Magento 2 Tax Calculation Rules for Ecommerce Stores in Canada

Confused about how taxes work across Canadian provinces in your Magento store? Magento 2 tax calculation rules manage GST, PST, and HST based on region. A correct setup avoids tax errors and builds customer trust.

This article covers configuration steps, common mistakes, and display settings for Canadian taxes.

Key Takeaways

-

Magento 2 uses tax rules, zones, and classes to apply taxes across Canada.

-

Canadian stores must configure GST, PST, and HST based on each customer’s shipping region.

-

Product and customer tax class assignments are essential for accurate tax logic.

-

Display settings help customers understand pricing and build trust.

-

Testing orders across provinces prevents compliance issues before launch.

-

What are Magento 2 Tax Calculation Rules for Canadian Stores?

-

Importance of Magento Tax Calculation Rules for E-Stores in Canada

What are Magento 2 Tax Calculation Rules for Canadian Stores?

Magento uses tax rules to calculate sales tax based on Canadian store specifications. Canadian stores need configuration for federal and provincial tax rates.

Magento supports setup for different tax zones, covering GST, PST, and HST based on region. Define tax zones and rates, then assign them to product tax classes. Link these classes to customer groups through tax rules. The system applies correct taxes during checkout as per customer’s shipping address.

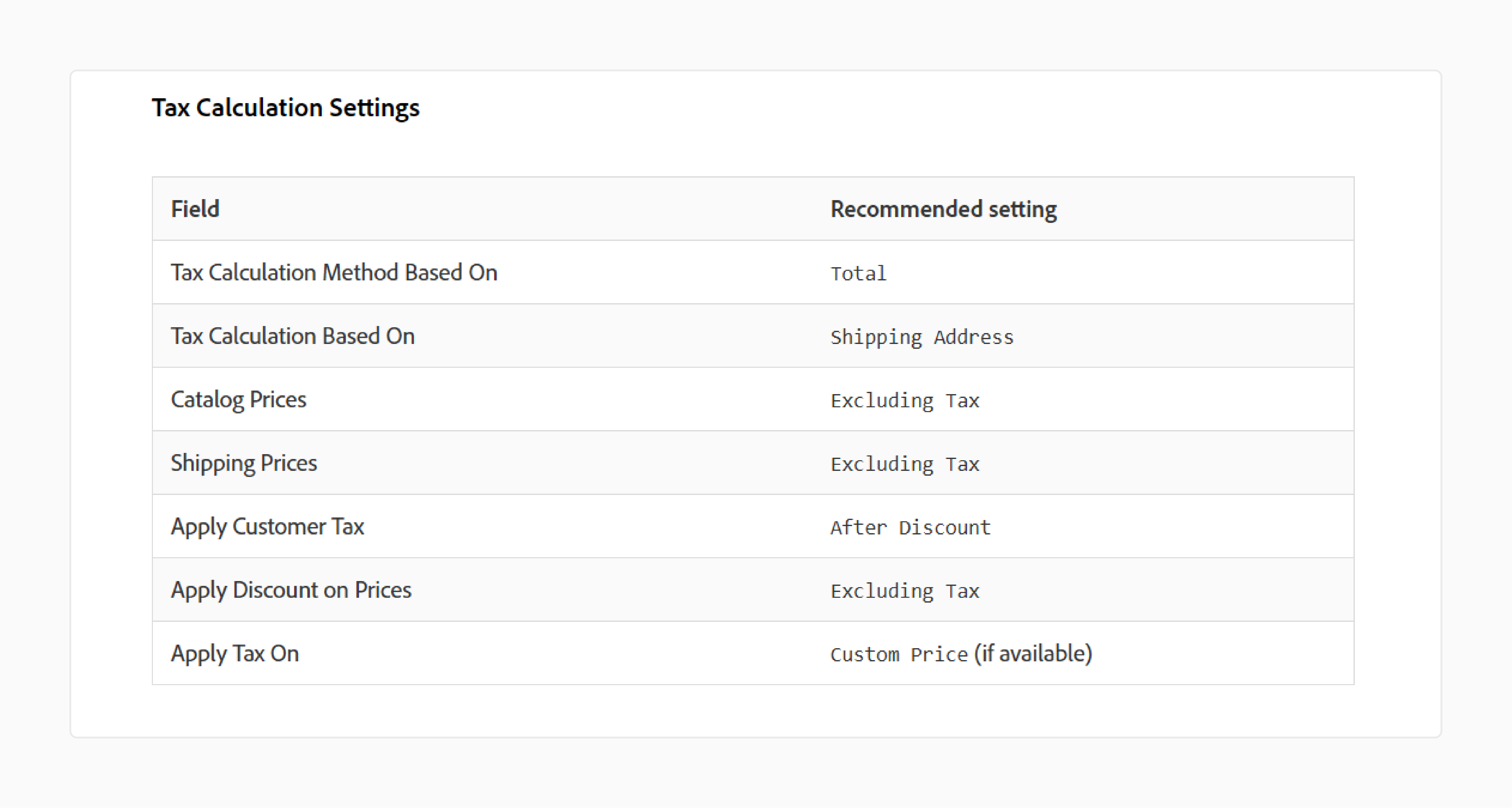

Magento 2 provides key settings to control how tax applies to pricing and discounts. Set Tax Calculation Method Based On to Total. Use Shipping Address for the Tax Calculation Based On field. Keep Catalog Prices and Shipping Prices as Excluding Tax. Set Apply Customer Tax to calculate after discounts. Choose Custom Price (if available) under Apply Tax On to handle flexible pricing needs.

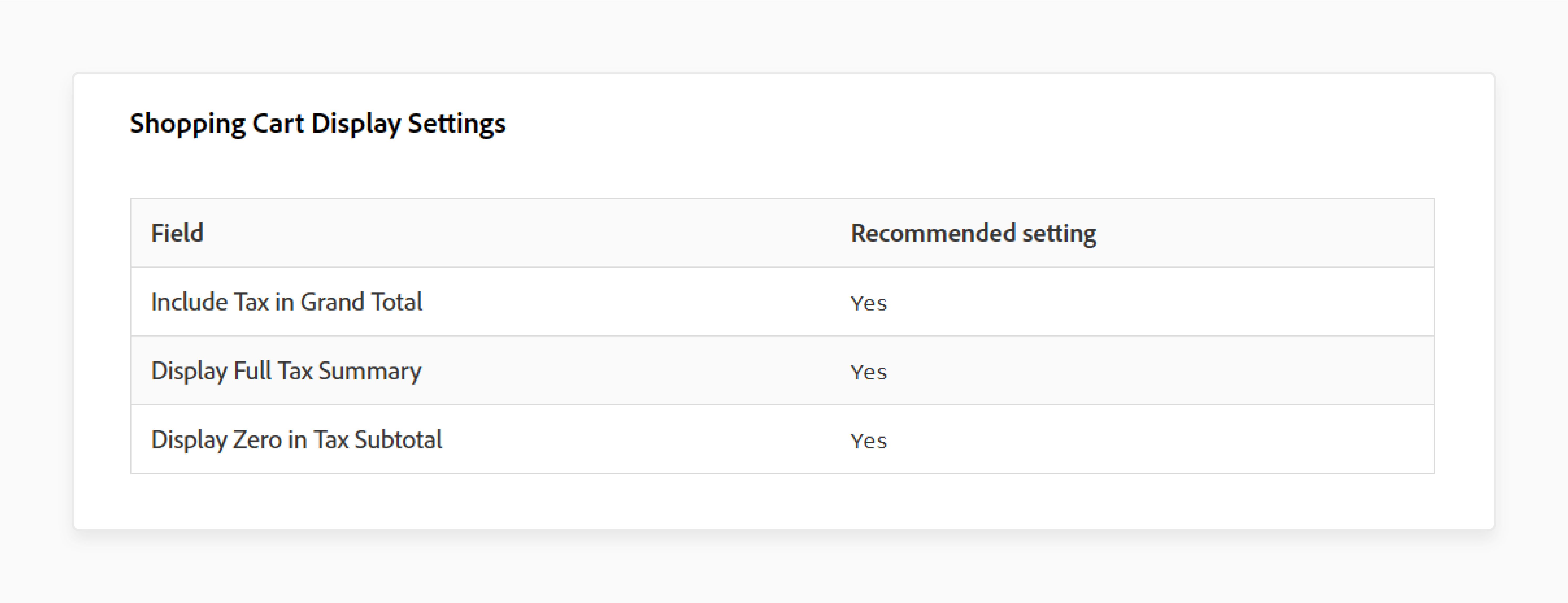

Tax display settings manage how tax information appears across the storefront. In the shopping cart, show Display Prices and Display Subtotals as Excluding Tax. Enable Display Full Tax Summary to provide clear breakdowns. Apply Hreflang tags and use SEO-driven URLs for store localization. Include tax in the Order Total field. These settings enhance clarity, foster trust, and ease compliance with Canadian tax laws.

Importance of Magento Tax Calculation Rules for E-Stores in Canada

| Feature | Explanation |

|---|---|

| Geo-Specific Tax Rates | Magento lets you configure tax rules for different Canadian provinces. Each region may have GST, PST, or HST. These taxes vary by location, so accurate configuration is essential. Magento applies the correct rate based on the customer’s shipping address. It helps store owners stay compliant with local tax laws. It also ensures customers see accurate totals. |

| Tax Class Assignment | Magento uses product and customer tax classes to apply the right tax. Products group under specific classes like taxable or non-taxable. Customers can also belong to different tax groups based on their business type or region. You assign these classes to tax rules for targeted control. This setup supports flexible taxation for various product and user types. |

| Automated Tax Application | Tax rules automate how taxes should apply during checkout. Magento checks the product, customer class, and shipping region. It then calculates tax using the linked rule. It eliminates manual errors. It ensures consistent and reliable tax calculations across all orders. |

| Pricing Accuracy | Magento settings ensure that tax addition is correct from catalog and cart prices. You can choose to show prices with or without tax. It affects how users perceive value and transparency. Correct pricing avoids disputes and builds customer trust. It also supports accurate invoice generation. |

| Display Configuration | Magento gives control over how tax appears in: Product pages Carts Order summaries You can choose to show tax amounts in a separate manner or combined. You can also display a full tax summary during checkout. This clarity improves user experience and reduces confusion. It also supports compliance with Canadian tax reporting. |

| Support for Discounts | Magento handles how tax interacts with discount rules. You can apply tax before or after discounts. You also control whether discounts apply to tax-inclusive or tax-exclusive prices. This flexibility enables the smooth running of promotions without compromising tax compliance. It ensures accurate tax even with complex pricing strategies. |

| Legal Compliance | Magento tax settings help meet CRA (Canada Revenue Agency) requirements. You can configure invoices to include required tax details. Accurate tax setup avoids penalties and audit issues. It also improves accounting accuracy. Magento ensures that all legal obligations for tax calculation and reporting meet. |

Tax Configuration for Canadian Magento Stores

Step 1: Open Tax Configuration Settings

-

Go to Stores > Settings > Configuration in the Magento Admin.

-

Set the Store View to the specific website or store, if needed.

-

Expand Sales in the left panel.

-

Click Tax to view the settings.

Step 2: Set Tax Calculation Preferences

-

Tax Calculation Method Based On: Total

-

Tax Calculation Based On: Shipping Address

-

Catalog Prices: Excluding Tax

-

Shipping Prices: Excluding Tax

-

Apply Customer Tax: After Discount

-

Apply Discount on Prices: Excluding Tax

-

Apply Tax On: Custom Price

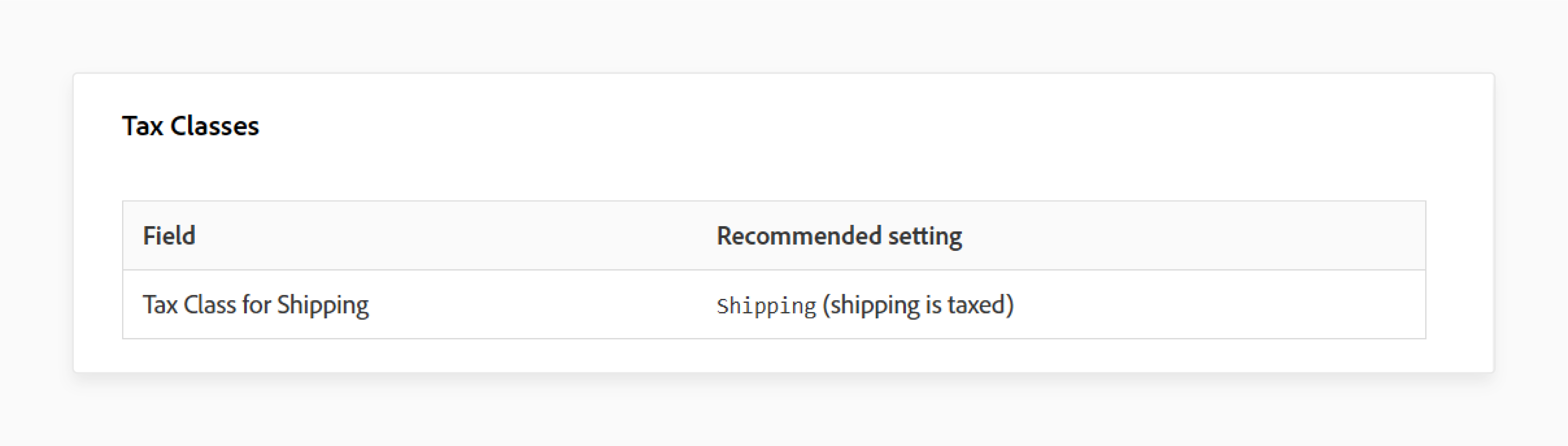

Step 3: Assign Tax Classes

- Tax Class for Shipping: Shipping

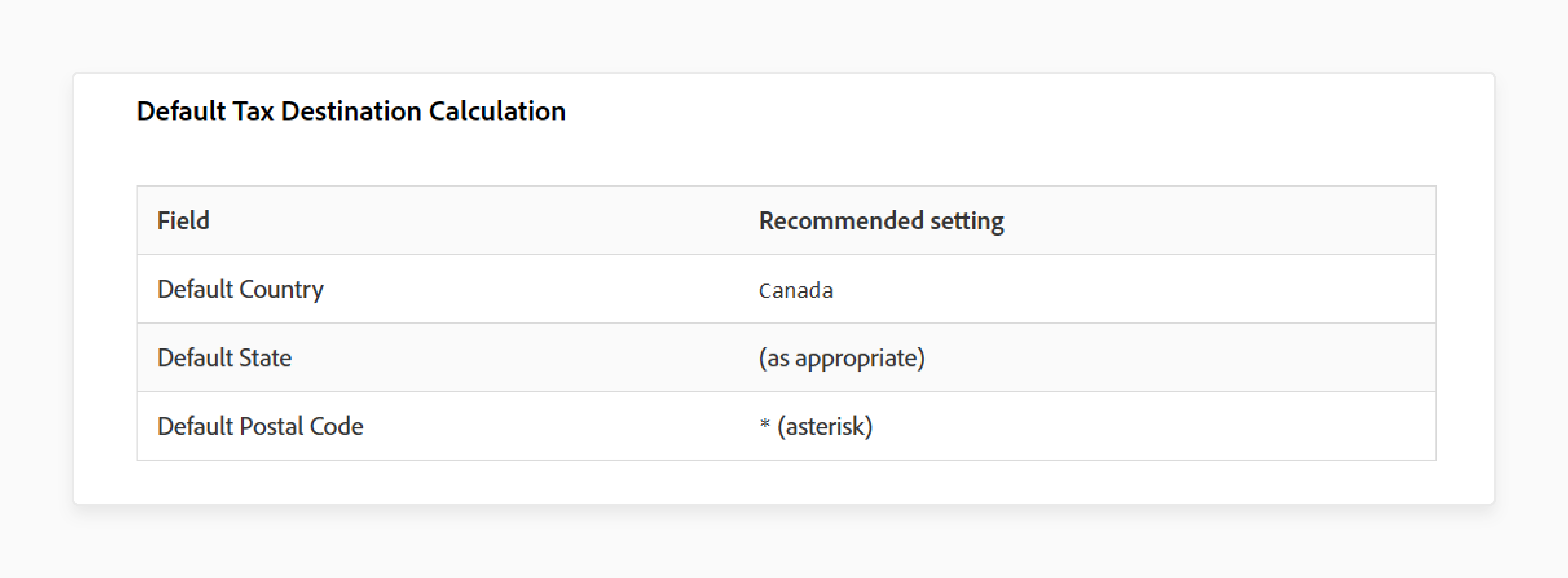

Step 4: Set Default Tax Destination

-

Default Country: Canada

-

Default State: As applicable

-

Default Postal Code: * (asterisk)

Step 5: Configure Shopping Cart Display

-

Include Tax in Grand Total: Yes

-

Display Full Tax Summary: Yes

-

Display Zero in Tax Subtotal: Yes

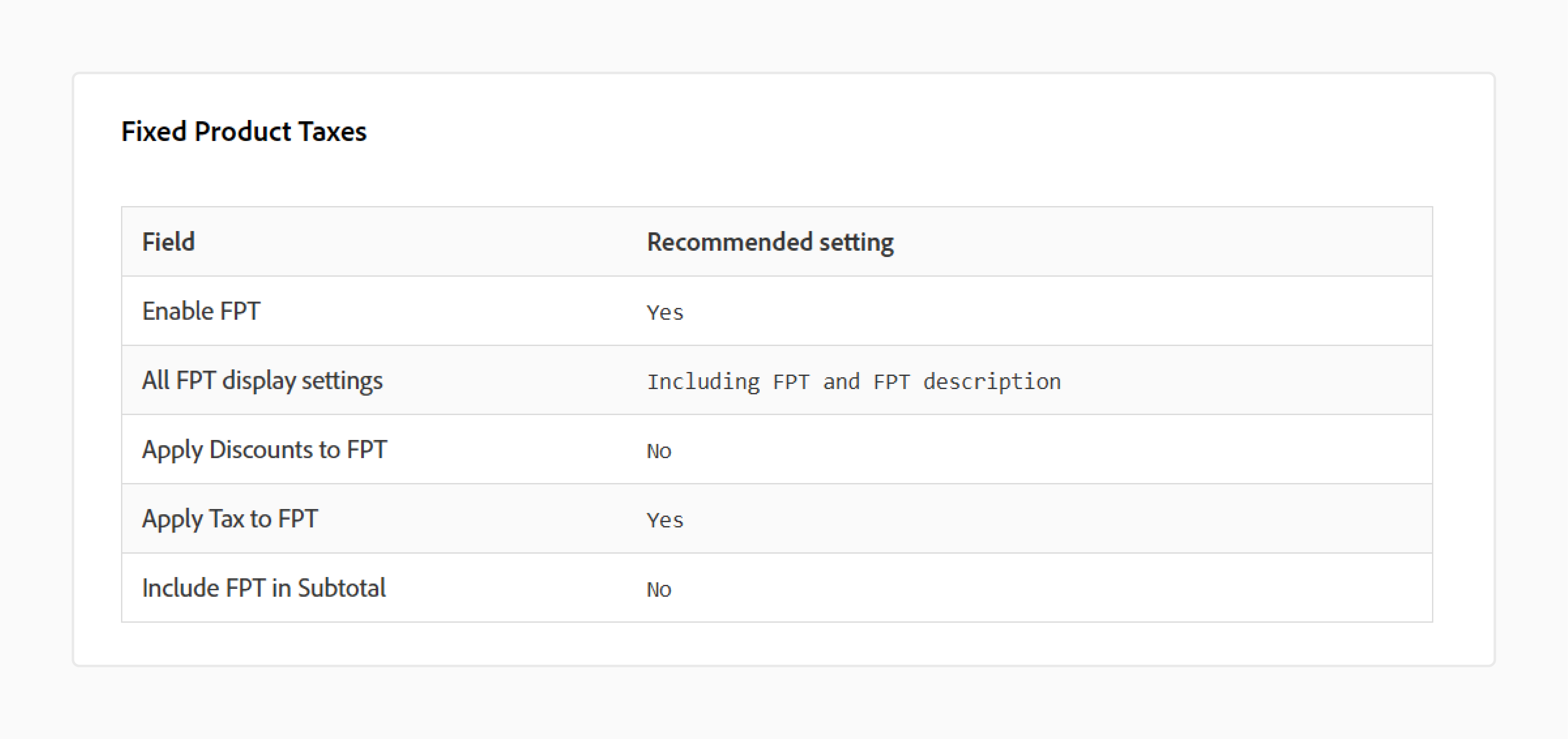

Step 6: Enable and Configure Fixed Product Tax (FPT)

-

Enable FPT: Yes

-

All FPT display settings: Including FPT and description

-

Apply Discounts to FPT: No

-

Apply Tax to FPT: Yes

-

Include FPT in Subtotal: No

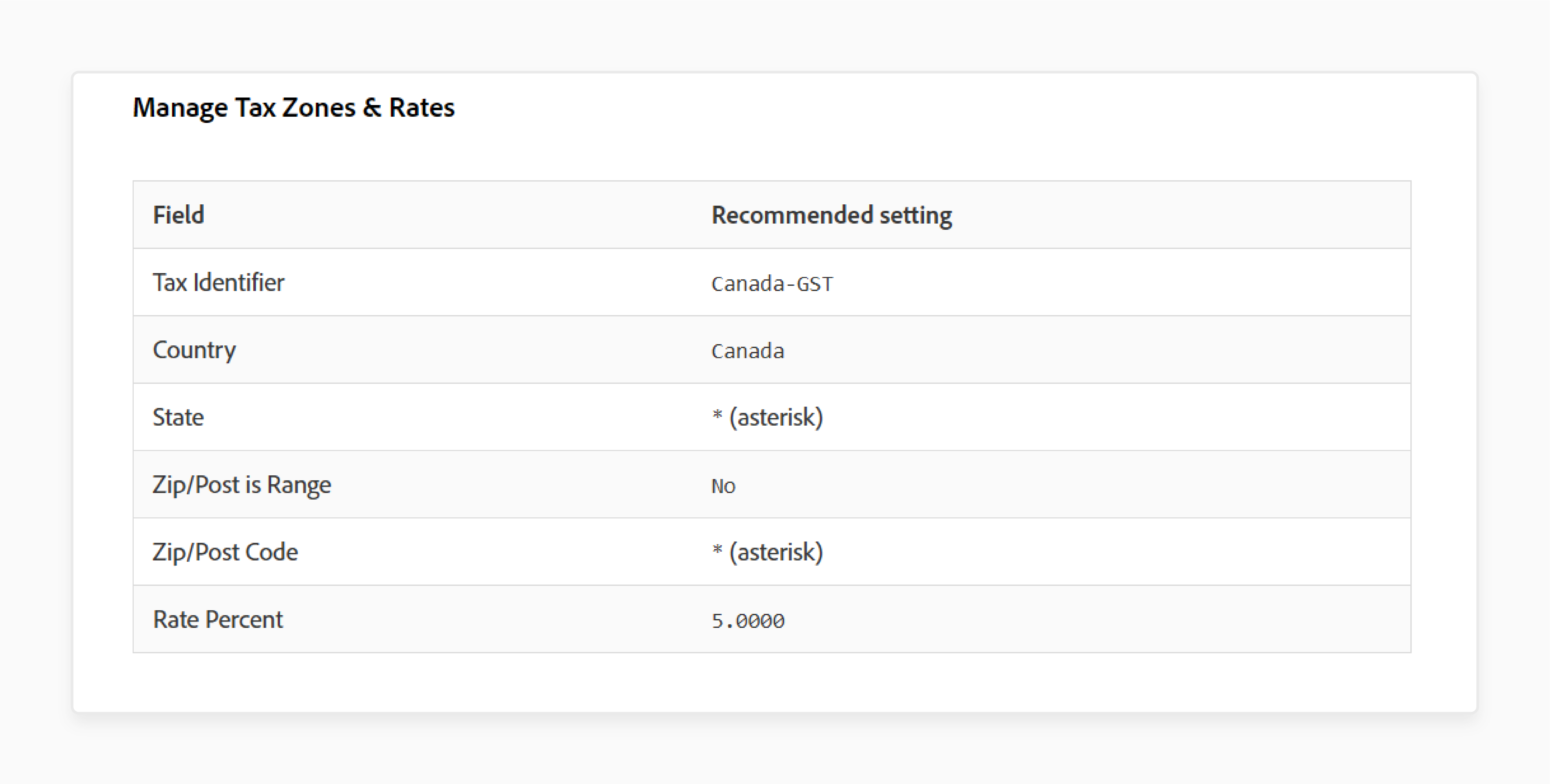

Step 7: Create GST Tax Rate

-

Go to Manage Tax Zones & Rates.

-

Set the following:

-

Tax Identifier: Canada-GST

-

Country: Canada

-

State: * (asterisk)

-

Zip/Post is Range: No

-

Zip/Post Code: * (asterisk)

-

Rate Percent: 5.0000

-

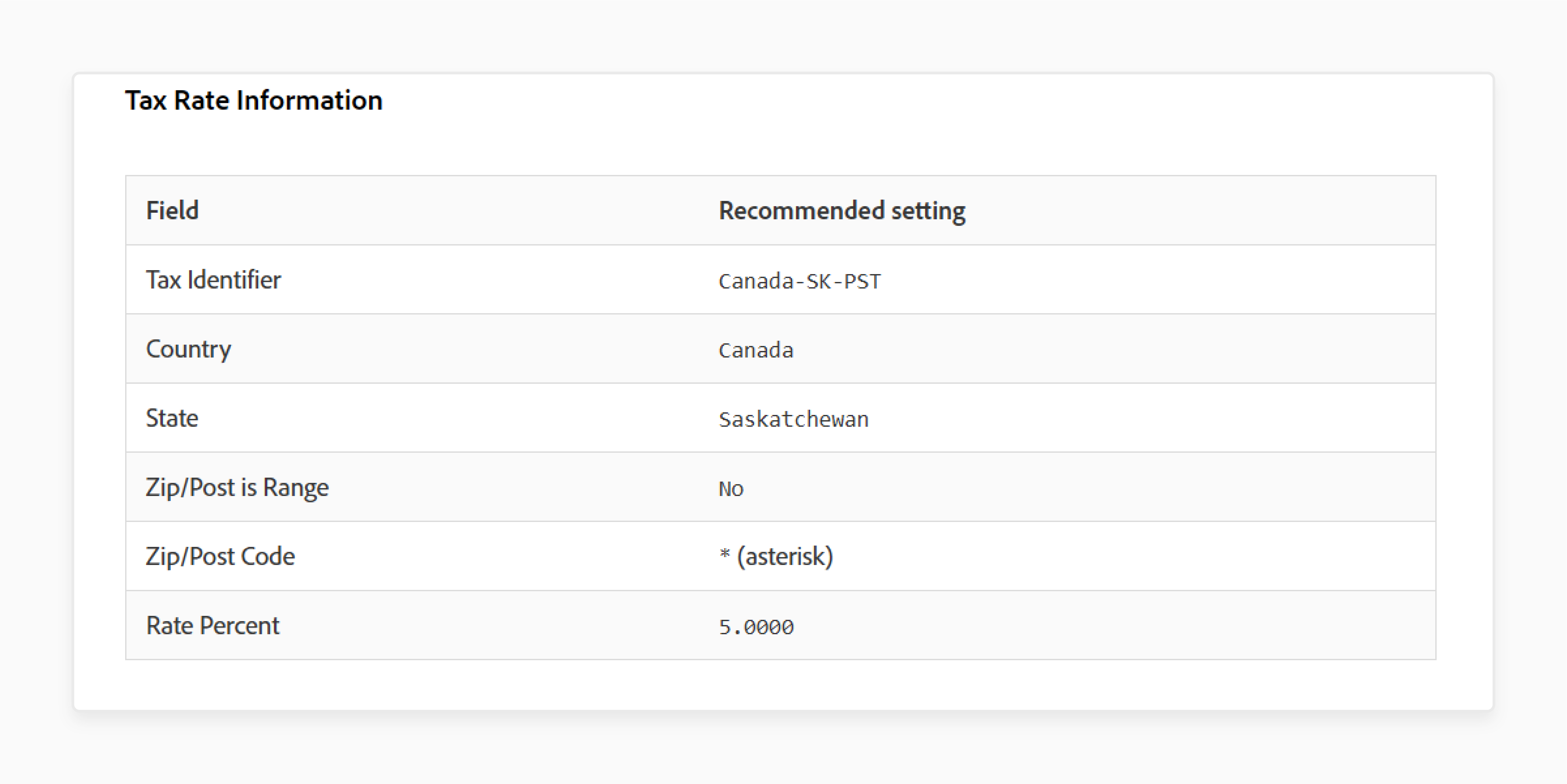

Step 8: Create PST Tax Rate for Saskatchewan

-

Add another rate under Manage Tax Zones & Rates.

-

Use these values:

-

Tax Identifier: Canada-SK-PST

-

Country: Canada

-

State: Saskatchewan

-

Zip/Post is Range: No

-

Zip/Post Code: * (asterisk)

-

Rate Percent: 5.0000

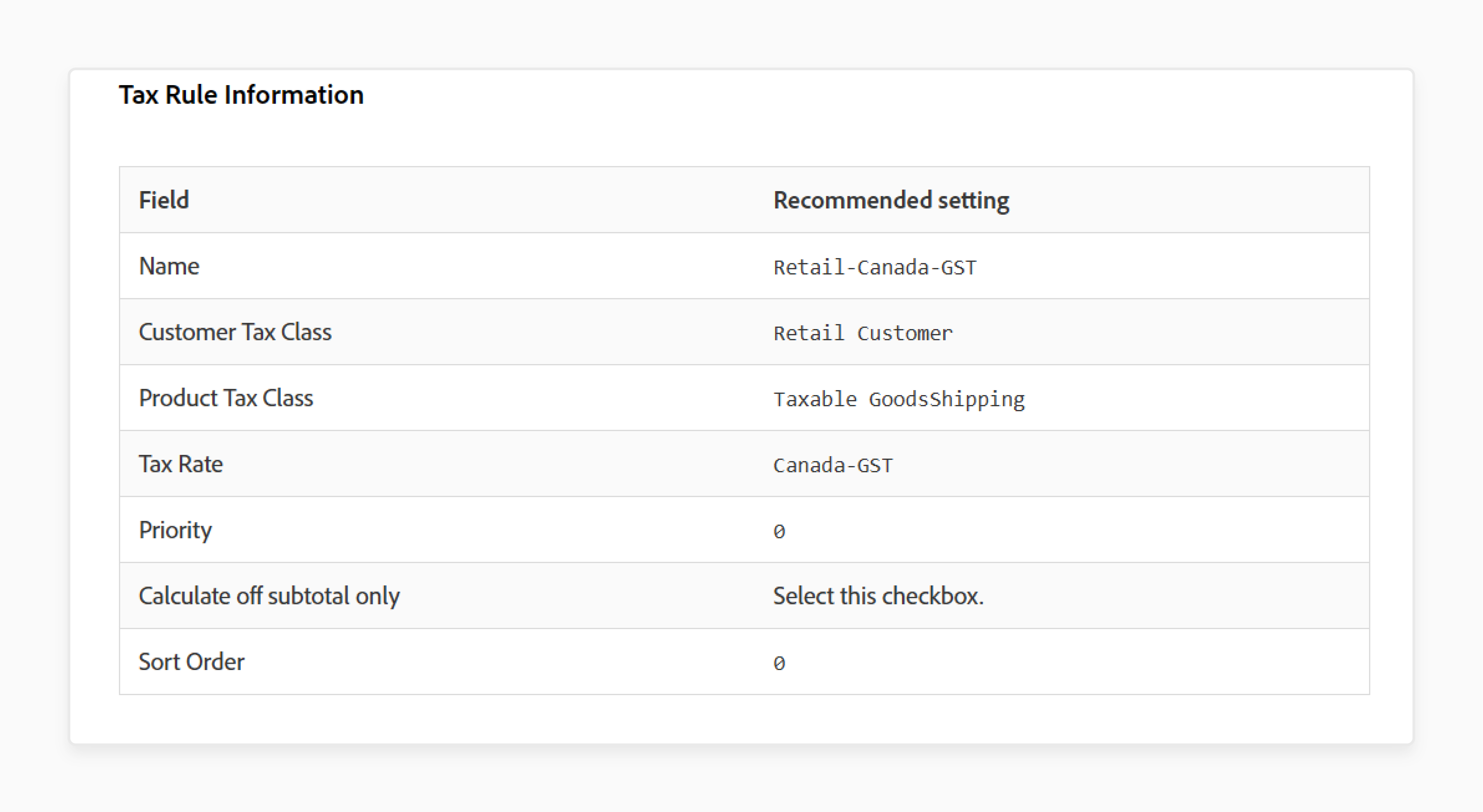

Step 9: Create GST Tax Rule

-

Go to Tax Rules and create a new rule.

-

Set the following:

-

Name: Retail-Canada-GST

-

Customer Tax Class: Retail Customer

-

Product Tax Class: Taxable GoodsShipping

-

Tax Rate: Canada-GST

-

Priority: 0

-

Calculate off subtotal only: Check this

-

Sort Order: 0

-

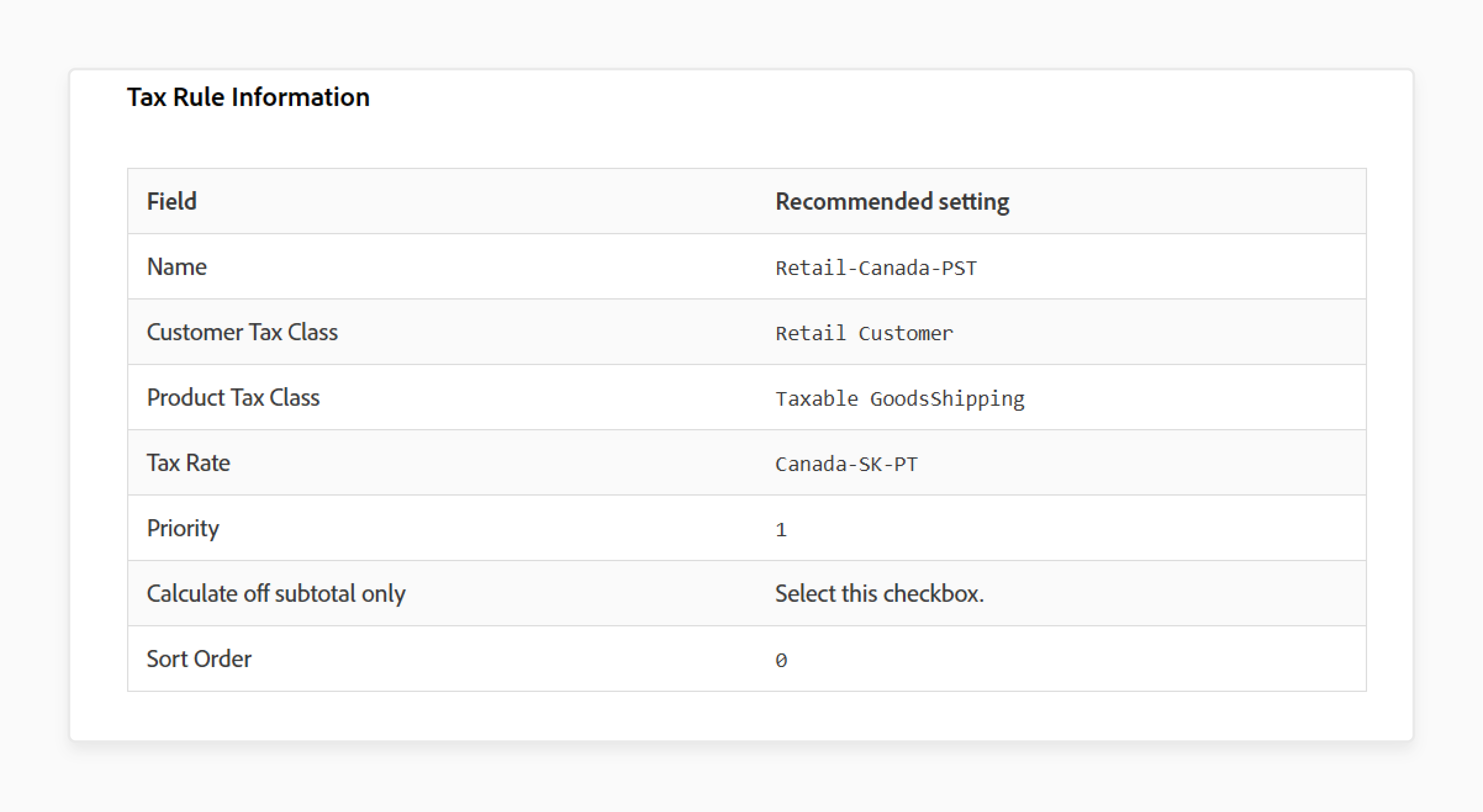

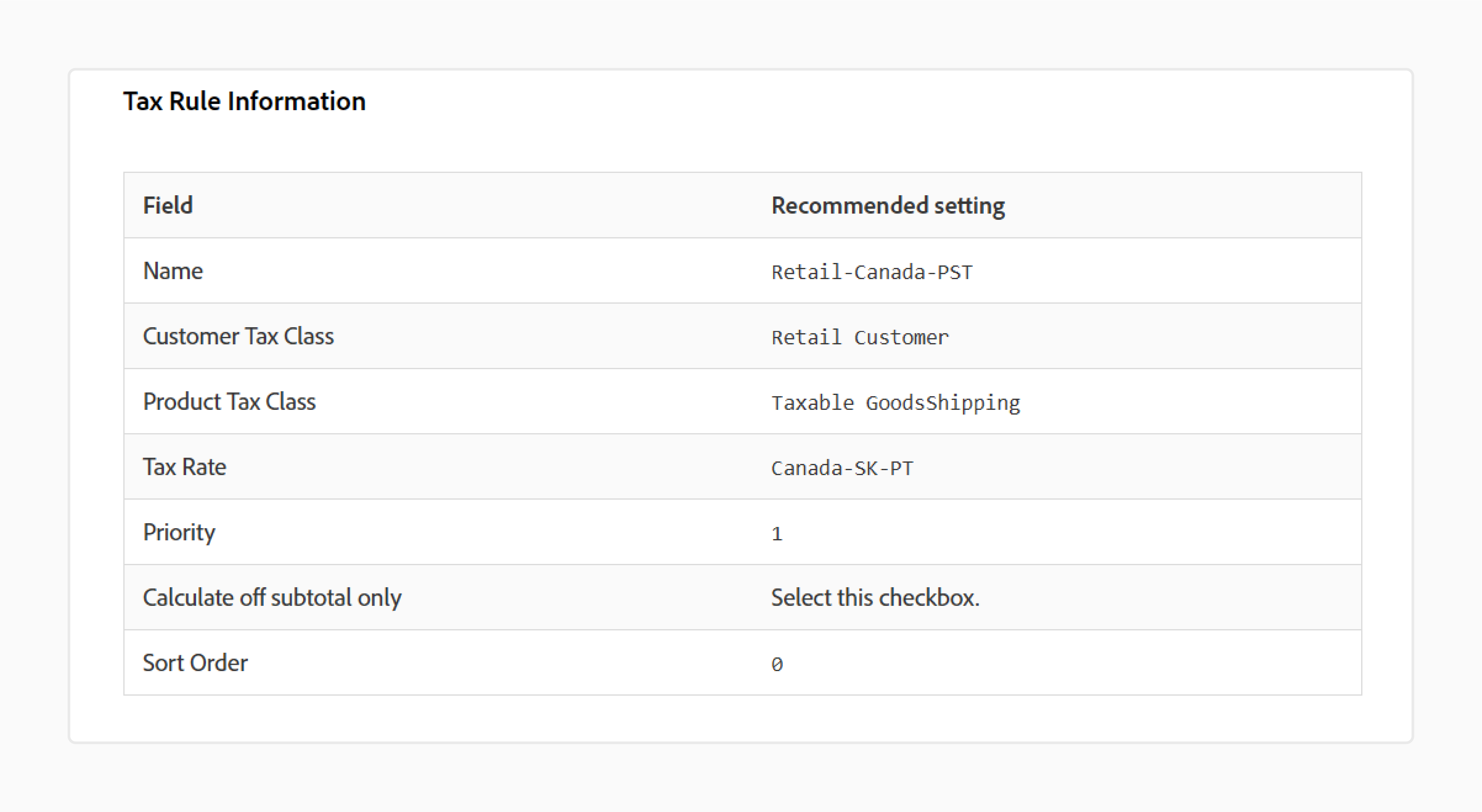

Step 10: Create PST Tax Rule for Saskatchewan

-

Create another tax rule.

-

Enter the following:

-

Name: Retail-Canada-PST

-

Customer Tax Class: Retail Customer

-

Product Tax Class: Taxable GoodsShipping

-

Tax Rate: Canada-SK-PST

-

Priority: 1

-

Calculate off subtotal only: Check this

-

Sort Order: 0

-

Step 11: Save and Verify Setup

-

Click Save Config.

-

Place a test order in the storefront.

-

Confirm that GST and PST display as separate line items and are not compounded.

Common Mistakes to Avoid in Canadian Tax Setup

| Mistake | Explanation |

|---|---|

| Incorrect Tax Zone Configuration | Assigning the wrong province codes or regions breaks tax logic. Magento uses zones to calculate GST, PST, or HST. A mismatch triggers incorrect totals at checkout. Always match each tax zone with its exact provincial need. Use Canada’s tax structure as your reference. |

| Missing Tax Class Assignments | Skipping the product or customer tax class assignment leads to broken tax rules. Magento uses these classes to apply the right tax rate. Missing assignments result in untaxed taxed orders. Assign each product and customer group a valid class. Link these classes to your tax rules. |

| Wrong Calculation Settings | Choosing incorrect options under Tax Calculation Method causes pricing issues. For Canadian stores, set the method to Total and apply tax on Custom Price (if available). These settings ensure accurate pricing logic. Check all values under Calculation Settings. Make sure they support your pricing strategy. |

| Ignoring Display Settings | Failing to configure tax display fields creates confusion. Buyers may see inconsistent totals across the store. Always set Display Prices, Subtotals, and Shipping Amounts in cart and invoices. Turn on Full Tax Summary for transparency. Clarity at every step builds customer trust. |

| No Testing Before Launch | Skipping Magento checkout testing causes last-minute issues. Merchants must simulate real orders across provinces. Testing catches tax errors and display gaps. Use different products, addresses, and discount types. Fix all issues before going live to avoid tax compliance risks. |

FAQs

1. How does Magento 2 handle different tax rates across Canadian provinces?

Magento 2 uses tax zones and rates to manage GST, PST, and HST. Each province in Canada may follow a different tax structure. Magento applies the correct rate based on the customer’s shipping address. You must create tax zones that reflect real provincial divisions. Then link each to its correct tax percentage. This setup ensures accuracy at checkout.

2. What are the best tax calculation settings for Canadian Magento stores?

Set Tax Calculation Method Based On to Total. Use Shipping Address for the Tax Calculation Based On field. Keep both Catalog Prices and Shipping Prices as Excluding Tax. Under Apply Tax On, select Custom Price (if available). These settings ensure precise tax application and discount compatibility.

3. How can I show tax details to Canadian customers?

Go to Shopping Cart Display Settings and turn on Display Full Tax Summary. Set Display Prices and Display Subtotals to Excluding Tax. In invoices, also show zero tax subtotals and use clear labels. This transparency helps customers understand their order totals. It also supports compliance with Canadian reporting rules.

4. What common tax setup mistakes should I avoid?

Avoid skipping tax class assignments for products or customers. Don’t misconfigure province codes or tax zones. Incorrect calculation settings can lead to wrong totals. Always configure display settings to prevent confusion. Test orders before launch to catch errors across provinces.

Summary

Magento 2 tax calculation rules help apply Canadian taxes for e-stores. Here’s what you gain with the correct setup:

-

Accurate Tax Application: Magento applies the right rate for each customer.

-

Clear Tax Display: Buyers see full tax details in cart and invoices.

-

Discount Compatibility: Tax works well with your promotion logic.

-

Provincial Compliance: GST, PST, and HST rules match each region.

-

Error-Free Checkout: Testing catches problems before you go live.

Consider managed Magento hosting for faster, error-free tax setup for e-stores in Canada.