Magento Financial Performance Analysis: Guide & Trends 2025

Quick Answer: TL;DR

Magento financial performance analysis examines key metrics like revenue, transactions, and customer acquisition costs within the platform. It uses descriptive analytics to assess sales trends and profitability. Adobe Commerce upgrades deliver 516% ROI over three years. The platform showed 29% revenue growth in 2023. The 2025 focus emphasizes AI-driven analytics for 15% forecasting error reduction and personalized revenue strategies.

The Role of Magento 2 Marketing Automation

Magento 2 marketing automation helps organize & enhance marketing efforts for eCommerce businesses.

Magento 2 marketing automation offers AI-powered personalization and omnichannel coordination abilities. It allows merchants to automate repetitive marketing tasks such as:

- Email campaigns

- Customer segmentation

- Personalized product recommendations

- Conversational marketing through chatbots and messaging

Magento's marketing automation works with various marketing platforms to provide advanced reporting & information. It includes predictive data analysis and a Customer Data Platform (CDP) connection. Businesses can customize their methods based on customer behavior & preferences. The automation helps boost speed and optimize customer engagement to maintain privacy compliance. It also drives sales growth and provides AI-driven personalized experiences.

Why Magento 2 Marketing Automation Matters?

Cart Abandonment Recovery Estimator

Estimate how much revenue you could recover by implementing cart abandonment automation.

Calculate Your Potential Recovery

Industry average recovery rates with automation range from 10% to 25%.

Potential Monthly Recovered Revenue: €0.00

1. Better Customer Segmentation

Marketing automation lets you segment customers based on specific criteria like:

- Purchasing behavior

- Demographics

- Engagement levels

- AI-identified micro-segments

This segmentation helps create personalized marketing campaigns through Magento's advanced customer segmentation techniques. This approach yields higher conversion rates and improved customer satisfaction.

2. Personal Customer Experience

Automation creates personal shopping experiences for your customers. Based on customer behavior and preferences, you can trigger:

- Automated email campaigns

- AI-powered product recommendations

- Customized promotions

- Dynamic content personalization

Modern tools like 'Adobe Sensei' & 'Nosto' use real-time behavioral data to adapt experiences. They help increase repeat purchases and customer loyalty.

3. Time and Resource Savings

Automating repetitive marketing tasks saves time and resources, especially when combined with productivity tracking software to monitor campaign workloads and outcomes. Your team can focus on strategic initiatives while workflows run in the background instead of managing:

- Email campaigns

- Social media posts

- Customer follow-ups

- Conversational marketing through chatbots

4. Information-Based Decision Making

Magento 2's marketing automation tools provide detailed reporting and predictive data analysis abilities. You can analyze campaign performance. It allows you to gain information about what works & what does not work. You can make informed decisions based on information to improve your marketing methods.

5. Better Lead Nurturing

Marketing automation helps nurture leads through the sales funnel. Automated workflows send targeted content. It enables businesses to lead based on their stage in the buying journey. This process helps them convert them into customers faster.

6. Regular Customer Engagement

Regular contact is necessary for marketing and automation. Your customers receive timely and relevant communications across all channels. Automated campaigns maintain regular contact with customers through omnichannel coordination. They help you build your brand popularity and drive engagement.

7. Higher Return On Investment (ROI)

Automating marketing processes increases the speed and success of your campaigns. Leading brands achieve over 100x ROI with platforms like 'Klaviyo'. Automated campaigns are more precise & targeted, which helps cut wasted spend & increase profitability.

Advantages of Magento Marketing Automation

| Advantage | Description |

|---|---|

| Voice Search Support | Supports modern trends like 'voice search'. These trends help your Magento website improve SEO performance & stay ahead of competitors. |

| Enhanced Targeting of Message | Enables targeted and personalized messaging, moving beyond ineffective mass mailings. Delivers timely, relevant notifications that match individual customer needs & expectations. |

| Increased Customer Satisfaction | Improves the entire customer journey by increasing engagement/enhancing brand perception/reducing churn. Marketing automation ensures quick, simple, & effective interactions that elevate the customer experience. |

| Efficiency and Productivity | Automates repetitive marketing tasks, freeing up time for strategic/creative work. This process allows marketers to focus on innovation rather than routine processes. |

| Improved Lead Quality | Nurtures leads by delivering relevant offers to specific customer segments. It results in higher-quality leads for the sales team & improved interactions with clients. |

| Income Boost | Drives measurable increases in conversions and leads. Most users report higher conversion rates and see more leads. They can set up marketing automation, providing a rapid return on investment. |

10 Key Areas of Magento 2 Marketing Automation

1. Email Marketing Automation

Email marketing is a major part of any effective digital marketing strategy. Magento 2 offers powerful email automation features like:

- Trigger emails based on customer actions: Send 'welcome emails' when someone signs up. Consider including abandoned cart reminders for customers who leave items in their carts. Adding post-purchase follow-ups after checkout also helps attract customers.

- Segment email lists: Create targeted campaigns based on customer behavior, demographics, & checkout history.

- Personalize content: Use dynamic content to customize emails to individual customers. This approach enables companies to enhance engagement and boost conversion rates.

2. Customer Segmentation and Targeting

Good marketing requires precise targeting. Magento 2 helps create detailed customer segments based on criteria like 'checkout history'. Consider 'browsing behavior', 'customer demographics', and 'AI-identified micro-segments'. Key benefits include:

- Automate segment updates: Keep your customer segments up-to-date with live data synchronization.

- Target specific segments with personal campaigns: Send customized marketing messages to customer groups. This approach helps increase relevance and success.

3. Behavioral Tracking and Data Analysis

Understanding customer behavior helps create effective marketing. Magento 2 provides tools to:

- Track customer interactions: Assess "browsing patterns", "product views", and "buying behaviors".

- Analyze data to gain insights: Generate reports that understand what drives customer actions. Optimize your marketing methods with predictive data analysis.

- Trigger automated responses: Respond to specific behaviors. Send discounts to high-value customers or reminders to inactive users.

4. Product Recommendations

Personal product recommendations can boost sales. Magento 2 allows you to:

- Automate product suggestions: Use AI algorithms. They recommend products based on customer behavior and preferences.

- Display recommendations across channels: Show personal recommendations. Set them up on your "website", in "emails", and through "mobile apps".

- Increase cross-sell & upsell opportunities: Suggest 'related products' or 'higher-value items'. This flexibility helps increase average order value.

5. Loyalty Programs & Customer Retention

Retaining existing customers costs less than acquiring new ones. Magento 2 helps you:

- Automate loyalty program management: Reward customers for repeat purchases, referrals, & other actions.

- Personalize loyalty offers: Customize rewards & promotions to specific customer segments and behaviors.

- Track & analyze loyalty program performance: Measure the effectiveness of your loyalty initiatives. Then, adjust methods as needed.

6. Social Media Connection

Social media helps reach and engage customers. Magento 2's automation features include:

- Automate social posting: Schedule and publish posts across various social media platforms. Use a social media scheduling tool to do so.

- Track social media interactions: Assess engagement numbers. Companies can also analyze the performance of their social campaigns.

- Connect social data with customer profiles: Use social media behavior. This strategy enables you to better segment and target customers.

7. Content Personalization

Send the right content to the right audience. Magento 2 allows you to:

- Automate content delivery: Show personal content. Use AI-powered tools customized to specific customer segments and behaviors.

- Use dynamic content blocks: Customize website content, banners, & promotions for different user groups.

- Measure content success: Track engagement numbers. Then, adjust your content plan based on performance data.

8. Multi-Channel Marketing

Reaching customers across various channels increases your marketing reach. Magento 2 supports true omnichannel coordination with:

- Unified multi-channel campaigns: Coordinate marketing efforts across 'email', 'social media', 'SMS', 'WhatsApp', & more. Use tools like 'Omnisend' and 'Emarsys'.

- Automate workflows: Create smooth customer journeys that transition across different channels without friction.

- Regular messaging: Maintain a consistent and personal brand message across all touchpoints.

- Live synchronization: Maintain unified customer experiences across 'web', 'mobile', 'social', and 'physical stores'.

9. Conversational Marketing Automation

Modern Magento 2 stores use conversational marketing for live engagement. Consider the following:

- Automated chatbots: Deploy AI-powered chatbots for customer support & lead nurturing. Use tools like 'Tidio' & 'ManyChat'.

- WhatsApp and messaging automation: Automate customer communications through popular messaging platforms.

- Live support: Provide instant responses to customer queries. These will help guide them through the checkout journey.

10. Connection Ease

Look for tools with native Magento 2 extensions and smooth data synchronization. Tools like 'Klaviyo' & 'Omnisend' offer plug-and-play setups that sync your store data. Consider the following:

- Email-focused: Mailchimp offers strong email automation with easy-to-use templates and basic segmentation.

- Omnichannel needs: Omnisend and Dotdigital work well for multi-channel campaigns. These include 'email', 'SMS', and 'social media'.

- CRM connection: HubSpot provides complete CRM options with 'sales team collaboration' features.

- Advanced data analysis: Klaviyo focuses on deep e-commerce information. It supports 'revenue attribution' and 'predictive analytics'.

6 Best Magento 2 Marketing Automation Tools

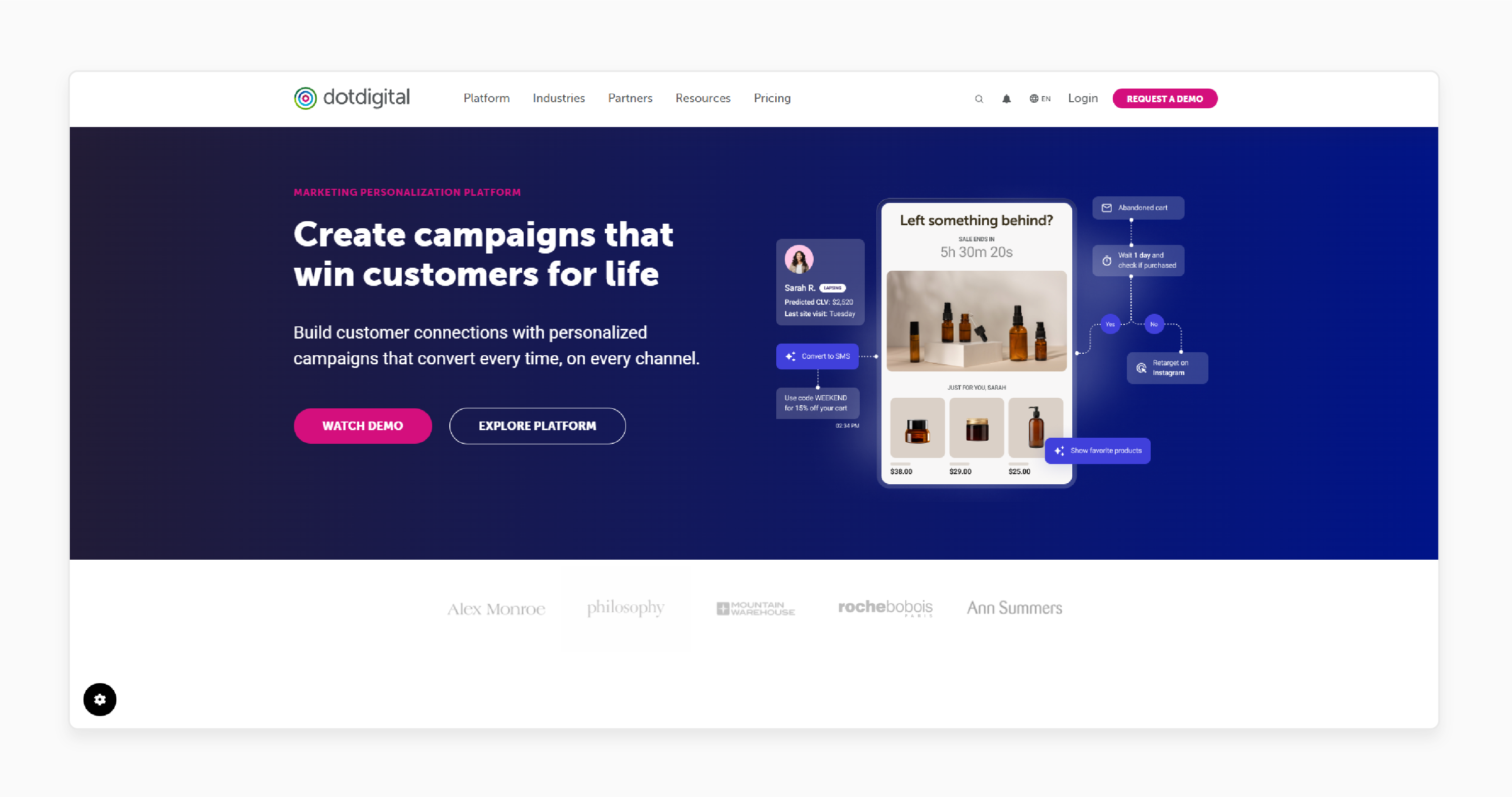

1. Dotdigital

Dotdigital is an integrated marketing automation platform that integrates with Magento 2. The tool specializes in omnichannel marketing automation. It personalizes customer interactions across email, SMS, social media, and more.

Features

- Email Marketing Automation: Design, send, and track automated email campaigns. Includes abandoned cart recovery, which usually recovers lost sales.

- Customer Segmentation: Advanced segmentation tools enable the creation of segments. They do this based on "checkout behavior", "engagement", and "custom fields". You can segment them by 'RFM analysis (Recency, Frequency, Monetary value)'.

- Behavioral Tracking: Assess customer behavior and automate personalized responses. Do this based on website actions, such as "product views" and "time spent on a page".

- Reporting and Data Analysis: Detailed campaign performance reports enable 'ROI tracking' & 'conversion data'. These reports show revenue per "email" and "customer lifetime value".

- Privacy Concerns: Privacy tools with built-in consent management meet GDPR requirements. WhatsApp connection allows messaging campaigns.

Pricing

Starts from $150/month

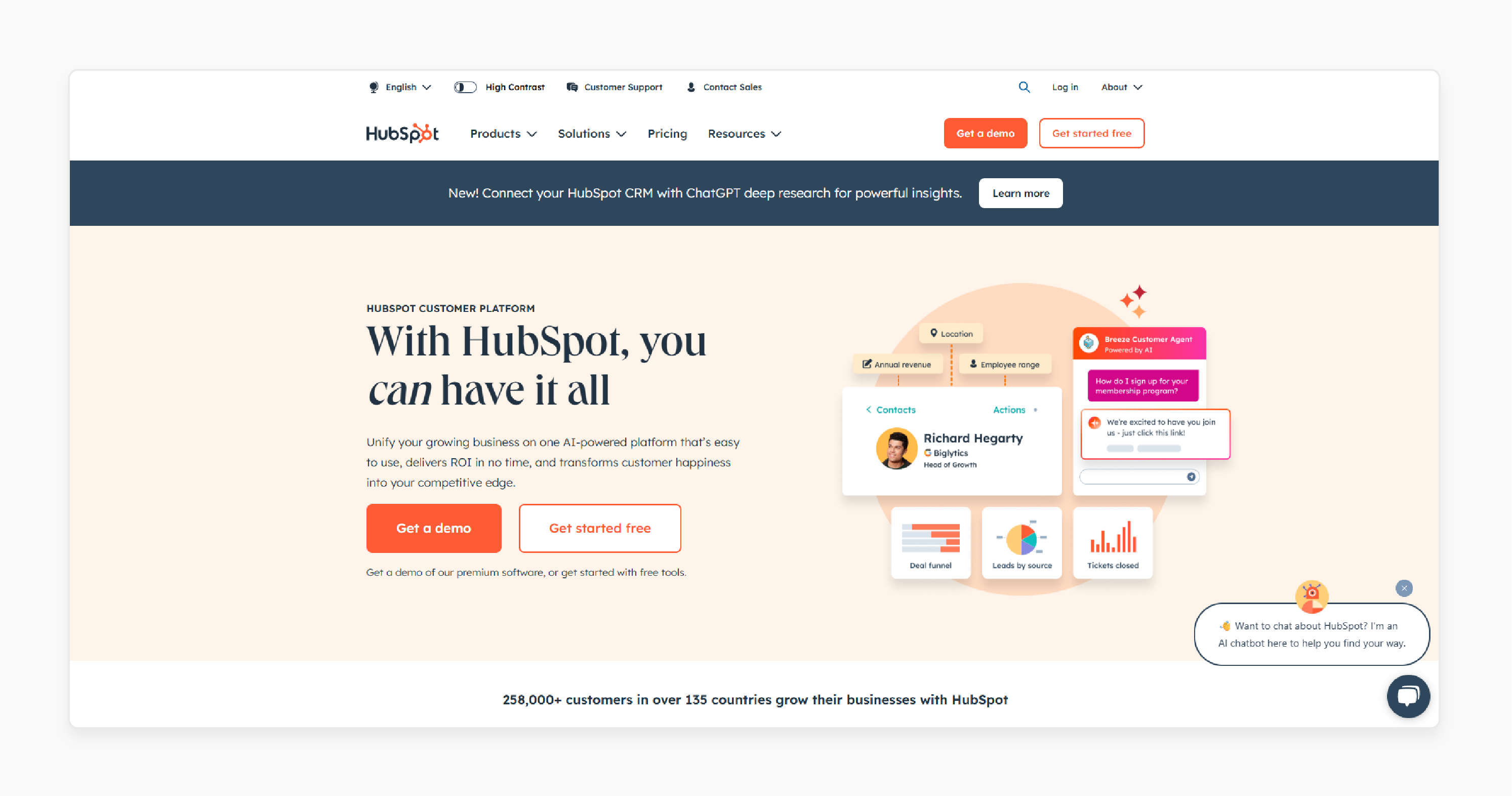

2. HubSpot

HubSpot offers powerful inbound marketing tools that integrate with Magento 2. The tool provides 'CRM', 'marketing', 'sales', and 'customer service automation' in one platform. It helps with lead nurturing, email marketing, and data analysis to better campaigns.

Features

- Marketing Automation: Automate emails & social media posts with workflow builders and lead scoring. Lead scoring ranges from "0 to 100", based on engagement and fit.

- CRM Connection: Sync customer data between Magento & HubSpot CRM for unified customer profiles. Updates happen in real-time when customers make purchases.

- Lead Management: Score leads based on behavior & nurture them through the sales funnel. They track which content leads consumers to checkout.

- Data Analysis & Reporting: Create detailed reports to measure marketing success with attribution reporting. This flexibility shows which campaigns drive actual revenue.

Pricing

Starts from $18/month

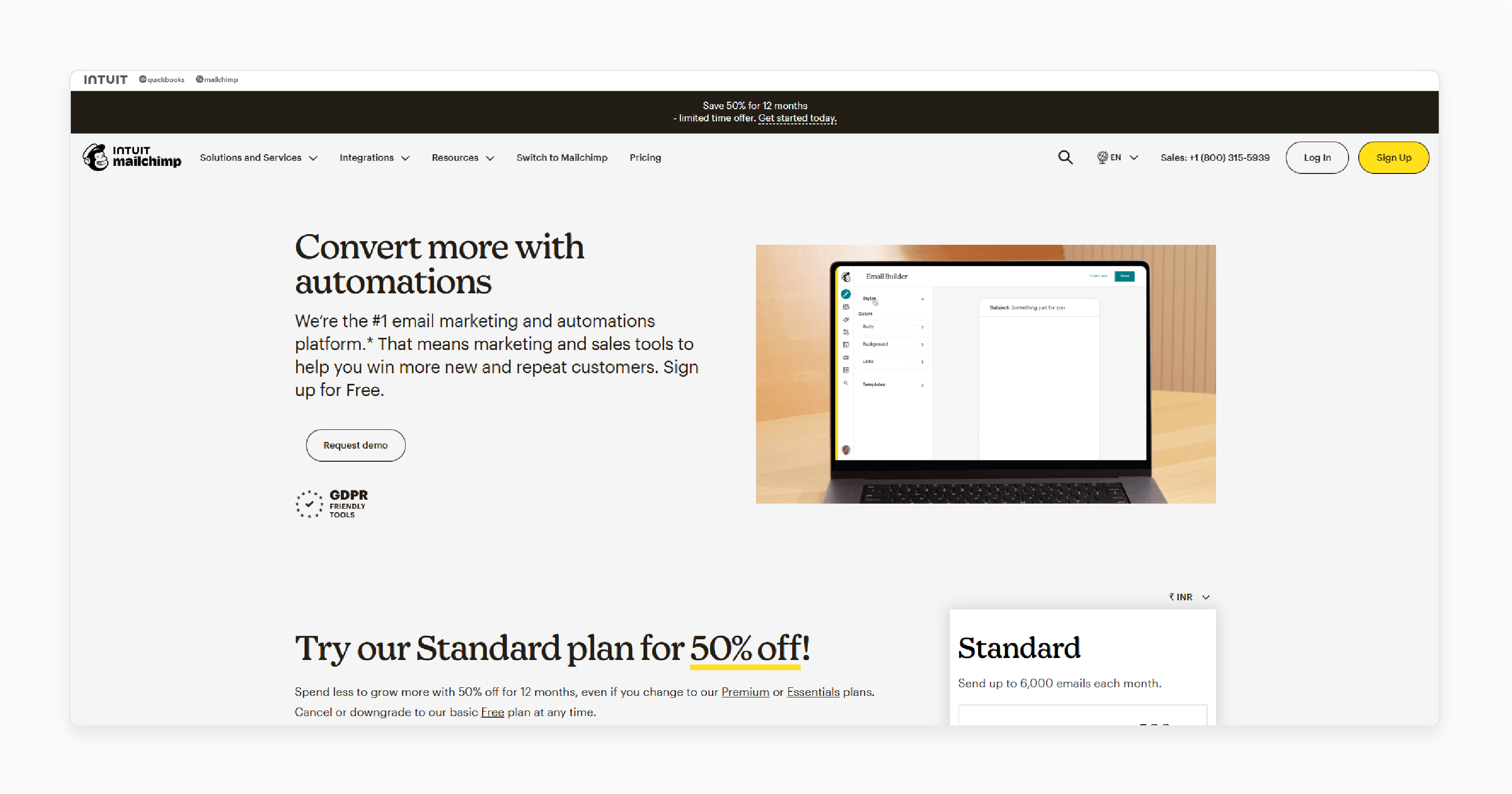

3. Mailchimp

Mailchimp is popular for email marketing automation. It offers ease of use with powerful options for small to medium businesses. It works with Magento to manage 'subscriber lists', create targeted campaigns, & track engagement.

Features

- Email Campaigns: Design & automate personal email marketing campaigns with templates & A/B testing. There are over 300 pre-designed templates available.

- E-commerce Connection: Sync Magento store data for targeted marketing. Make decisions based on purchasing history and product interests. This process enables you to import product catalogs for automatic recommendations.

- Customer Journey Builder: Create automated workflows based on customer actions and behaviors. These include 'purchases', 'website visits', & 'email opens'. Visual workflow builder helps display customer paths.

- Data Analysis: Detailed Mailchimp reports track 'open rates', 'click rates', & 'revenue' from campaigns. Industry benchmarks help compare performance.

Pricing

Starts from $13/month

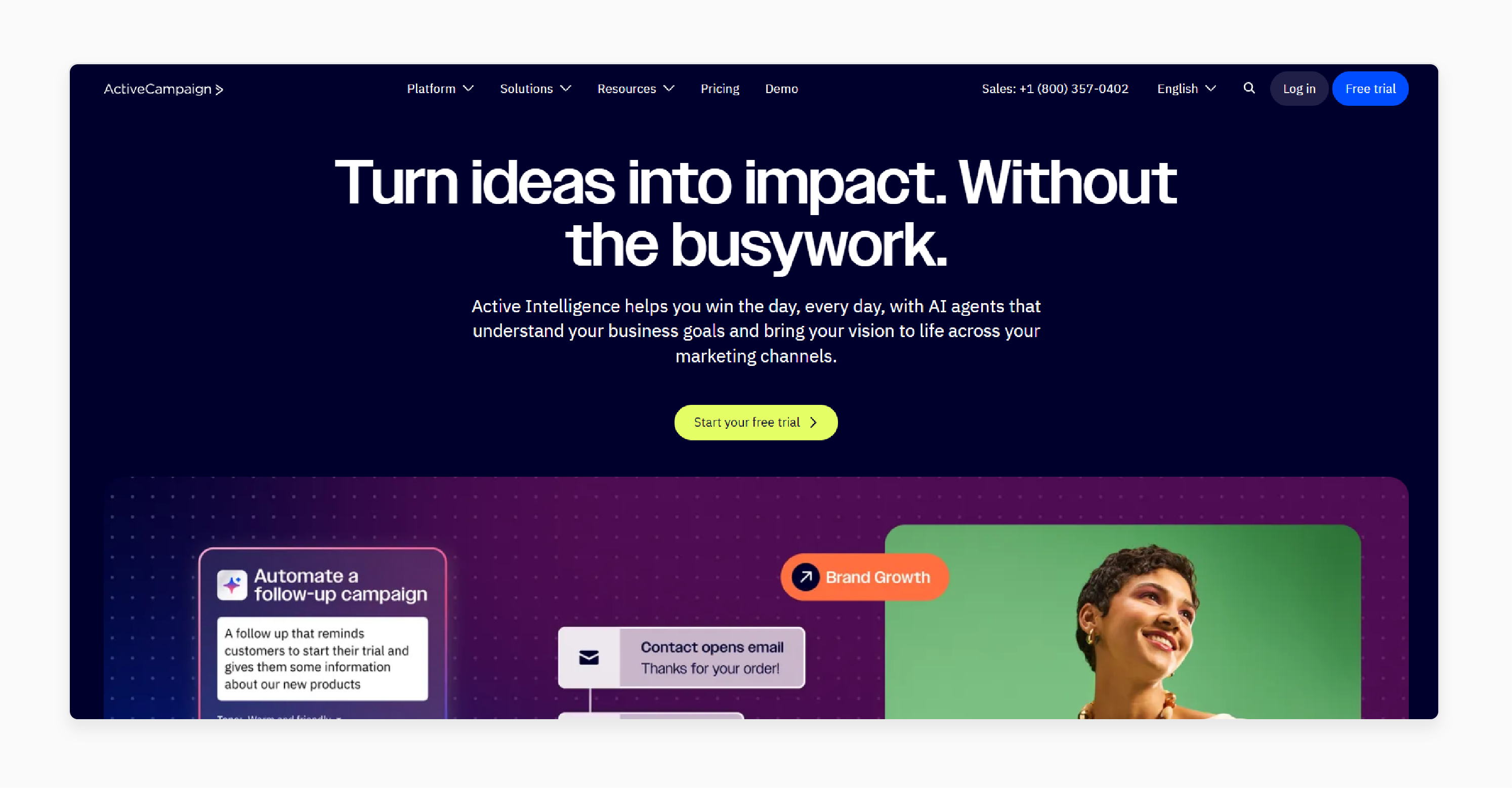

4. ActiveCampaign

ActiveCampaign combines 'email marketing', 'marketing automation', 'sales automation', and 'CRM functions'. It allows personal messaging and automates customer journeys. The platform offers advanced marketing automation options for growing businesses.

Features

- Email Automation: Automate personal email campaigns with 'conditional logic' and 'dynamic content'. If-then logic enables the creation of "branching workflows" based on customer behavior.

- Customer Segmentation: Segment customers based on 'behavior', 'checkout history', 'location', and 'custom fields'. Segments update in an automatic way as customer data changes.

- Behavioral Tracking: Track customer interactions and automate responses. Do this based on 'website visits', 'email engagement', and 'buying behavior'. Site tracking works without added setup.

- Sales Automation: Connect marketing efforts with sales processes through 'lead scoring' & 'CRM integration'. Assign "leads" to "sales reps" based on criteria in an automatic manner.

Pricing

Starts from $29/month

5. Klaviyo

Klaviyo specializes in ecommerce marketing automation. It enables businesses to segment customers/send personalized emails based on their behavior. The tool also enhances campaigns with powerful 'data analysis' & 'A/B testing' capabilities.

Features

- Email and SMS Marketing: Automate email & SMS campaigns with advanced personalization & timing optimization. Optimize send times to increase open rates.

- Advanced Segmentation: Create detailed customer segments to enhance targeted marketing and personalized experiences. Do this based on 'buying behavior', 'predicted lifetime value', & engagement. Predictive analytics identifies customers likely to churn, & cross-channel data creates more accurate segments.

- Product Recommendations: Provide personalized product suggestions based on 'browsing history' and 'purchasing patterns'. Machine learning improves recommendations over time.

- Data Analysis: In-depth Klaviyo reports measure 'revenue attribution', 'customer lifetime value', & 'campaign ROI'. Cohort analysis shows customer retention patterns.

-

Tracking & Personalization: Add new fields for 'Viewed Product' and 'Added To Cart' events. These include

external_catalog_idandintegration_key. API improves tracking and personalization. Predictive data analysis and CDP synchronization abilities are also available.

Pricing

Starts from $20/month

6. Omnisend

Omnisend offers integrated omnichannel marketing automation designed especially for e-commerce. It works well with Magento 2. Thus, it enables companies to provide a unified customer experience across various touchpoints.

Features

- Omnichannel Automation: Coordinate 'email', 'SMS', 'push notifications', & 'social media campaigns' from one platform. Customers can receive different messages on different channels in the same workflow.

- Pre-built Automation: Include ready-to-use workflows for 'welcome series' and 'abandoned cart recovery'. Post-purchase follow-ups save setup time and boost e-commerce conversions.

- Live Data Analysis: Track performance across all channels with detailed reporting & revenue attribution. The unified dashboard shows ROI for each communication channel.

- Live Updates: Live web push notifications reach customers browsing your site. AI-powered trigger improvement optimizes send times based on individual customer behavior. A better WhatsApp connection also allows for a broader messaging reach.

Pricing

Starts from $16/month

How to Choose the Right Marketing Automation Tool for Your Magento 2 Store?

| Factor | Key Considerations and Evaluation Criteria | What You Get |

|---|---|---|

| Pricing Structure | Alignment with store size and business stage. | Free tiers (up to 500 contacts/emails) and paid plans from $30–$600/month |

| Best Fit Store Size | Suitability for different revenue levels and complexities. | Options for small, growing, or enterprise-level stores. |

| Email & SMS Capabilities | Inclusion of email and SMS marketing features. | Some tools bundle both in free plans; others focus on advanced email only. |

| Analytics & Reporting | Depth and sophistication of analytics and reporting. | Basic stats in entry plans, advanced segmentation in higher tiers. |

| Support Availability | The availability and responsiveness of customer support. | 24/7 live chat, phone support for paid plans, live webinars, and community help. |

| Documentation Quality | The quality and detail of documentation. | Extensive guides, video tutorials, and knowledge bases. |

| Training & Certification | Access to training programs and certification courses. | Free certification courses and live training webinars. |

| Ease of Use | User-preferred interface and ease of adoption. | Drag-and-drop editors, simple onboarding, and intuitive dashboards. |

| Magento 2 Integration | Flexible integration with the Magento 2 platform. | Native Magento 2 integrations, API access, and eCommerce automation. |

| Scalability | Ability to scale according to business growth. | Plans range from free to enterprise, with add-ons available for advanced needs. |

| Hidden Costs | Awareness of potential added or hidden costs. | Watch for extra fees, data migration costs, training expenses, and premium support charges. |

| Community Resources | Presence of active community and peer support resources. | Active online communities, forums, & user groups for troubleshooting. |

FAQs

1. How does a Magento marketing automation plugin work?

A Magento marketing automation extension automates several tasks. These include email campaigns, customer segmentation, & personal product recommendations. This automation enhances marketing efforts & accelerates the speed of ecommerce businesses. Key features include AI-powered personalization/omnichannel coordination.

2. How can Magento’s marketing automation increase conversions?

Magento marketing automation optimizes conversions. It delivers personalized experiences via targeted email campaigns, AI-powered product recommendations, & targeted promotions. This process ensures customers receive timely/relevant engagement across all channels.

3. How does Adobe Commerce work with marketing automation tools in Magento?

Adobe Commerce performs well with Magento’s marketing automation tools. It supports advanced data analysis, AI-powered personalization, & customer segmentation. These options create effective/personalized marketing campaigns/foster better customer engagement.

4. What benefits does a Magento marketing automation plugin offer for ecommerce businesses?

A Magento marketing automation extension enables better customer segmentation/AI-driven personalized marketing. A higher ROI helps automate repetitive tasks. Ecommerce businesses focus on planned growth initiatives, maintain privacy compliance, & offer omnichannel experiences.

5. How can Magento marketing automation options help with customer retention?

Magento 2 marketing automation tools help businesses increase customer loyalty/repeat purchases. They deliver timely, personalized messages like post-purchase follow-ups/loyalty rewards/re-engagement campaigns. These automated interactions keep customers connected to your brand/encourage repeat purchases. Advanced segmentation/predictive analytics ensure each message feels relevant/valuable to the recipient.

6. What kinds of marketing tasks can I automate with Magento?

Magento marketing automation lets you automate a wide range of tasks. These include email campaigns/abandoned cart recovery/dynamic product recommendations/customer segmentation. You can also schedule & personalize promotional banners/manage loyalty programs/trigger actions. This process enhances operations, enabling your team to focus on strategic initiatives.

Summary

Magento 2 marketing automation provides exceptional customer experiences via well-planned automation. Effective marketing automation strategies for your store help increase speed and sales growth. It lets businesses:

- Improve customer segmentation & organize your marketing efforts for greater speed/engagement/sales growth.

- Trigger automated email campaigns, product recommendations, & customized promotions across several channels.

- Save time and resources by automating tasks like customer follow-ups & conversational marketing.

- Enhance campaign speed & success to achieve a higher return on investment.

- Provide omnichannel experiences with unified messaging across email/SMS/social media/messaging platforms.

- Maintain privacy compliance with built-in consent management & data protection options.

Improve customer segmentation and automate your marketing efforts with Magento hosting services.

[Updated on June 09, 2025]