country selection config - Custom dev services - Fraud order management - Advanced webhook support | $199 |

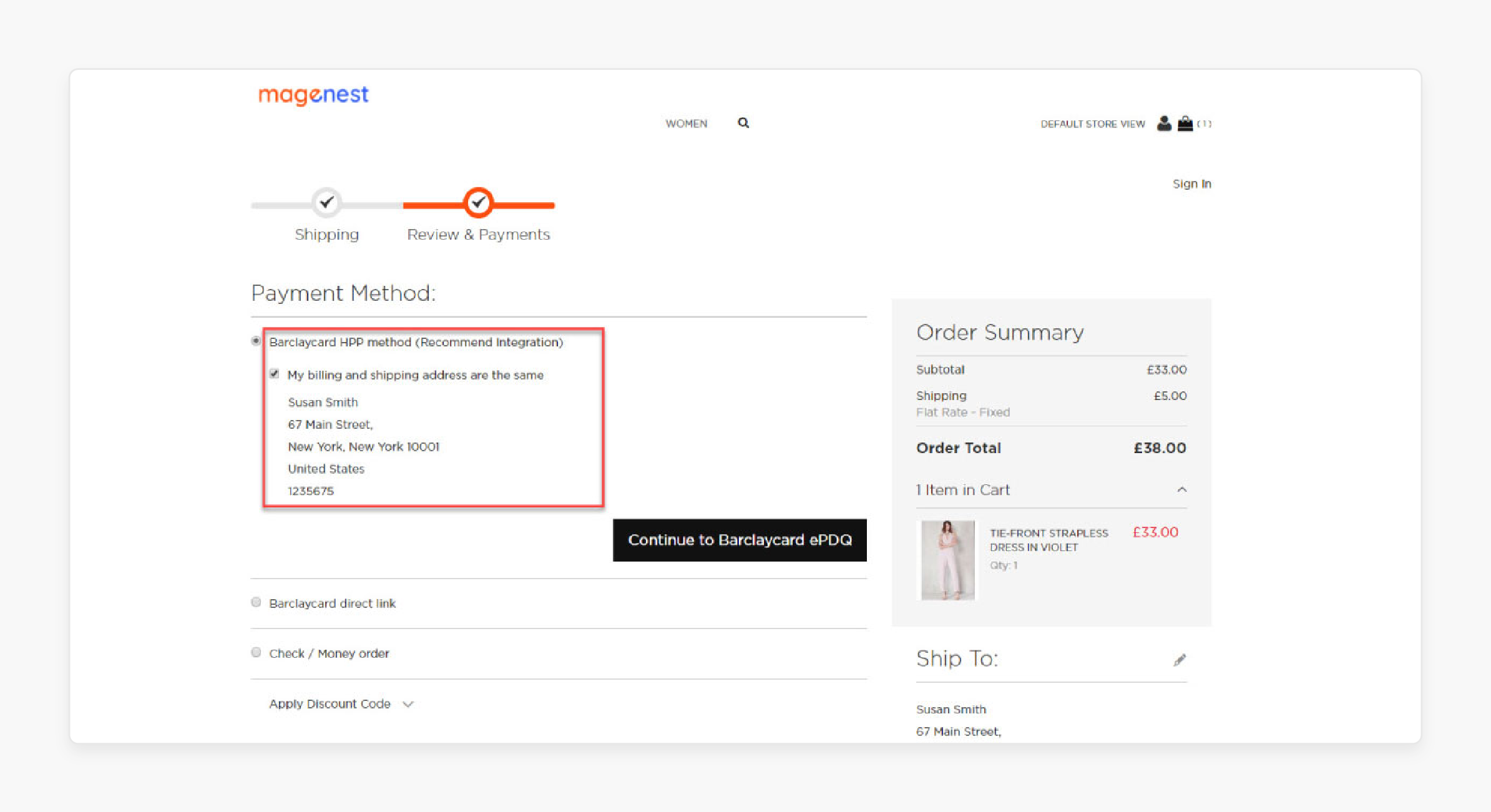

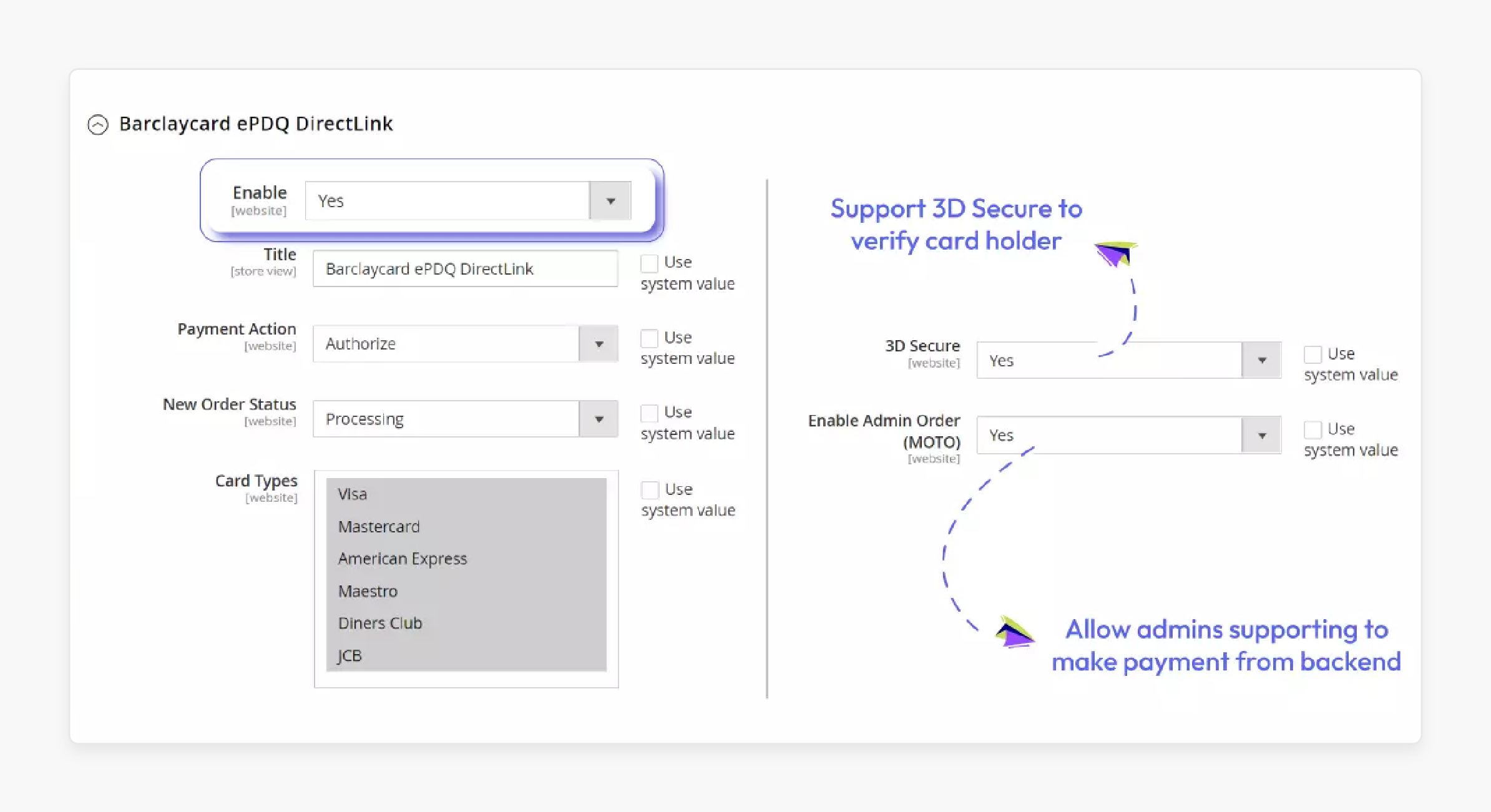

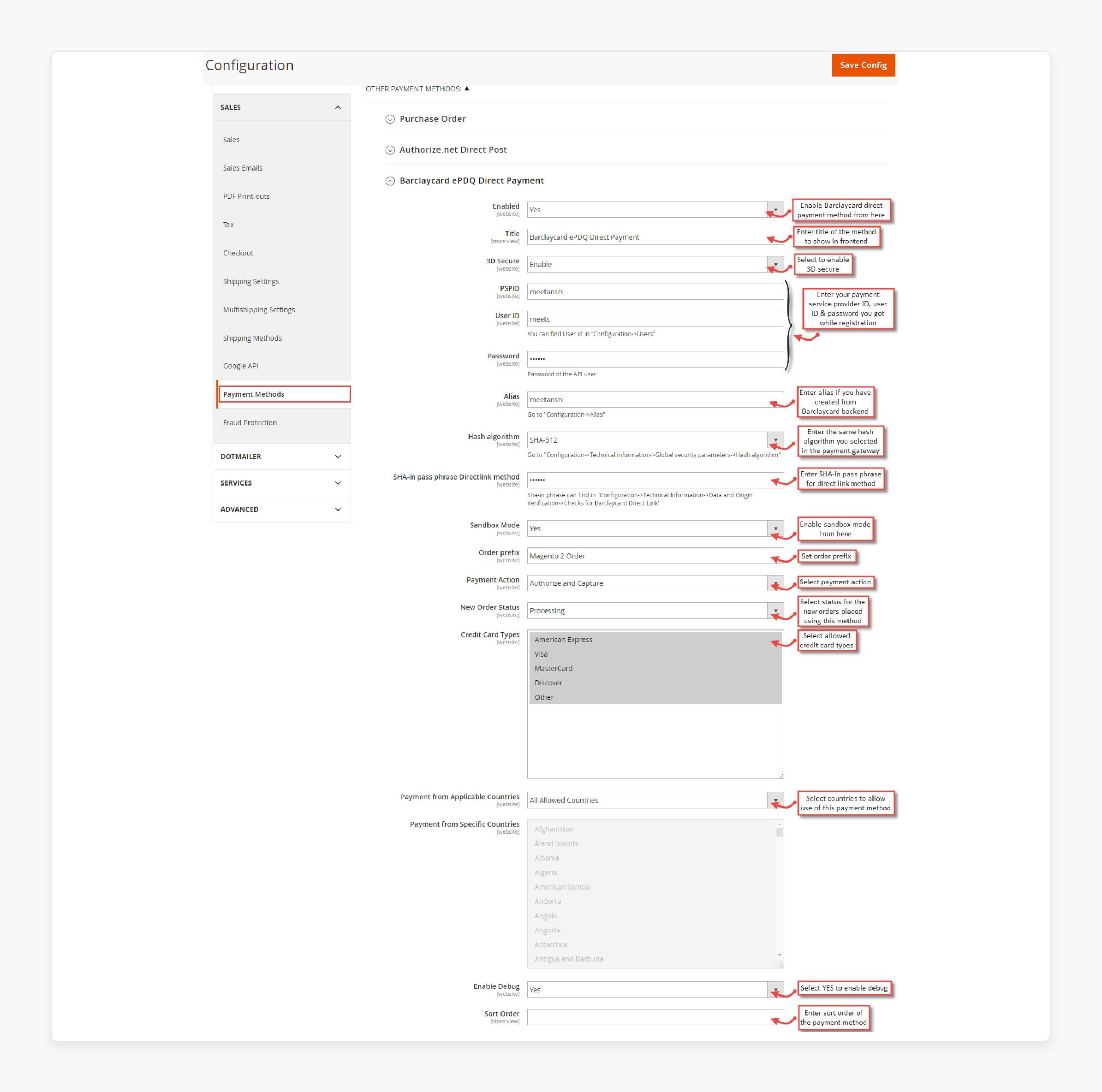

Steps to Configure the Magento 2 Barclaycard Payment Extension

-

Log in to the Magento admin panel after installing the extension.

-

Navigate to the Barclaycard ePDQ Direct Payment section.

-

Enable the extension, enter the title, and the 3D Secure key.

-

Enter your User ID and Password, and then select an encryption method.

-

Choose the credit card types for your store and payment action.

-

Pick the specific countries your store operates in to receive payments.

-

Enable Sandbox mode and test the payment methods via checkout.

-

View the changes on the front end and back end.

Troubleshooting Common Issues with the Barclaycard Payment Gateway

| Issue | Possible Causes | Troubleshooting Steps |

|---|---|---|

| Payment Not Processing | - Incorrect API keys or credentials - Misconfigured endpoint URLs - Incompatible extension version | - Verify API keys and credentials in Magento Admin under Stores > Configuration > Sales > Payment Methods - Check endpoint URLs match Barclaycard's documentation - Ensure the extension is compatible with your Magento version. |

| 3D Secure Authentication Fails | - 3D Secure is not enabled in the Barclaycard account - Incorrect SHA-IN/SHA-OUT passphrases - Network issues | - Confirm 3D Secure is enabled in your Barclaycard merchant account - Validate SHA-IN and SHA-OUT passphrases in extension settings - Test connectivity to Barclaycard servers; check logs in /var/log for errors |

| Redirect to Payment Page Fails | - ePDQ e-commerce mode misconfigured - SSL certificate issues - Theme or extension conflicts | - Check ePDQ settings in Magento Admin for correct redirection URLs - Verify SSL certificate is valid and HTTPS is enforced - Switch to the default Luma theme, disable non-essential extensions, then test again |

| MOTO (Backend) Payments Fail | - MOTO is not enabled in the Barclaycard account - Incorrect permissions - Cache not cleared | - Ensure MOTO is activated in your Barclaycard account - Check admin user permissions under System > Permissions > Roles - Clear cache: bin/magento cache:clean and bin/magento cache:flush |

| Transaction Security Errors | - Incorrect hash algorithm configuration - Missing CVC verification - PCI compliance issues | - Confirm hash algorithm matches Barclaycard settings - Enable CVC verification in extension config - Validate Magento PCI DSS compliance with the SAQ A form for ePDQ/DirectLink |

| Orders Not Visible in Backend | - Cron job not running - Queue issues - Database or indexer issues | - Verify cron is configured: check crontab -l and ensure bin/magento cron:run works - Inspect logs in /var/log for queue errors - Reindex: bin/magento indexer:reindex |

| Compatibility Issues | - Extension not compatible with Magento version - Conflicts with other extensions | - Check vendor documentation for supported Magento versions. - Disable other extensions one by one to identify conflicts - Test in a staging environment |

| Slow Payment Processing | - Server performance issues - Large order volume - Unoptimized extension | - Optimize server: increase PHP memory limit in php.ini (e.g., memory_limit = 512M) - Test with smaller order batches - Contact vendor for performance optimization or updates |

FAQs

1. How do I process refunds for Barclaycard payments in my store?

Barclaycard extensions support refunds where credit memos are generated from invoices. Store owners navigate to Sales > Orders and click "Credit Memo". The system calculates refund amounts and processes them through the original payment gateway. The Barclaycard payment method handles both partial and full refunds.

2. Can I use Barclaycard payments with many currencies in my online store?

Yes, Barclaycard supports Magento multi-currency transactions. The payment gateway is compatible with store setups, including multi-currency functionality. Barclaycard offers multi-currency support in different regions. Using Barclaycard enables secure online transactions across various countries.

3. What are the testing options before going live with Barclaycard payments?

Barclaycard provides sandbox mode functionality for testing payment processing before going live. Merchants can sign up for a test merchant account to test payment processing. Store owners can test the payment method by placing test orders using sandbox mode. The hosted payment page displays test transactions without processing real money.

4. Does Barclaycard integration work with one-step checkout extensions?

Barclaycard extensions are compatible with Magento 2 One Step Checkout plugins. Mageplaza's Barclaycard extension is compatible with Mageplaza One Step Checkout. The integration maintains seamless functionality during the checkout process. This compatibility ensures a smooth, secure online experience for customers.

5. Can I create orders from the backend using Barclaycard for phone orders?

Yes, Barclaycard extensions support MOTO functionality for online payments. Admins can create orders from the backend using the Barclaycard payment method. This function helps save time for customers who order via email or phone calls. The Magento 2 store processes these backend orders through the same secure infrastructure.

Summary

The Magento 2 Barclaycard is an international payment gateway for global stores. In this tutorial, we explained how to configure the extension. Here is a quick recap:

-

Barclaycard integration connects Uthe UK payment gateway with stores.

-

Extensions offer hosted and direct payment processing methods

-

Security features include 3D Secure and SHA encryption protection.

-

Popular extensions cost $ 199 or more, offering full payment functionality.

-

Configuration requires PSPID credentials and proper security settings.

Choose managed Magento hosting with Barclaycard for quick transactions and strong security.