Amazon Pay Magento 2 Security and Compliance Tips

Are you concerned about keeping your customers' payment data secure? The Amazon Pay Magento 2 integration combines Amazon's security infrastructure with the Magento platform.

In this article, we will outline the best security and compliance practices.

Secure Your Amazon Pay Integration

Transform your Magento 2 checkout with enterprise-grade security and seamless payment processing

Customer Payment

Secure card entry

Tokenization

Instant encryption

Secure Processing

Protected transaction

Key Takeaways

-

Amazon Pay integration simplifies checkout and builds customer trust.

-

PCI compliance requirements drop from complex to simple levels.

-

Advanced fraud protection uses machine learning across global networks.

-

Payment tokenization ensures that all customer financial data remains secure and confidential.

-

Site performance optimization maintains fast checkout loading speeds.

-

Customer analytics reveal purchasing patterns and transaction insights.

What is the Amazon Pay Magento 2 Integration?

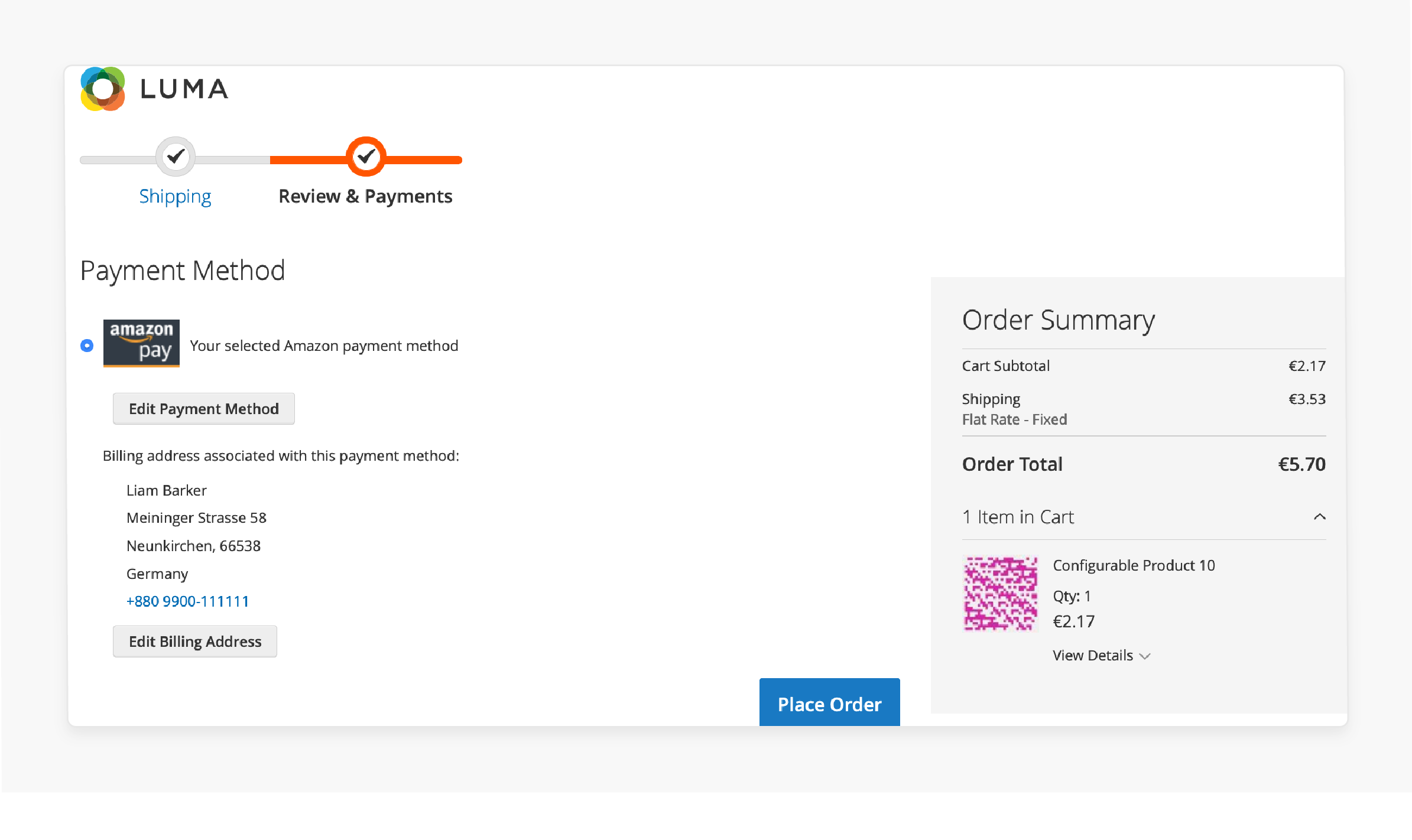

Amazon Pay Magento integration enables store owners to offer Amazon Pay as a payment option. It provides customers with a familiar, secure, and efficient way to complete purchases. This integration involves installing an official Amazon Pay extension. It connects the Magento backend with Amazon’s payment infrastructure.

Common benefits of integrating Amazon Pay into your store include:

-

Simplified Checkout Experience: Pay using Amazon credentials without payment or shipping details.

-

Increased Conversion Rates: The one-click buy feature helps reduce cart abandonment.

-

Trusted Brand Recognition: Leveraging Amazon’s reputation fosters customer confidence in our stores.

-

Advanced Fraud Protection: Amazon Pay offers built-in fraud detection and secure tokenization.

-

Multi-Currency Support: The integration supports payments in many currencies..

-

Seamless Order Management: Orders paid via Amazon Pay sync with Magento’s backend. It allows merchants to manage orders, refunds, and cancellations.

-

Customization Options: You can customize the placement and appearance of the Amazon Pay button. It is to match the store’s branding and optimize user experience.

-

Error Handling and Logging: It logs errors and displays helpful messages during checkout. This helps merchants identify and resolve issues.

Security and Compliance Considerations for Amazon Pay in Magento

PCI Compliance Simplified

See how Amazon Pay reduces your compliance burden

Without Amazon Pay

SAQ D Compliance

SAQ D Requirements Include:

- • Network segmentation & firewall configuration

- • Vulnerability management program

- • Access control measures

- • Regular security testing

- • Incident response procedures

- • Physical security controls

- • Extensive documentation

With Amazon Pay

SAQ A Compliance

SAQ A Benefits:

- • No card data touches your servers

- • Amazon handles all security

- • Simple annual self-assessment

- • Minimal documentation required

- • No expensive security tools

- • Reduced liability & risk

- • Focus on your business

Your Potential Savings

1. PCI DSS Compliance and Reduced Liability

-

Amazon Pay reduces Magento's PCI compliance burden for merchants. When customers use Amazon Pay, they enter payment details on Amazon's secure servers. Your Magento store never touches sensitive card data. This keeps credit card information completely off your servers.

-

This separation changes your compliance requirements. Without Amazon Pay, most Magento 2 stores fall under the SAQ D category. SAQ D is the most complex level of compliance. It requires over 300 security controls. Merchants must use extensive security measures. Annual compliance costs can reach tens of thousands of dollars.

-

With Amazon Pay, merchants qualify for SAQ A. This is the simplest compliance level. SAQ A only requires about 20 security controls. The questionnaire takes minutes instead of months to complete

2. Advanced Fraud Protection Mechanisms

Real-Time Fraud Detection in Action

See how Amazon Pay analyzes billions of data points in milliseconds

Transaction Initiated

Customer submits payment

ML Analysis

AI evaluates risk factors

Risk Assessment

Score calculated instantly

Decision Made

Approve or flag transaction

Transaction Simulator

Risk Factor Analysis

-

Amazon Pay employs ML algorithms for fraud detection. The system analyzes billions of transactions across Amazon's global network. It learns from patterns in legitimate and fraudulent behavior.

-

The AI improves its detection accuracy. Each transaction benefits from insights gained across millions of Amazon accounts. The system identifies subtle fraud indicators that humans might miss.

-

Real-time risk assessment happens during checkout. Amazon Pay evaluates dozens of risk factors within milliseconds. It checks the buyer's buying history and account age. The system examines shipping addresses and payment methods.

-

Device fingerprinting identifies suspicious hardware. Behavioral analysis detects unusual purchasing patterns. High-risk transactions get flagged immediately. Merchants receive risk scores before order fulfillment.

-

Amazon's chargeback protection offers significant financial safeguards. The Amazon Pay A-to-Z Guarantee covers eligible transactions. Merchants get protection against fraudulent chargebacks. Amazon handles dispute resolution with customers.

-

This reduces the admin burden on store owners. Coverage includes the full transaction amount plus chargeback fees. Merchants must ship to the address provided by Amazon Pay.

3. Payment Tokenization and Data Security

-

Amazon Pay uses advanced tokenization to protect payment data. When customers select their payment method, Amazon generates a unique token. This token represents the payment information. It contains no actual credit card numbers.

-

The token is meaningless if intercepted. Only Amazon's secure servers can decode these tokens. Each token works only for specific transactions. They expire after use or timeout. This prevents token replay attacks.

-

Data transmission between Magento and Amazon uses many security layers. All communication happens over HTTPS connections. TLS 1.2 or higher encryption protects data in transit. Amazon Pay uses certificate pinning for added security.

-

This prevents man-in-the-middle attacks. Network traffic checking cannot reveal sensitive information. Amazon's infrastructure includes DDoS protection. This ensures availability during attack attempts.

-

Customer data is stored in accordance with strict encryption standards. Amazon encrypts all payment data at rest. They use AES-256 encryption algorithms. Many encryption keys protect different types of data.

-

Hardware security modules safeguard encryption keys. This provides redundancy and disaster recovery. Access logs track every data interaction.

-

Each API call requires signed requests. Merchants receive unique API credentials. Secret keys should never be sent over networks. Magento OAuth 2.0 handles authorization flows.

-

Time-based request signatures prevent replay attacks. IP whitelisting adds another security layer. Rate limiting prevents brute force attempts. Suspicious API activity triggers automatic alerts.

4. Regulatory Compliance and Best Practices

-

Amazon Pay includes built-in GDPR compliance features for European merchants. The system provides clear consent mechanisms for data processing. Customers can access their payment data through Amazon's portal. Data portability allows easy information export.

-

Right to deletion requests processed through Amazon's systems. Amazon Pay maintains detailed privacy policies in many languages. Merchants can configure data retention periods. The platform anonymizes old transaction data. Processing agreements follow GDPR requirements.

-

Strong Customer Authentication (SCA) is used in Amazon Pay. The system uses multi-factor authentication for European transactions. Customers verify payments through Amazon's app or SMS. Biometric authentication options include fingerprint and face recognition. Amazon handles all SCA exemption logic. Low-value transactions are processed under exemption rules.

-

Recurring payments maintain SCA compliance. The system adapts to changing regulatory requirements. Merchants don't need to manage SCA complexity themselves.

-

Regional compliance extends beyond European regulations. Amazon Pay supports CCPA requirements for California merchants. The platform handles requests for consumer privacy rights.

-

Each region has strict data localization rules. Amazon maintains local data centers where required. Currency and tax regulations adapt by region as the system updates for new regional laws.

Performance Optimization and Scalability with Amazon Pay

1. Impact on Site Performance Metrics

-

Amazon Pay integration can affect checkout page load times. The payment service needs to load external scripts and establish secure connections. This process adds latency to the initial page rendering.

-

Users may experience delays when the Amazon Pay button first appears on the checkout page. The authentication flow involves many server requests that can slow down the experience.

-

The Amazon Pay JavaScript SDK adds considerable weight to web pages. The library includes modules for payment processing, user authentication, and error handling.

-

Amazon Pay integration increases server-side processing requirements. The system must handle extra API calls for payment verification and order processing. Database queries multiply as the application manages order data and Amazon payment tokens.

-

Session management becomes complex when coordinating between the system and Amazon. Server memory usage grows due to maintaining the payment state across many request cycles. Backend systems need extra checking to track Amazon Pay transaction processing times.

-

Amazon Pay affects Google's Core Web Vitals measurements. Largest Contentful Paint scores suffer when payment buttons load slowly or block rendering. First Input Delay increases as the browser processes Amazon Pay's JavaScript libraries.

2. Checkout Speed Optimization Techniques

-

One-click checkout transforms the buying experience with Amazon Pay. Returning Amazon customers bypass traditional checkout forms. They click the Amazon Pay button and confirm their order. The entire process takes seconds instead of minutes. Shipping addresses are pulled from Amazon accounts. Payment methods are pre-selected.

-

API call latency reduction requires strategic optimization. Use connection pooling for API requests. This reuses existing connections instead of creating new ones. Use Amazon's closest regional endpoints. Geographic proximity reduces network latency.

-

Batch API calls when possible. Many requests in one call save round-trip time. Set appropriate timeout values. Use retry logic for failed calls. Cache API responses when data doesn't change often.

-

Button placement and loading strategies affect perceived speed. Place Amazon Pay buttons above the fold. Customers see them immediately without scrolling. Magento Lazy loads the button JavaScript. This prevents blocking initial page renders.

3. Caching Strategies for Amazon Pay Integration

-

Static content caching accelerates payment page loading. Cache Amazon Pay button images on your CDN for improved performance. Store JavaScript libraries after the first download. Set long cache headers for static assets. Use versioning for cache busting when updates occur.

-

Compress all static files with Gzip or Brotli. Use browser caching for repeat visitors. Cache CSS files that style payment elements. This reduces server requests by up to 80%. Payment pages load much faster with proper static caching.

-

Session data optimization prevents unnecessary database queries. Store customer tokens in fast session storage. Use in-memory caching for active sessions and session clustering for high availability. Clean expired sessions.

-

Use Redis for session storage instead of files. Use Redis clustering for redundancy. Configure appropriate memory limits. Enable LRU eviction policies. Compress large cache values. Use pipelining for bulk operations. Check memory usage.

-

Use separate cache pools for different data types. Set up Redis persistence for important data. Memcached works well for simple key-value caching. Choose based on your specific needs. Proper configuration reduces checkout times by 40-50%.

-

Varnish configuration requires Amazon Pay-specific rules. Create VCL rules to bypass the cache for checkout URLs. Strip unnecessary cookies from cached requests. Configure grace mode for high traffic periods. Use device detection for mobile optimization.

Troubleshooting Common Amazon Pay Integration Challenges

Troubleshooting Amazon Pay Integration

Find solutions to common challenges quickly

Configuration Errors

API credentials not working

- 1 Verify that the Merchant ID, Access Key, and Secret Key are correctly entered without spaces

- 2 Confirm you're using the correct environment credentials (Sandbox vs Production)

- 3 Check credentials in configuration:

bin/magento config:show payment/amazon_payment/merchant_id bin/magento config:show payment/amazon_payment/access_key bin/magento config:show payment/amazon_payment/secret_key

Payment button not appearing

- 1 Enable Amazon Pay in Store Configuration

- 2 Clear Magento cache:

bin/magento cache:clean bin/magento cache:flush

- 3 Check if module is enabled:

grep Amazon_Pay app/etc/config.php

Wrong currency displayed

- 1 Set the correct currency in Amazon Seller Central

- 2 Match store currency with Amazon Pay settings in Magento Admin

- 3 Verify currency configuration:

bin/magento config:show currency/options/base

API Connection Issues

SSL/TLS handshake failures

- 1 Update to TLS 1.2 or higher

- 2 Install the latest SSL certificates

- 3 Check server OpenSSL version:

openssl version curl --version | grep SSL

Timeout errors during checkout

- 1 Increase API timeout settings in configuration

- 2 Check firewall rules for Amazon endpoints

- 3 Test connection to Amazon endpoints:

curl -I https://pay-api.amazon.com/ ping pay-api.amazon.com

403 Forbidden responses

- 1 Regenerate API credentials in Amazon Seller Central

- 2 Check IP whitelist settings

- 3 Verify account is active and not suspended

Module Conflicts

One Step Checkout incompatibility

- 1 Disable Amazon Pay on custom checkout pages

- 2 Create compatibility patches if needed

- 3 Update both modules to latest versions

composer update amazon-pay/amazon-pay-magento-2 bin/magento setup:upgrade

Payment method not showing with other gateways

- 1 Check sort order configuration

- 2 Resolve JavaScript conflicts in browser console

- 3 Adjust payment method rules in Admin

Customer Experience Problems

Address not populating correctly

- 1 Enable address book sharing in Amazon Seller Central

- 2 Map fields correctly in Magento configuration

- 3 Clear customer session data

Declined payments without clear errors

- 1 Check customer's Amazon account status

- 2 Verify transaction limits are not exceeded

- 3 Enable detailed logging:

bin/magento config:set payment/amazon_payment/logging 1 bin/magento cache:clean

Performance Issues

Slow checkout loading

- 1 Use asynchronous loading for Amazon Pay scripts

- 2 Optimize API calls with caching

- 3 Enable JavaScript bundling:

bin/magento config:set dev/js/enable_js_bundling 1 bin/magento setup:static-content:deploy

Database locks during high traffic

- 1 Optimize order processing with queue systems

- 2 Implement database clustering

- 3 Monitor database locks:

SHOW PROCESSLIST; SHOW ENGINE INNODB STATUS;

Customer Analytics and Reporting Capabilities of Amazon Pay

1. Transaction Analytics and Reporting

-

Payment success and failure rate analysis reveals critical performance metrics. The system tracks authorization success rates on an hourly, daily, and monthly basis. Merchants can identify patterns in payment failures. Common reasons for decline are listed in detailed reports. The analytics show which cards fail often. Geographic analysis reveals regions with higher failure rates.

-

Average order value (AOV) trends show Amazon Pay's impact on revenue. Reports compare AOV between Amazon Pay and other payment methods. The data often shows Amazon Pay users spend 20-30% more per order.

-

Seasonal trends become visible in the analytics. Merchants can track AOV changes after using Amazon Pay. Product category analysis shows where Amazon Pay drives higher values.

-

Refund and chargeback analytics protect profit margins. The reporting system tracks refund rates by payment method. Merchants can identify products with high return rates.

-

Chargeback trends appear in monthly comparison charts. The analytics calculate the true cost of disputes. Amazon's A-to-Z Guarantee claims show.

-

Settlement report integration streamlines financial reconciliation. Amazon Pay settlement files import into Magento 2. The system matches transactions with orders. Daily settlement reports arrive via automated feeds.

2. Customer Behavior Insights and Patterns

-

Repeat buy rate analysis shows how Amazon Pay affects customer loyalty. The system tracks how often customers return to buy again. Amazon Pay users show 40% higher repeat buy rates. Reports compare first-time buyers with returning customers.

-

Merchants can see buy frequency patterns over time. The data reveals which products drive repeat buys. Customer groups are segmented by their buying frequency. This information helps create targeted loyalty programs. Store owners can identify their most valuable repeat customers.

-

Customer lifetime value tracking measures long-term customer worth. The system calculates total revenue per customer over time. Amazon Pay customers often generate higher lifetime values. Reports show average customer value by payment method.

-

Merchants can predict future revenue from customer segments. The tracking includes all buys across many years.

-

Geographic distribution mapping shows where Amazon Pay performs best. Heat maps display customer concentration by region. Urban areas show higher adoption rates. The system tracks data at the city, state, and country levels.

-

International usage patterns become visible. Merchants can identify underserved geographic markets. Shipping preferences vary by location.

3. Business Intelligence and Marketing Applications

-

Predictive analytics help forecast future buying patterns. The system analyzes past buying behavior to predict future actions. It identifies customers likely to buy soon. Amazon Pay transaction history improves prediction accuracy.

-

The analytics spot seasonal buying patterns early. Merchants can stock Magento inventory based on predictions. The system alerts when customers might abandon your store.

-

Integration with Google Analytics and Adobe Analytics provides deeper insights. Amazon Pay data flows into these platforms. Merchants can track the complete customer journey. The integration shows how customers find your store.

-

It reveals which marketing channels drive Amazon Pay users. Custom events track payment method selection. Goals measure Amazon Pay conversion rates.

-

Custom report building empowers different teams across your business. Executives need high-level revenue summaries. The system creates automated weekly dashboards for them. Finance teams need detailed transaction reports.

-

Marketing wants customer behavior analytics. Each department gets reports tailored to their needs. Reports are scheduled via email. Visual charts make data easy to understand.

FAQs

1. What system requirements must stores meet before installing the extension?

Your Magento store must run version 2.3.0 or higher. It should have the HTTPS protocol and valid SSL certificates. You need SSH server access to execute Composer commands. You must disable any installed Amazon Pay extensions before proceeding. The server requires reliable internet connectivity to communicate with Amazon's APIs.

2. How does Amazon sign-in work when users want to create an account on a Magento store?

Amazon sign-in allows users to log in using their Amazon username and password. The system fetches name, email address, and user ID from Amazon to create Magento accounts. When an account already exists, the system can link it to add Amazon Sign-in as another login option. If Amazon and Magento accounts don't work, customers can only see Amazon Pay buttons.

3. Where can owners find the documentation for configuring API credentials?

The official Amazon Pay documentation provides installation and configuration guides. Merchants can access their API credentials through Amazon Seller Central. Select "Magento 2" as their platform. They navigate to the API access section. The documentation includes command line configuration instructions referencing Magento's official developer guides.

4. Can users find the extension on the Magento marketplace?

Merchants can buy the free Amazon Pay module from the Magento marketplace. Starting from version 5.0.0, Amazon Pay is on the Magento Marketplace. It features next-generation web checkout technology. The marketplace has disabled package downloads in favor of Composer installation methods.

5. What are the billing fees when processing Amazon Pay transactions?

Amazon Pay fees are transaction-based with a domestic processing fee and authorization component. They charge 2.9% plus $0.30 per authorized transaction. Cross-border processing incurs extra fees when customers use international payment methods. Authorization fees of $0.30 exist when transactions are processed. When refunds occur, merchants receive back the domestic and cross-border processing fees.

Summary

The Amazon Pay Magento integration monitors all the financial aspects of a store. In this article, we explain the security and compliance tips to optimize operations. Here is a recap:

-

Amazon Pay integration reduces PCI compliance from complex to simple.

-

Advanced fraud protection uses machine learning across Amazon's global network.

-

Payment tokenization and encryption secure all customer transaction data.

-

One-click checkout improves conversion rates and customer experience.

-

Detailed analytics provide insights into customer behavior and performance.

Choose managed Magento hosting with Amazon Pay for optimized features and performance.