Payment Tokenization Technique Magento: Types and Trends

Did you know that 43% of cyberattacks target small businesses with payment data breaches? Payment tokenization technique Magento protects sensitive credit card data.

The article explores the working, types, and trends of payment tokenization.

Key Takeaways

- Follow the steps of tokenization, from user input to secure storage.

- Compare tokenization with encryption to determine which method is more secure.

- Tokenization techniques include Vault, client-side, and hybrid methods.

- Top tokenization providers include Adyen and Braintree.

- Stay ahead with trends like AI-based fraud prevention and payment orchestration.

Looking for the best Magento development agency USA? Choosing the right development agency is essential for eCommerce succes. Top agencies have the expertise to create a high-performing online store. This article covers the top 25 agencies in the USA and tips for choosing the best one.

? Choosing Magento Development Agency

Duration: 1:55 | ? Source

Key Takeaways

- Discover the benefits of hiring a Magento development agency for your eCommerce project.

- Explore the top 25 Magento development agencies in the USA.

- Learn essential tips for choosing the best agency to meet your specific needs.

- Understand the importance of working with certified Magento developers and experienced agencies.

- Discover how a full-service agency can provide comprehensive support for your online store.

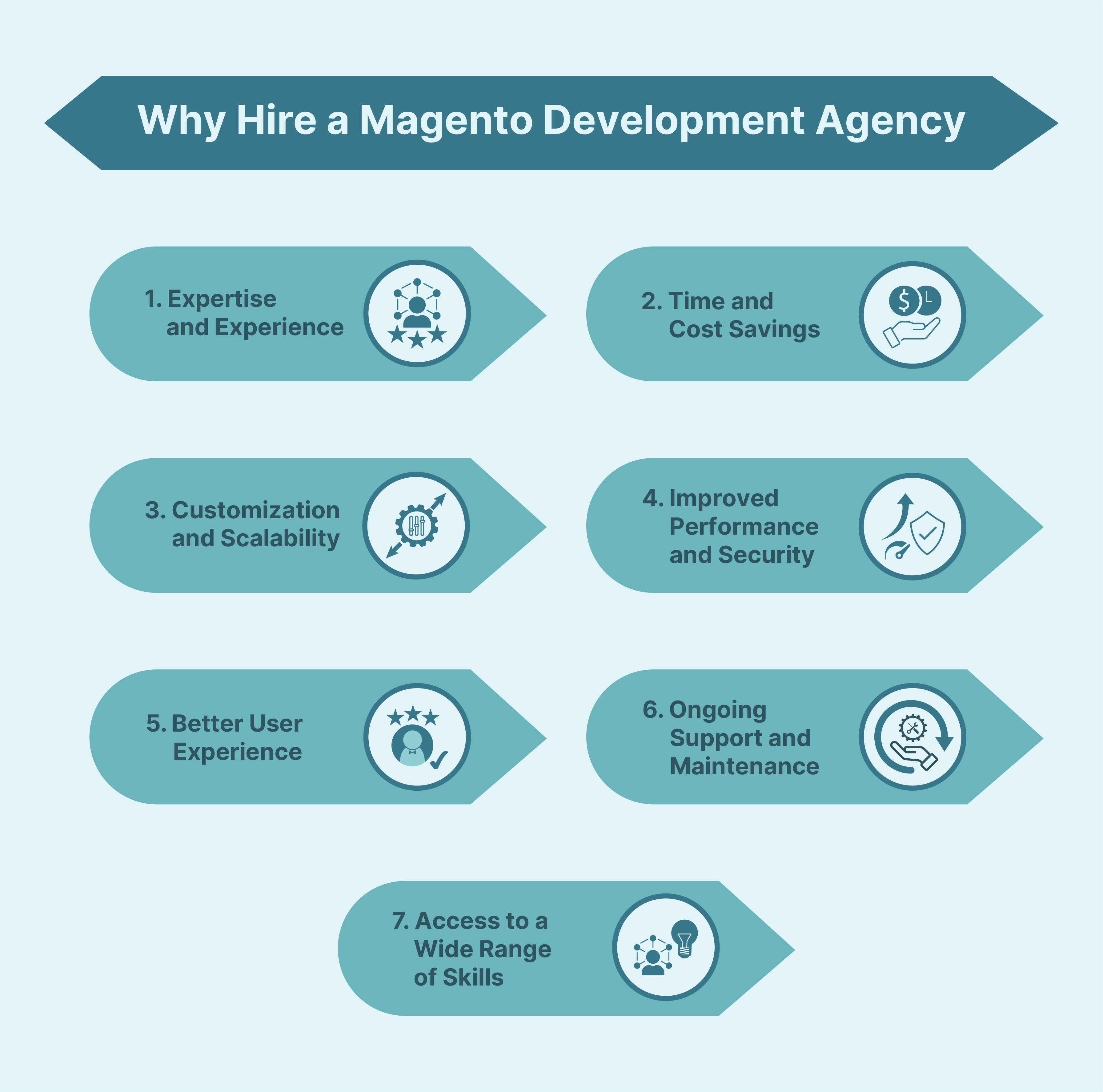

Why Hire a Magento Development Agency?

1. Expertise and Experience

A Magento development agency has a team of skilled developers. They have extensive experience in creating and customizing Magento stores. They stay up-to-date with the latest Magento trends and best practices. This expertise ensures that your store is built to the highest standards.

2. Time and Cost Savings

Hiring a Magento development agency saves you time and money. They have streamlined processes and efficient workflows. It allows them to deliver your project faster than if you were to do it in-house. They also have access to a wide range of resources and tools. Magento development agency helps to keep costs down.

3. Customization and Scalability

Magento development agencies can customize your store to meet your unique business needs. They can create custom modules, extensions, and Magento integrations. It ensures that your store is tailored to your specific requirements. They also ensure that your store is scalable. It can grow with your business.

4. Improved Performance and Security

Magento development agencies optimize your store for performance and security. They use best practices for coding and server configuration. It ensures that your store loads quickly and is secure. They also implement security measures to protect against hacks and data breaches.

5. Better User Experience

Magento development agencies create stores that provide a better user experience. They focus on creating intuitive navigation, fast load times, and mobile responsiveness. Magento development helps to increase customer engagement and conversions. They also implement best practices for SEO. Agencies help to improve your store's visibility in search engine results.

6. Ongoing Support and Maintenance

Magento development agencies provide ongoing support and maintenance for your store. They can help with bug fixes, updates, and security patches. They can also provide training for your staff. These agencies ensure that your store remains up-to-date and running smoothly.

7. Access to a Wide Range of Skills

Magento development agencies have a wide range of skills beyond just development. They can provide services such as design, SEO, marketing, and project management. It allows you to access a full range of skills. You can get everything you need to create and grow your online store.

26 Best Magento Development Companies in the USA

1. Brainvire

| Details | Explanation |

|---|---|

| Agency Link | Brainvire Infotech Inc. |

| Founded | 2000 |

| Key Features | Brainvire Infotech Inc. specializes in end-to-end Magento e-commerce solutions. Their services include custom development, migration and upgrades, and website design. They also offer payment gateway and third-party API integration, performance optimization, mobile app development, and security enhancements. The team comprises of 250-500 professionals. Charges are based on the customized nature of services provided. Contact Braivire’s support for pricing plans. |

2. Magneto IT Solutions

| Details | Explanation |

|---|---|

| Agency Link | Magneto IT Solutions |

| Founded | 2010 |

| Key Features | Magneto IT Solutions focuses on digital commerce solutions. The company works with manufacturers, wholesalers, and retailers globally. Magneto offers a platform-agnostic approach. The team comprises 50-249 employees. Charges are $50/hr. Magneto IT Solutions delivers custom solutions to meet unique business needs. |

3. ITRex

| Details | Explanation |

|---|---|

| Agency Link | ITRex |

| Founded | 2009 |

| Key Features | ITRex provides technology consulting and software development. The agency has delivered 500+ industry-specific solutions. ITRex has expertise in emerging technologies. The company employs 250-999 professionals. Charges are $50/hr. ITRex works with Fortune 500 companies and startups. |

4. Folio3 eCommerce

| Details | Explanation |

|---|---|

| Agency Link | Folio3 eCommerce |

| Founded | 2005 |

| Key Features | Folio3 specializes in end-to-end Magento eCommerce solutions, including custom store design, website development, support and maintenance, and store migration. As a certified Magento partner, it helps businesses of all sizes scale and succeed online. Backed by a team of Magento-certified professionals, the company is dedicated to delivering innovative, high quality, and scalable solutions tailored to client needs.Get in touch today to discuss how we can transform your Magento store. |

5. WebDesk Solution

| Details | Explanation |

|---|---|

| Agency Link | WebDesk Solution |

| Founded | 2012 |

| Key Features | WebDesk Solution specializes in custom web design and development. The company offers eCommerce, mobile app development, and API integration. WebDesk Solution is a certified partner of major digital commerce platforms. The team includes 1-50 employees. Charges are $80/hr. WebDesk Solution focuses on delivering high-quality and scalable solutions. |

6. Pencil Designs

| Details | Explanation |

|---|---|

| Agency Link | |

| Founded | N/A |

| Key Features | Pencil Designs focuses on branding and eCommerce development. The agency helps businesses express ideas and design products. Pencil Designs creates robust eCommerce software. The team comprises 10-49 employees. Charges are $50/hr. Pencil Designs is known for creative and innovative solutions. |

7. TheCommerceShop

| Details | Explanation |

|---|---|

| Agency Link | TheCommerceShop |

| Founded | 2009 |

| Key Features | TheCommerceShop specializes in eCommerce development and digital marketing. The agency offers services like conversion rate optimization and SEO. TheCommerceShop has expertise in Magento, Shopify, and BigCommerce. The team includes 50-249 employees. Charges are $50/hr. TheCommerceShop provides tailored solutions to enhance online sales. |

8. SparxIT

| Details | Explanation |

|---|---|

| Agency Link | SparxIT |

| Founded | 2007 |

| Key Features | SparxIT focuses on software development and IT solutions. The company offers cross-platform and native mobile app development. SparxIT has expertise in React Native, Flutter, and more. The team comprises 99-200 employees. Charges are $25/hr. SparxIT delivers high-end web solutions leveraging various technologies. |

9. Barwenock LLC

| Details | Explanation |

|---|---|

| Agency Link | Barwenock LLC |

| Founded | N/A |

| Key Features | Barwenock LLC offers end-to-end solutions for eCommerce. The company provides consulting, development, and product administration. Barwenock is an official Adobe partner. The team comprises 45-55 employees. Charges are $35/hr. Barwenock LLC delivers tailored solutions for complex eCommerce needs. |

10. CODIANT

| Details | Explanation |

|---|---|

| Agency Link | CODIANT |

| Founded | N/A |

| Key Features | CODIANT focuses on mobility and custom web product development. The company offers ISO 9001-2008 & ISO/IEC 27001:2013 certifications. CODIANT has a team of 250+ certified developers. Charges are $100/hr. CODIANT delivers innovative and secure solutions for various industries. |

11. OrbitLift

| Details | Explanation |

|---|---|

| Agency Link | OrbitLift |

| Founded | N/A |

| Key Features | OrbitLift specializes in eCommerce applications. The company uses data-driven methods to make intelligent choices. OrbitLift helps businesses increase revenue and optimize assets. The team comprises 10-49 employees. Charges are $50/hr. OrbitLift focuses on creating scalable and efficient eCommerce solutions. |

12. SeedCart

| Details | Explanation |

|---|---|

| Agency Link | SeedCart |

| Founded | N/A |

| Key Features | SeedCart offers full-service eCommerce web development. The company has 10+ years of experience. SeedCart delivers transformative digital experiences. The team comprises 51+ employees. Charges are $49/hr. SeedCart focuses on client satisfaction and high-quality solutions. |

13. Terasol Technologies

| Details | Explanation |

|---|---|

| Agency Link | Terasol Technologies |

| Founded | 2014 |

| Key Features | Terasol Technologies provides web consulting and app development |

. The company delivers optimal web solutions. Terasol serves a global client base. The team includes 10-49 employees. Charges are $50/hr. Terasol Technologies focuses on innovation and cutting-edge technologies. |

14. Clavax

| Details | Explanation |

|---|---|

| Agency Link | Clavax |

| Founded | N/A |

| Key Features | Clavax empowers companies with creative solutions. The company has a multidisciplinary team of eCommerce developers. Clavax offers high-impact solutions. The team comprises 50-249 employees. Charges are $25/hr. Clavax focuses on delivering robust and scalable software solutions. |

15. Trango Tech

| Details | Explanation |

|---|---|

| Agency Link | Trango Tech |

| Founded | N/A |

| Key Features | Trango Tech offers digital transformation services. The company provides business and digital solutions. Trango Tech helps clients grow. The team includes 100-1000 employees. Charges are $0.24/hr. Trango Tech focuses on innovation and effective digital strategies. |

16. Webplanex

| Details | Explanation |

|---|---|

| Agency Link | Webplanex |

| Founded | N/A |

| Key Features | Webplanex specializes in eCommerce development and web design. The company uses the latest technologies. Webplanex creates user-friendly online shopping experiences. The team comprises 50-150 employees. Charges are $20/hr. Webplanex focuses on client satisfaction and high-quality solutions. |

17. Sunflower Lab

| Details | Explanation |

|---|---|

| Agency Link | Sunflower Lab |

| Founded | 2010 |

| Key Features | Sunflower Lab provides custom software and mobile app development. The company serves various industries including healthcare and finance. Sunflower Lab has a high customer satisfaction rate. The team comprises 10-49 employees. Charges are $50/hr. Sunflower Lab focuses on delivering reliable and innovative solutions. |

18. Zealous System

| Details | Explanation |

|---|---|

| Agency Link | Zealous System |

| Founded | N/A |

| Key Features | Zealous System specializes in mobile app development. The company uses the latest technologies like Swift and Kotlin. Zealous System provides high-quality software solutions. The team comprises 50-249 employees. Charges are $25/hr. Zealous System serves clients globally across various industries. |

19. Big Drop Inc

| Details | Explanation |

|---|---|

| Agency Link | Big Drop Inc |

| Founded | 2013 |

| Key Features | Big Drop Inc. offers digital experiences that make an impact. The company works with startups, SMBs, and Fortune 500 companies. Big Drop Inc. provides web design and branding services. The team comprises 50-249 employees. Charges are $100/hr. Big Drop Inc. focuses on creativity and technology to deliver outstanding results. |

20. Forebear Productions

| Details | Explanation |

|---|---|

| Agency Link | Forebear Productions |

| Founded | N/A |

| Key Features | Forebear Productions offers offshore software development. The company provides creative and easy-to-use solutions. Forebear Productions focuses on reliability and ROI. The team comprises 10-49 employees. Charges are $25/hr. Forebear Productions delivers cost-effective and efficient solutions. |

21. Plus972

| Details | Explanation |

|---|---|

| Agency Link | Plus972 |

| Founded | 2009 |

| Key Features | Plus972 is a boutique branding and marketing agency. The company has a global presence. Plus972 delivers long-lasting results. The team comprises 10-49 employees. Charges are $200/hr. Plus972 focuses on delivering customized branding solutions. |

22. Fastly

| Details | Explanation |

|---|---|

| Agency Link | Fastly |

| Founded | 2011 |

| Key Features | Fastly offers a fast content delivery network (CDN). The company provides edge cloud platform services. Fastly focuses on reliability and security. The team comprises 250-999 employees. Charges are $25/hr. Fastly delivers high-performance solutions for modern websites and applications. |

23. Vertex

| Details | Explanation |

|---|---|

| Agency Link | Vertex |

| Founded | 1978 |

| Key Features | Vertex offers tax technology and services. The company automates and manages global indirect taxes. Vertex helps businesses stay compliant. The team comprises 10-49 employees. Charges are $100/hr. Vertex delivers comprehensive tax solutions. |

24. Springbot

| Details | Explanation |

|---|---|

| Agency Link | Springbot |

| Founded | 2012 |

| Key Features | Springbot provides eCommerce marketing automation. The company offers email, social media, and online ads. Springbot focuses on increasing sales. The team comprises 50-249 employees. Charges are $25/hr. Springbot integrates with platforms like Shopify and Magento to enhance marketing efforts. |

25. Syberry Corporation

| Details | Explanation |

|---|---|

| Agency Link | Syberry Corporation |

| Founded | 2011 |

| Key Features | Syberry Corporation offers custom software development services. The company serves various industries including healthcare and finance. Syberry Corporation provides high-quality and reliable solutions. The team comprises 150-249 employees. Charges are $25/hr. Syberry Corporation focuses on delivering customer-centric solutions. |

26. Foreignerds Inc

| Details | Explanation |

|---|---|

| Agency Link | Foreignerds Inc |

| Founded | 2013 |

| Key Features | Foreignerds Inc. specializes in digital marketing and web development. The company offers SEO, PPC, and social media marketing services. Foreignerds Inc. provides comprehensive eCommerce solutions. The team comprises 25-50 employees. Charges are $50/hr. Foreignerds Inc. focuses on delivering measurable results for clients. |

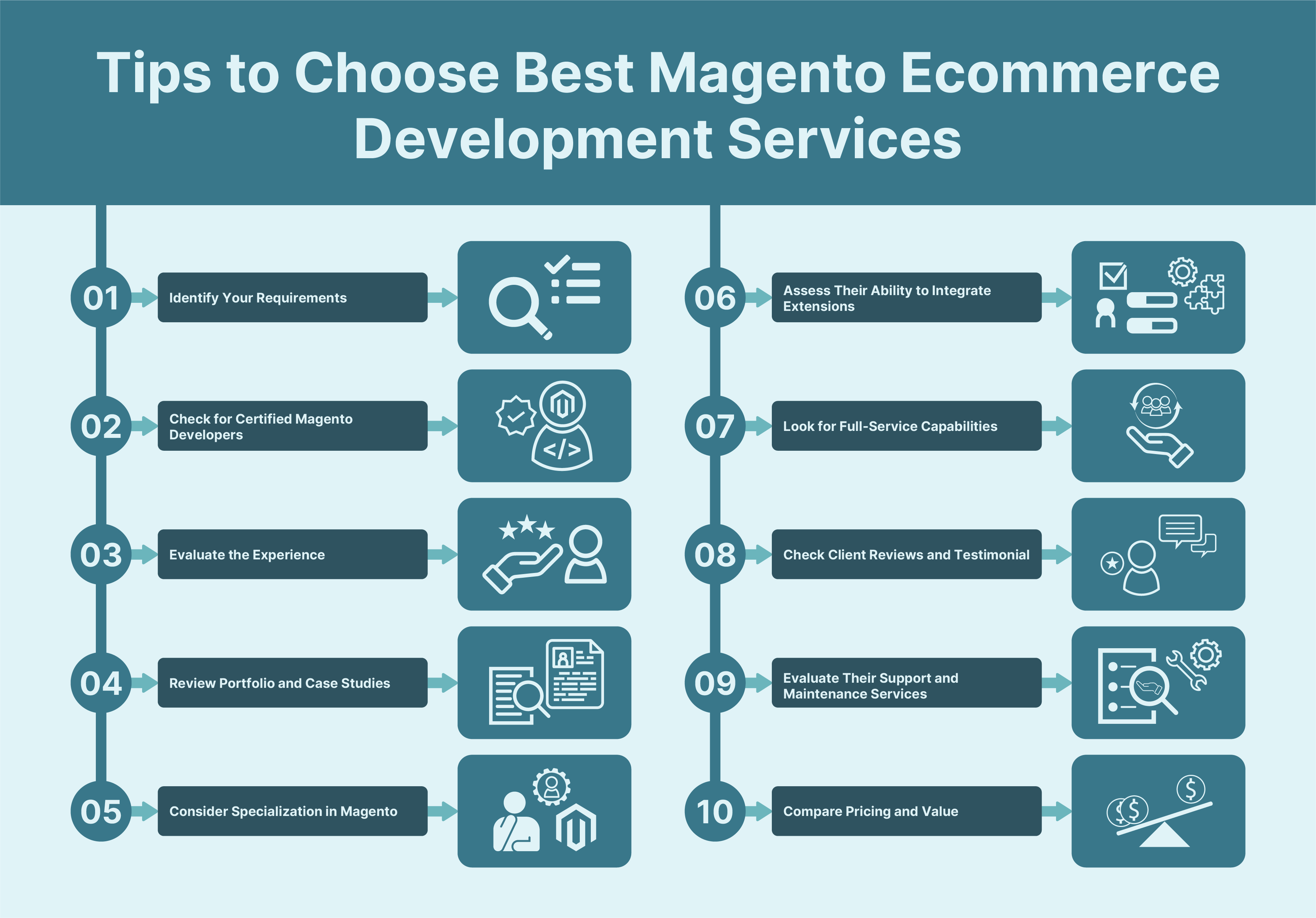

Tips to Choose Best Magento Ecommerce Development Services

1. Identify Your Requirements

First, identify the specific needs of your Magento website. Determine the features and functionalities you require. It includes deciding whether you need Magento 2 or still operate on Magento 1. Clear requirements help you choose the right Magento development service.

2. Check for Certified Magento Developers

Ensure the development firm has certified Magento developers. Certification guarantees expertise in Magento web development and design. Certified Magento developers are trained in best practices. They can deliver a high-quality Magento solution.

3. Evaluate the Experience

Look for a development team with extensive experience in Magento application development. Experienced Magento developers can handle complex projects. They bring valuable insights and efficient solutions. It ensures your Magento platform runs smoothly.

4. Review Portfolio and Case Studies

Examine the portfolio of the software development company. Check past projects and case studies. Look for projects similar to yours. It helps gauge their expertise in e-commerce development and Magento web development and design.

5. Consider Specialization in Magento

Choose a development firm that specializes in Magento commerce. Specialized Magento agencies offer in-depth knowledge of the Magento platform. They can provide customized Magento solutions. It ensures your project gets the focused expertise it needs.

6. Assess Their Ability to Integrate Extensions

The right Magento partner should have experience with Magento extensions. Extensions enhance the functionality of your Magento website. Ensure the development team can integrate and customize extensions effectively. It adds value to your Magento solution.

7. Look for Full-Service Capabilities

Select a Magento development service that offers comprehensive solutions. It includes mobile application development, design, and Magento web development and design. A full-service ecommerce agency can handle all aspects of your project. It ensures consistency and quality.

8. Check Client Reviews and Testimonials

Read reviews and testimonials from previous clients. It provides insights into the Magento service quality. Positive feedback indicates reliability and professionalism. Look for reviews about their Magento developer skills and Magento platform expertise.

9. Evaluate Their Support and Maintenance Services

Post-launch support is important for the success of your **Magento website**. Ensure the development firm offers robust support and maintenance. It includes regular updates, security checks, and troubleshooting. Reliable support keeps your Magento commerce site running smoothly.

10. Compare Pricing and Value

Finally, compare the pricing of different Magento agencies. Look for a balance between cost and quality. The cheapest option is not always the best. Evaluate the value provided, such as the expertise of the development team and the comprehensiveness of their Magento development service.

FAQs

1. Why should I hire a Magento development company in the USA?

Hiring a Magento development company in the USA ensures you get top-quality service. These web development companies have extensive experience and expertise. They follow the latest trends and best practices. It guarantees a high-performing website development project.

2. How do I choose the best Magento developers?

Look for leading Magento solution partners with proven track records. Check their portfolio and client reviews. Ensure they have a team of Magento experts and Adobe Magento certifications. It ensures you are hiring the best Magento developers.

3. What are the benefits of using Magento for e-commerce?

Magento offers flexibility and scalability for your online store. It supports various ecommerce development companies needs. The platform provides numerous customization options. Magento experts can tailor it to meet your specific business requirements.

4. Why should I choose an agency in the USA for my Magento project?

An agency based in the USA offers reliable and efficient services. They are up-to-date with the latest ecommerce development trends. Magento companies in the USA have a strong reputation. They have dedicated Magento hosting to ensure professionals handle your project.

5. What makes a leading Magento solution partner?

A leading Magento solution partner has extensive experience and expertise. They have a strong portfolio and positive client reviews. These Magento development companies provide comprehensive services. They ensure your project meets the highest standards of website development.

Summary

Selecting the right Magento development agency USA ensures the scalability, speed, and security of eCommerce sites. Key benefits that top agencies offer:

-

Expertise in custom Magento solutions

-

Integration of extensions for enhanced functionality

-

Comprehensive design, development, and support services

-

Proven track record of high-quality projects

-

Focus on value and meeting your business needs

Partner with the right Magento development agency to create a powerful online store. Consider managed Magento hosting for optimal performance and growth.