How to Set Up GST Extension for Magento 2 Indian Stores?

Are you struggling to set up GST on your Magento 2 store in India? A GST extension for Magento 2 can make the process easier and ensure compliance with Indian tax laws. In this tutorial, we will explain the steps to configure the Magento 2 GST extension and its best practices.

Key Takeaways

- Learn how GST replaces multiple taxes with a unified system in India.

- Discover steps to configure the Magento 2 GST extension for compliance.

- See how the extension auto-calculates GST rates for different products.

- Find out how to create GST-compliant invoices and manage reports.

- Get tips on maintaining GST compliance and validating customer GSTINs.

What is the Indian GST Tax Law?

The Goods and Services Tax (GST) was introduced in India in 2017. It replaces multiple indirect taxes with a single, unified tax system. Under GST, businesses need to file monthly, quarterly, or annual returns based on their turnover.

For online sellers, it's essential to have a system in place to calculate and apply the correct GST rates based on product type and Magento customer location.

SGST (State Goods and Services Tax) and CGST (Central Goods and Services Tax) are two components of GST. These are applicable to intra-state sales of goods and services in India's e-commerce sector.

1. SGST: A tax levied by the central government on the intra-state supply of goods and services. The revenue collected goes to the central government.

2. CGST: A tax levied by the state government on the intra-state supply of goods and services. The revenue collected goes to the respective state government.

When an online seller makes a sale within the same state, both SGST and CGST are levied on the transaction. The total GST rate is divided equally between SGST and CGST. For example, if the GST percentage on a product is 18%, it will be split as 9% SGST and 9% CGST.

Features of Magento 2 GST Extension

1. Tax Calculation

-

The GST extension automatically calculates the applicable GST rates for products.

-

It supports different GST rates for various standard-rated, zero-rated, or tax-exempt goods and services.

-

The feature considers the customer's shipping address, billing address, and GST registration status for the appropriate tax rate.

-

It handles inter-state sales and applies the correct GST rates accordingly.

2. GST Invoicing

-

The extension generates GST-compliant invoices for orders placed in the Magento 2 store.

-

The invoices are automatically generated in the specified format, such as PDF or HTML. It can be customized with the Magento store's theme elements.

-

Credit and debit notes are financial documents issued to adjust the original invoice amount due to reasons such as returns, discounts, or price changes.

-

The extension also supports the generation of these notes for order adjustments and refunds.

3. GST Tax Reporting

-

The GST extension provides extensive reporting features to assist store owners in meeting their tax reporting obligations.

-

It generates GST-specific reports, including GSTR-1 (outward supplies), GSTR-2 (inward supplies), and GSTR-3B (monthly summary return).

-

GSTR-1 is a monthly or quarterly return that summarizes all sales (outward supplies) made by a GST-registered taxpayer.

-

GSTR-3B is a self-declared monthly summary return filed by all regular taxpayers. It contains summarized details of outward supplies, inward supplies liable to reverse charge, ITC claimed, tax liability, and taxes paid.

-

The reports include details like the total taxable value, GST amount, and HSN/SAC (Services Accounting Code) summary.

-

The extension allows for the export of these reports in various formats, such as CSV or Excel, for easy filing with tax authorities.

4. GST Tax Configuration

-

The extension provides a user-friendly interface for configuring GST settings.

-

Store owners can set up their GSTIN and configure tax rates for different product categories. They can also define tax rules based on customer locations and product types.

-

The extension allows for the configuration of GST thresholds, exemptions, and other tax-related settings as per the applicable regulations.

-

It also supports the configuration of GST for shipping charges and additional fees.

5. Customer GST Validation

-

The GST extension enables the validation of customer GSTINs during the checkout process or customer registration.

-

It integrates with the government's GST portal or API to verify the authenticity and validity of the provided GSTIN.

-

This feature helps prevent fraudulent transactions and ensures that the correct GST rates are applied based on the customer's GST registration status.

-

The extension can also automatically populate the customer's address details based on their GSTIN.

6. GST-Compliant Product Management

-

The extension allows for the management of product-level GST details, such as HSN codes and applicable tax rates.

-

Store owners can assign HSN codes to products, which are used for accurate GST calculations and reporting.

-

The extension supports the configuration of different GST rates for individual products or product categories.

-

It also handles scenarios like bundled products, configurable products, and grouped products.

7. GST Reconciliation and Adjustment

-

The extension provides features for GST reconciliation and adjustment, allowing store owners to handle scenarios like returned orders or tax rate changes.

-

The GST extension allows for the manual adjustment of amounts in case of any discrepancies or errors.

-

It maintains a detailed audit trail of all GST-related transactions, making it easier to reconcile and resolve any issues.

Steps to Integrate GST Magento 2 Extension

Step 1: Download and Install the Magento 2 Extension

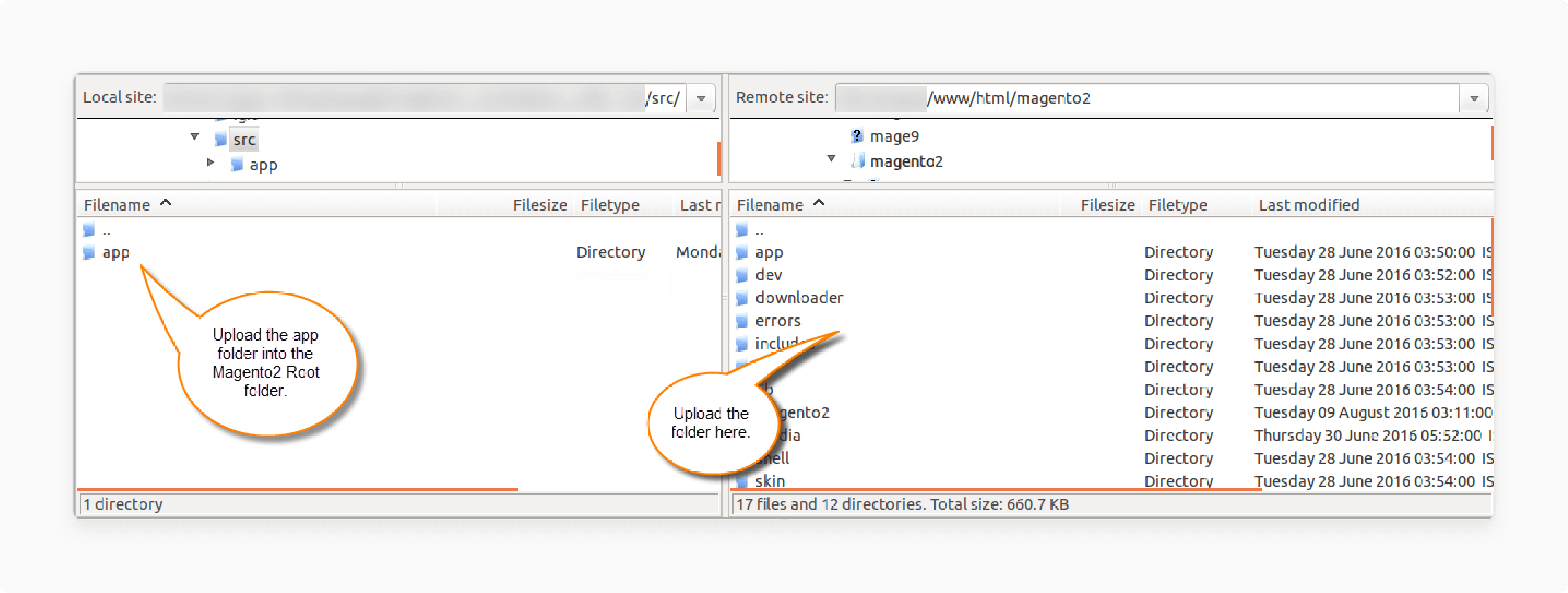

-

Download and unzip the extension files to the app folder.

-

Transfer the app folder to the Magento root directory.

-

Run these commands in the root directory:

php bin/magento setupphp bin/magento setup:diphp bin/magento setup:static-content

-

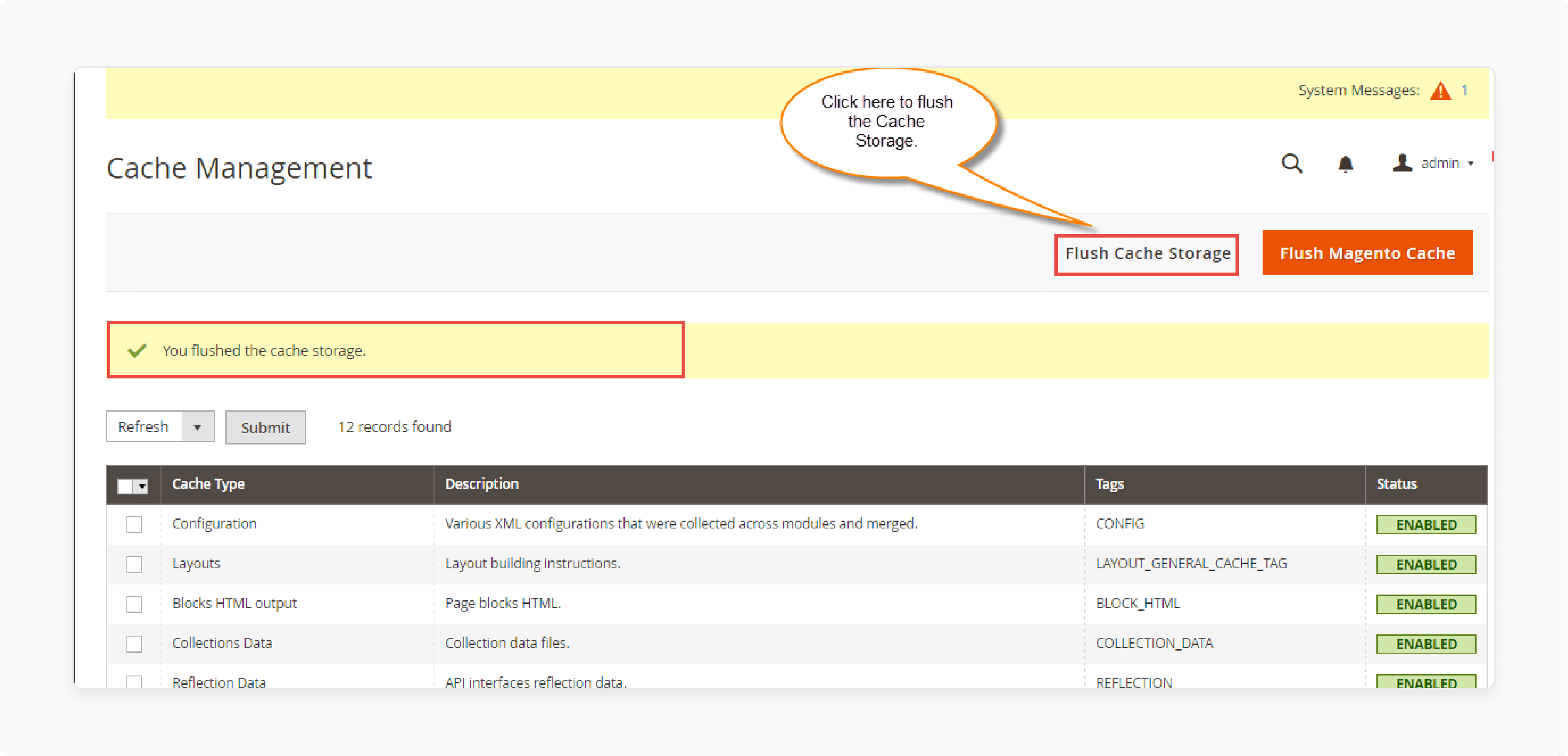

Go to System > Cache Management and clear the cache.

Step 2: Configure the Magento 2 Extension Settings

-

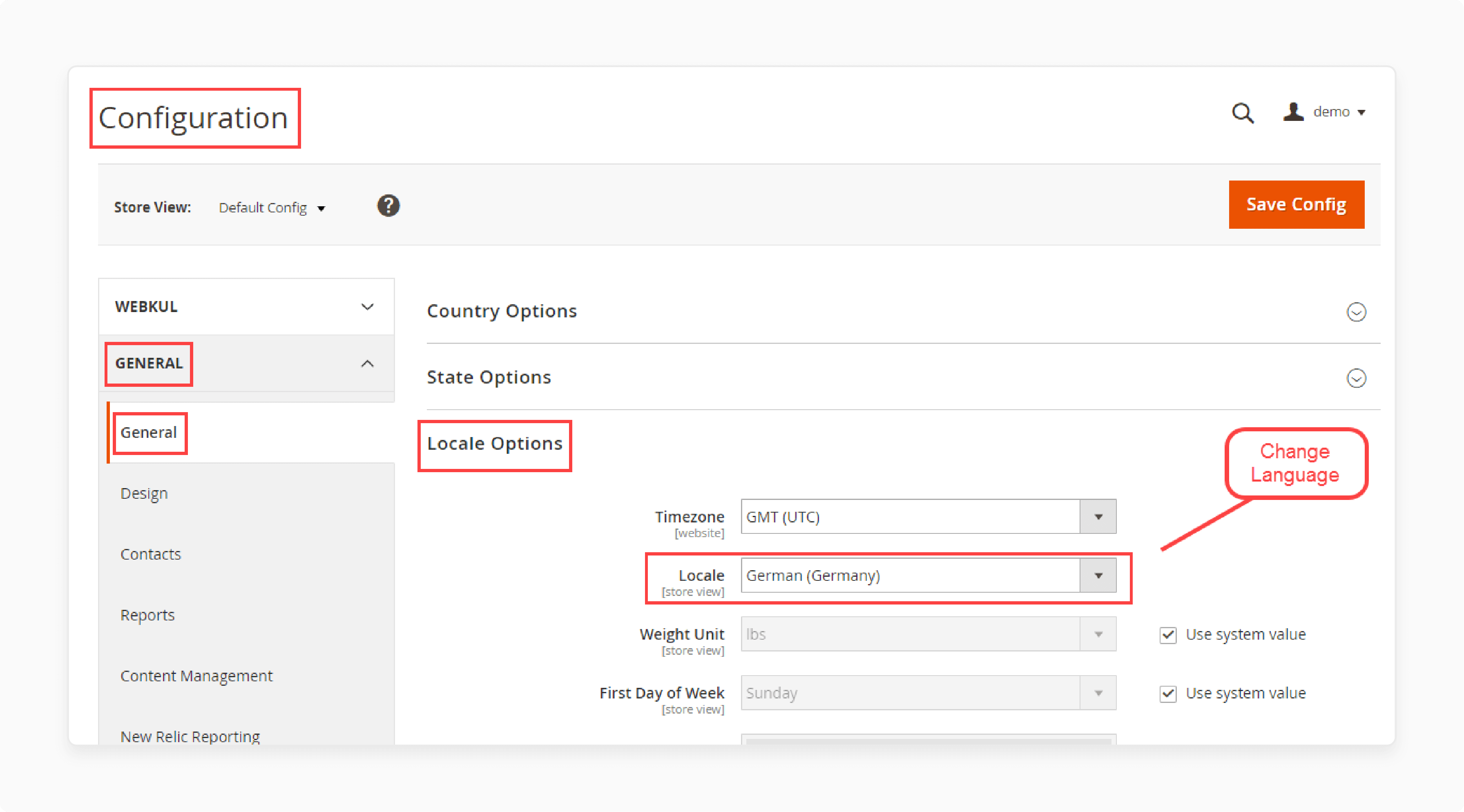

Log in to the Magento Admin Panel.

-

Go to Stores > Configuration > General > Locale Options.

-

Change the language and timezone according to your preference.

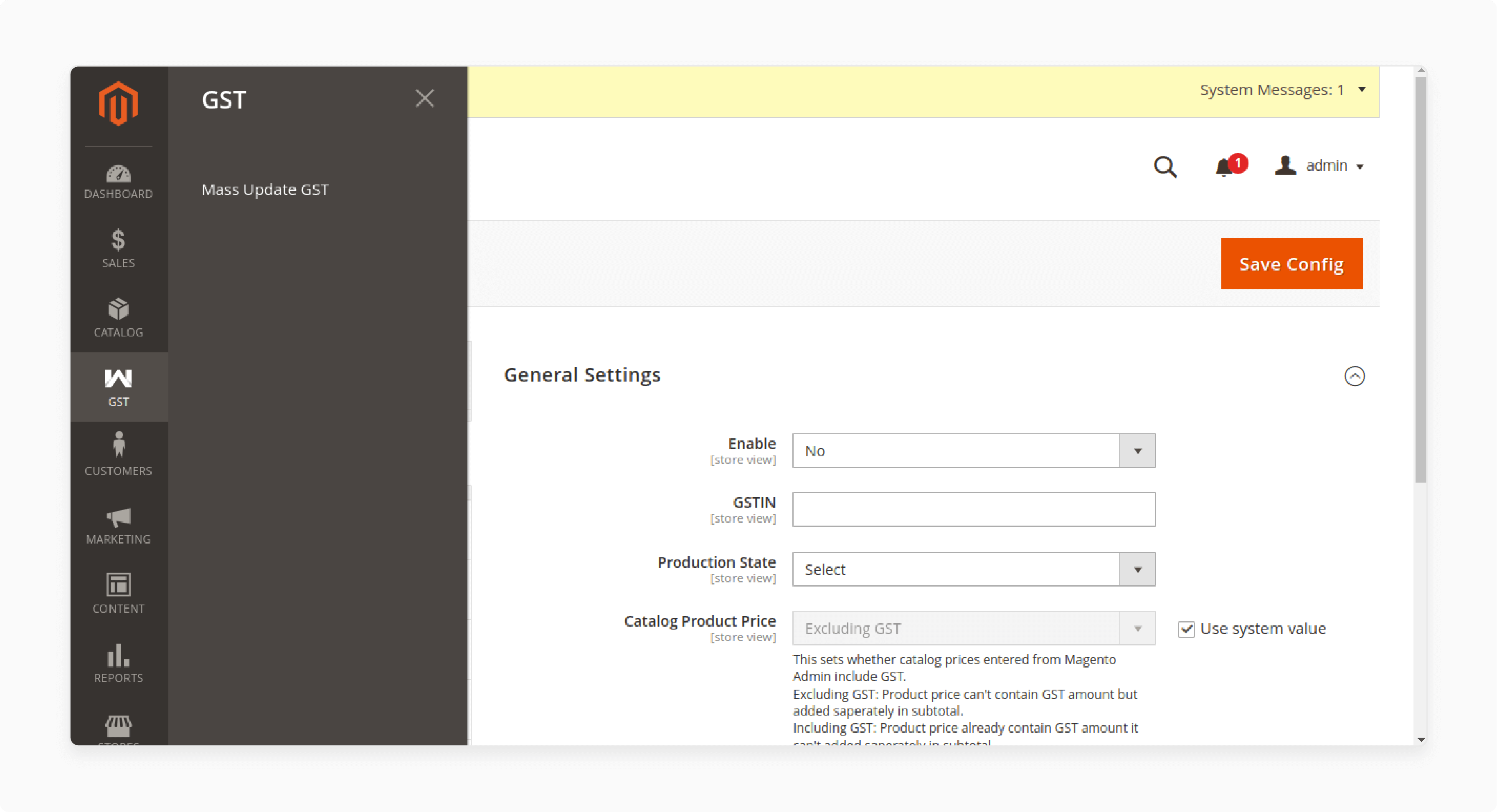

-

Go to Stores > Configuration > GST and enable the extension.

-

Add the GST number and production state to determine if intra-tax is applicable.

-

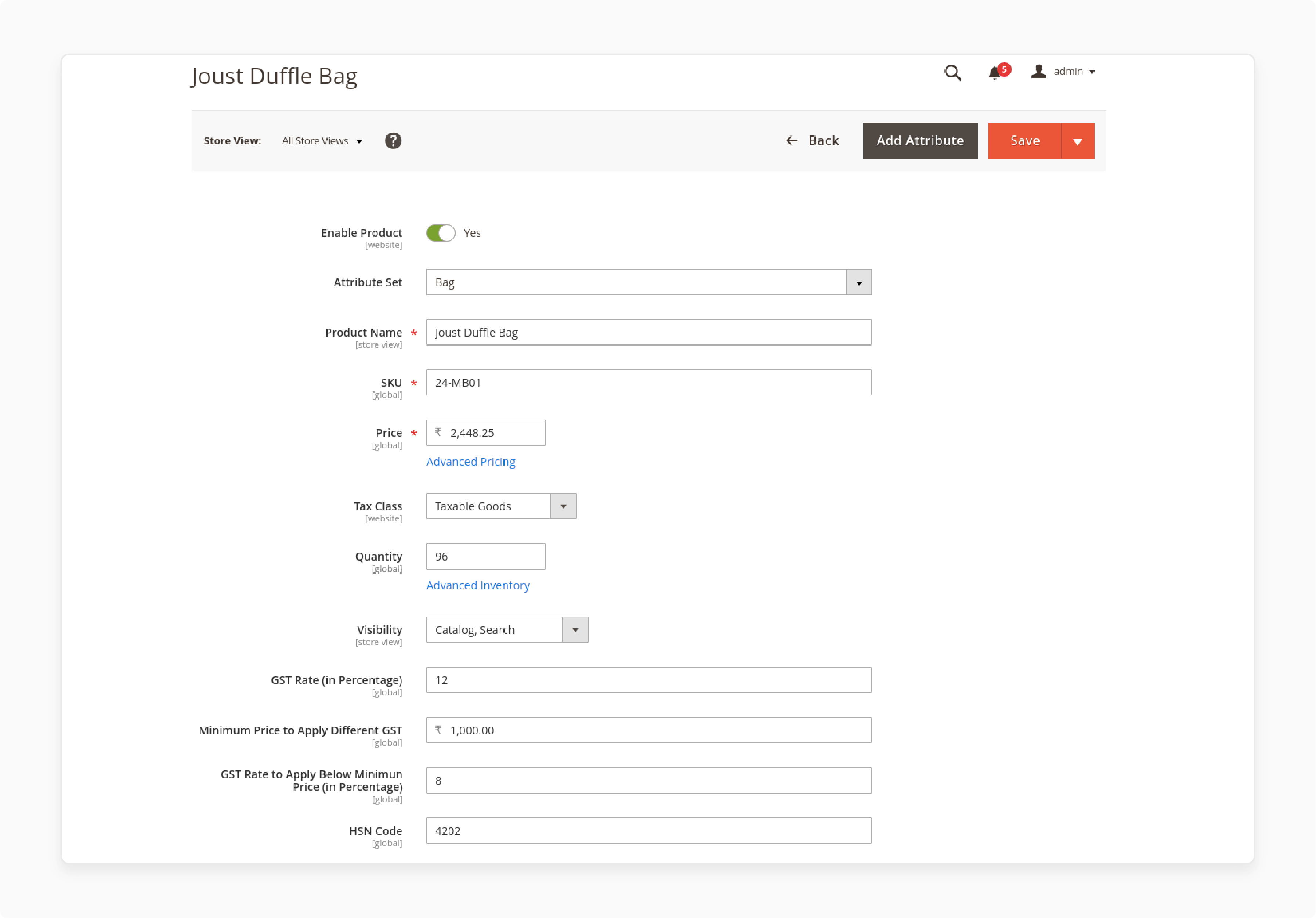

To edit GST settings for products, navigate to Catalog > Products.

-

Select Taxable Goods under Tax class.

-

Enter the GST rate that is chargeable for the product.

-

Enter the minimum GST rate in percentage for the products.

-

Provide the HSN code for the specific item.

-

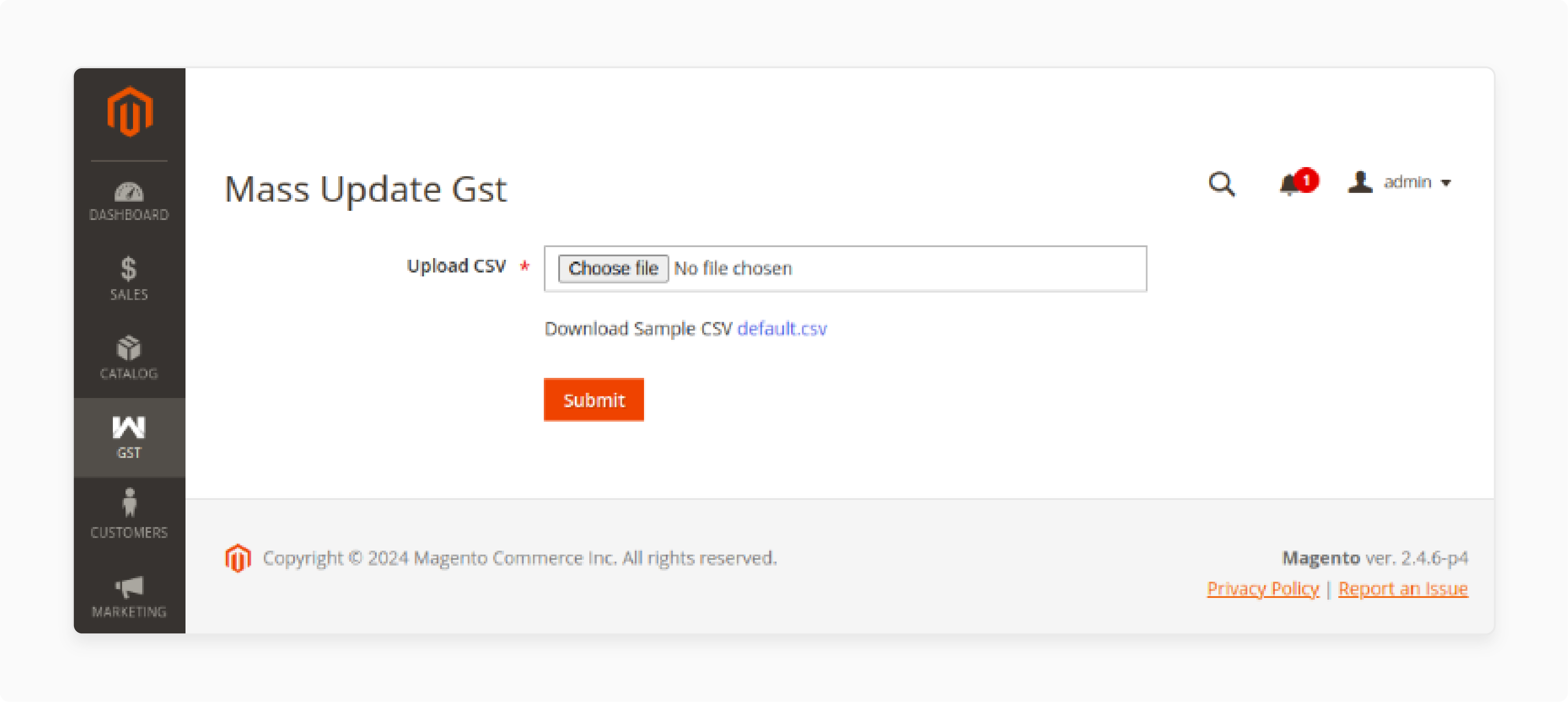

Choose the Mass Update option and upload the CSV file to enter the GST of all products.

-

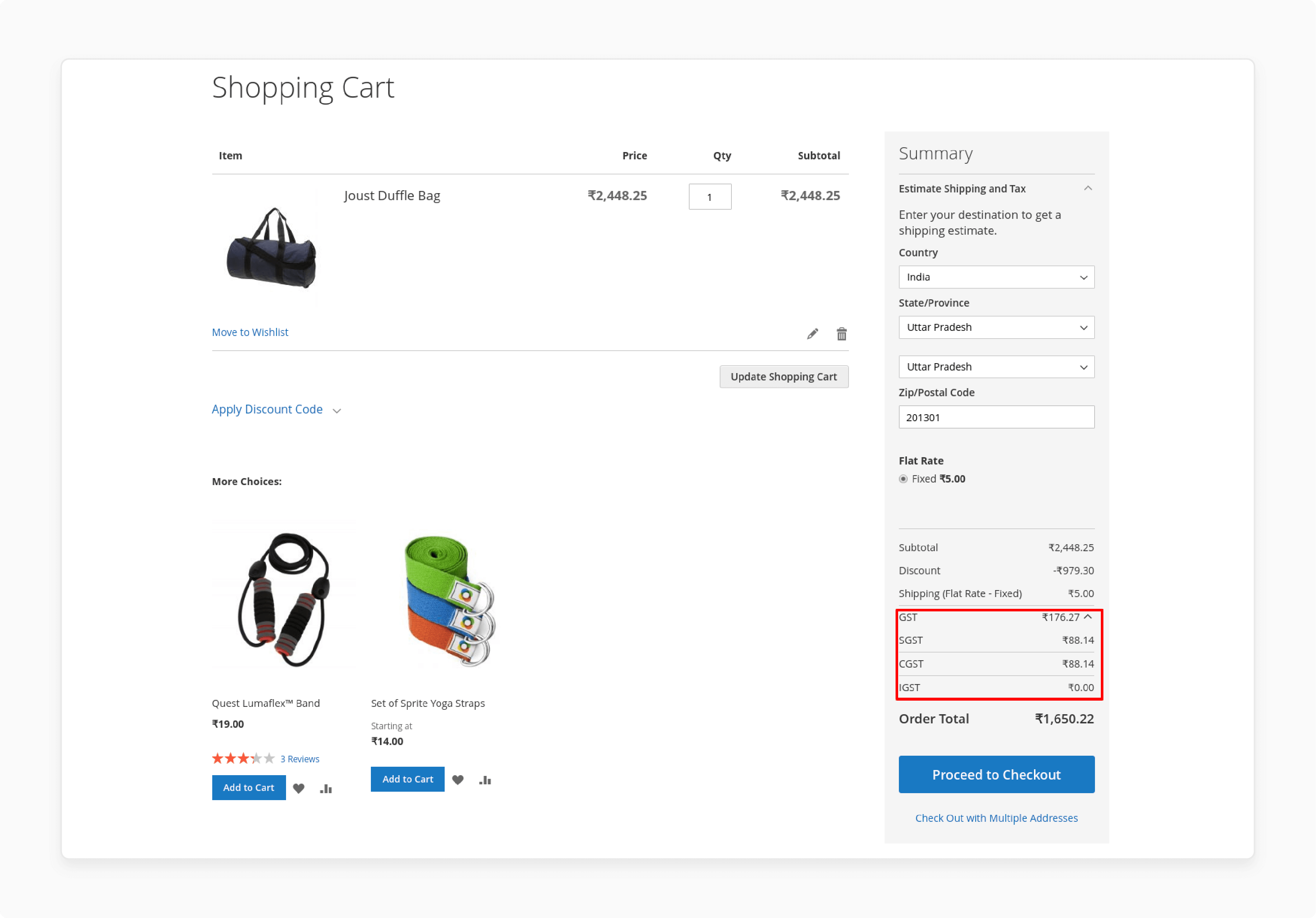

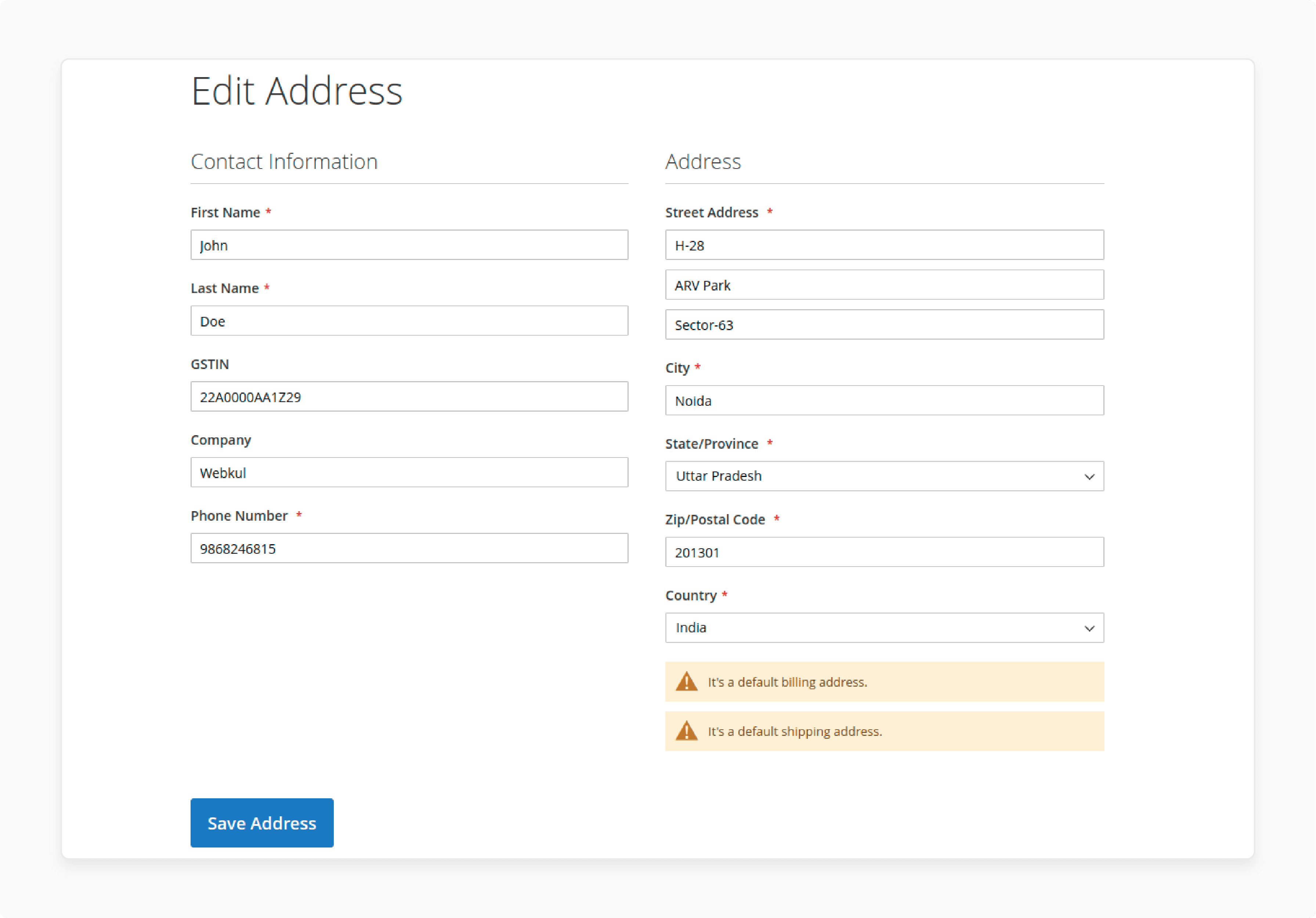

View the GST split in the shopping cart and address page of your store.

Troubleshooting Issues with Magento 2 Extension

| Issue | Description | Troubleshooting Steps |

|---|---|---|

| Installation problems | The website gets messed up after trying to install the GST extension | - Ensure compatibility with your Magento version - Follow proper installation steps via Composer or manual - Fix file permissions if needed after installation - Check that the extension is properly installed in the admin configuration |

| Incorrect GST calculations | GST rates or components like CGST, SGST, and IGST are not calculated correctly | - Verify GST configuration settings in the admin panel - Ensure GST rates and HSN codes are set correctly for products - Check if product prices are set as inclusive or exclusive of GST - Confirm the business origin state is configured for IGST |

| Missing GST information | GSTIN, HSN codes, and GST amounts are not displayed in orders, invoices, emails | - Enter GSTIN, CIN, and PAN numbers in the configuration - Enable display settings for GSTIN, HSN, GST breakup - Check if GST invoice and order templates are updated |

| Shipping GST issues | GST is not applied to shipping charges as expected | - Configure if shipping prices include or exclude GST - Verify shipping origin matches business origin for IGST |

| Report generation errors | Unable to generate or export GST reports | - Select appropriate filters for the report period - Ensure read/write permissions for report files - Verify database tables are populated with GST data |

Best Practices for GST Compliance Magento Extension

1. Accurate Tax Configuration

-

Define tax classes for products and customers accurately to ensure that the correct GST is applied to each transaction.

-

Set the** correct GST rates for different regions** and product categories to calculate GST accurately.

-

Create and apply tax rules that combine tax rates and tax classes, making it easier to apply GST to all relevant transactions.

2. GSTIN Validation

-

GST Identification Number is a unique 15-digit alphanumeric code assigned to every registered taxpayer under the law.

-

It is used to identify a business for GST purposes and is essential for filing GST returns and tax credits.

-

Add GSTIN as a mandatory field for B2B customers during registration or checkout to help in adding GST information accurately.

-

Use validation scripts within the** GST module to check the format** and authenticity of the GSTIN provided.

3. Invoice Management

-

Ensure invoices include necessary details like supplier’s and recipient’s

- GSTIN, HSN/SAC codes

- invoice types

- taxable value

- GST rate and amounts

- quantity

- description

-

Use the GST extension to generate GST-compliant invoices for each transaction automatically. The extension facilitates easy invoice management.

4. HSN/SAC Codes

-

HSN/SAC Codes or Harmonized System of Nomenclature and Services Accounting Codes are used to classify goods and services.

-

Categorize products and services accurately based on HSN/SAC codes to ensure correct GST is applied.

-

Apply the appropriate tax rate based on the HSN/SAC Code to calculate GST correctly.

5. GST Reports

-

Use the GST extension to generate the necessary reports required for monthly or quarterly filing. The extension facilitates accurate reporting.

-

Maintain detailed audit trails of all transactions to ensure compliance and verification, showing how GST was applied and calculated.

6. Customer Communication

-

Clearly show the GST breakup in the cart, checkout, and invoices. This transparency helps customers understand how GST is calculated and applied.

-

Provide information and support for any GST-related queries to help customers understand the GST module and how it impacts their purchases.

7. Consultation with Experts

-

Consult with tax professionals to ensure your practices are compliant with GST laws and to understand how to apply GST correctly.

-

Conduct regular audits by tax professionals to identify and rectify any compliance issues.

FAQs

How does the Magento 2 GST Extension help with GST compliance in India?

The Magento 2 GST India extension ensures compliance by automatically calculating and applying GST based on Indian tax laws. It makes it easier for Magento 2 store owners to manage GST in their stores.

Can the GST Extension handle multi-vendor setups in Magento 2?

Yes, the Magento 2 multi-vendor GST feature allows seamless GST integration for stores with multiple vendors. It ensures that the correct GST rate is applied to products from different sellers.

How does the GST Extension calculate and apply GST on products?

The GST extension auto-calculates the applicable GST rate based on the product type and customer location. It ensures that the GST applied is accurate and in compliance with GST standards.

Is it possible to view the applied GST in the Magento 2 storefront?

Yes, customers can view the GST applied in the frontend, including a detailed GST breakup on the cart, checkout pages, and invoices. This provides transparency in tax calculations.

How do I add GST rates to my Magento 2 store using the extension?

You can add GST rates collectively by uploading a CSV file with the GST rate for each product. The Magento 2 GST extension facilitates this process, making your Magento 2 store GST-ready efficiently.

Summary

The GST extension for Magento 2 is an essential tax calculation tool for ecommerce stores operating out of India. In this tutorial, we explained how to set up and configure the extension. Here is a summary:

- GST replaces multiple taxes with SGST, CGST, and IGST based on product type and location.

- The features auto-calculate GST rates, generate compliant invoices, and provide detailed tax reports.

- The extension validates customer GSTINs during checkout or registration.

- It offers an easy setup of GST settings, including tax rates, product categories, and rules, with support for shipping charges.

- It regularly updates tax settings, validates GSTINs, generates compliant invoices, and maintains detailed reports.

Choose managed Magento hosting services with GST extensions to expand your ecommerce store to India.