Magento Alternative Payment Method Analysis for Stores

Could your limited payment methods be costing you thousands in lost revenue? Magento alternative payment methods can change your checkout experience and increase conversion rates.

In this article, we explained the need for payment method diversity and its types.

Key Takeaways

-

Payment method diversity affects your store's conversion rates and revenue growth.

-

Customer groups prefer payment options based on age, income, and location.

-

Digital wallets, BNPL services, and regional payment systems drive satisfaction.

-

Cryptocurrency and CBDCs represent the future of online payment technology.

-

Quick setup and troubleshooting prevent payment processing problems.

What Are Alternative Payment Methods in Magento?

Alternative payment methods extend beyond the traditional credit and debit card options. These are not built into the platform. The methods use different financial instruments, technologies, or payment flows. It is a payment ecosystem that meets diverse customer preferences and market needs.

Alternative payment methods in 2025 include:

-

Digital wallets (Apple Pay, Google Pay, Samsung Pay).

-

Buy Now, Pay Later services (Klarna, Afterpay, Sezzle).

-

Cryptocurrency payments (Bitcoin, Ethereum, Litecoin).

-

Regional payment solutions (iDEAL, SOFORT, Alipay).

-

Mobile payment apps (Venmo, Cash App, Zelle).

-

Social commerce payments (Instagram Checkout, TikTok Shop).

-

Subscription and recurring payment systems.

-

Gift cards and store credit systems.

Why Magento Stores Need Payment Diversity?

1. Customer Abandonment and Lost Revenue

-

Customers abandon their carts at alarming rates when stores limit payment options. Research shows that 56% of shoppers leave their purchases incomplete.

-

Limited payment options cost retailers significant revenue. These losses compound across thousands of daily transactions. Payment friction creates lasting damage beyond immediate sales.

-

Customers who abandon carts due to payment limitations represent valuable segments. Stores with limited payment options struggle to recover lost sales.

2. Regional Payment Preferences and Global Market Needs

-

European customers trust bank transfers more than Magento credit cards. They feel comfortable moving money from their bank accounts. Digital wallets are also gaining popularity across European countries.

-

Asia-Pacific customers embrace mobile payments as their primary choice. They scan QR codes to pay for everything from coffee to cars. Mobile phones serve as their main payment tool. Credit cards take a back seat to smartphone-based payment apps.

-

North American shoppers still rely on credit cards. Yet, many now explore other payment options. Alternative methods gain ground among younger shoppers. Traditional card payments remain dominant but face growing competition.

-

Payment trust varies across different cultures. Customers prefer methods that their neighbors and friends recommend. Local payment systems build confidence through familiarity.

3. Competitive Advantage Through Payment Flexibility

-

Stores that offer many payment methods convert more visitors into customers. Shoppers complete purchases when they find their preferred payment option. Payment variety removes barriers that prevent sales completion.

-

One-click payment options end checkout friction. Customers avoid lengthy forms and complicated steps. Fast payment processes encourage impulse purchases and repeat buying.

-

International customers buy more when stores offer local payment methods. They trust familiar payment systems from their home countries. Regional payment support opens new markets and customer segments.

-

Customer service teams handle fewer payment-related complaints. Diverse payment options prevent common checkout problems. Support staff can focus on more complex customer needs instead of payment issues.

-

Payment method availability influences where customers choose to shop. Shoppers research payment options before making large purchases. Stores with limited payment choices lose customers to competitors.

-

Business customers have unique payment needs. They need invoice systems and order processing. Magento B2B success depends on accommodating corporate payment procedures.

4. Demographic-Specific Payment Needs

-

Young adults gravitate toward flexible payment plans. They prefer splitting purchases into smaller monthly payments. This generation values financial flexibility over immediate full payment. Buy now, pay later services match their budgeting preferences.

-

Millennials embrace smartphone-based payment solutions. They store payment methods in digital wallets on their phones. These customers appreciate quick and seamless mobile checkout experiences. Digital wallets offer the convenience this generation demands.

-

Generation X customers stick with familiar credit card systems. They trust traditional payment methods that they learned decades ago. Credit cards provide the security and rewards these customers value. This generation resists adopting newer payment technologies.

-

Wealthy customers choose premium payment options. They select payment methods that offer exclusive benefits and status. High-end payment services provide the prestige these customers seek. Premium features justify higher costs for affluent shoppers.

-

Smart stores recognize these demographic differences. They offer payment methods that match their target customer base. Understanding customer demographics helps predict payment preferences.

Top Magento 2 Alternative Payment Methods for Stores

Compare Payment Options for Your Store

Real costs, demographics, and conversion data for each payment method

Quick Cost Overview

1. Digital Wallets and Mobile Payments

-

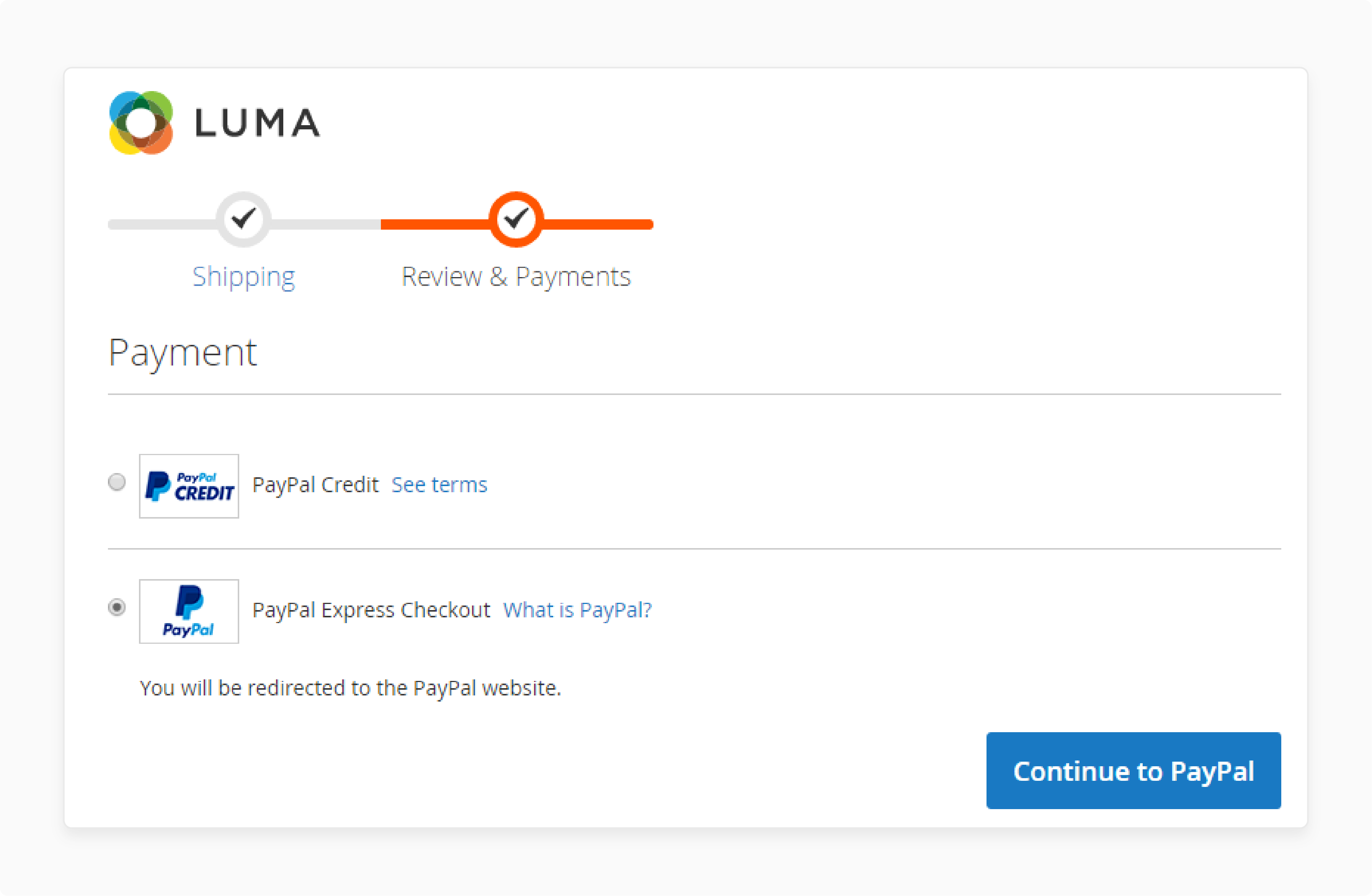

PayPal Express Checkout integrates with Magento stores. Store owners install the official PayPal extension from the Magento marketplace. The setup process needs basic PayPal business account credentials. Merchants can configure the payment method within their admin panel settings. The system fills shipping and billing details from PayPal accounts. Though some business payment solutions offer no foreign transaction fees for international purchases.

-

Apple Pay needs merchants to set up Touch ID and Face ID authentication. Store owners need SSL certificates and compatible payment processors. The integration works through supported payment gateways like Stripe or Square. Customers must have compatible iPhones or Apple Watches to use this service.

-

Google Pay setup involves registering with Google's merchant services. Stores need to install Google Pay APIs through their payment processor. The system needs Android device compatibility and Google account integration. Setup includes security verification and merchant account approval.

-

Amazon Pay leverages existing Amazon customer accounts for checkout. Customers use their saved Amazon payment methods and shipping addresses. The system eliminates the need to create new accounts on merchant websites.

2. Buy Now, Pay Later (BNPL) Solutions

-

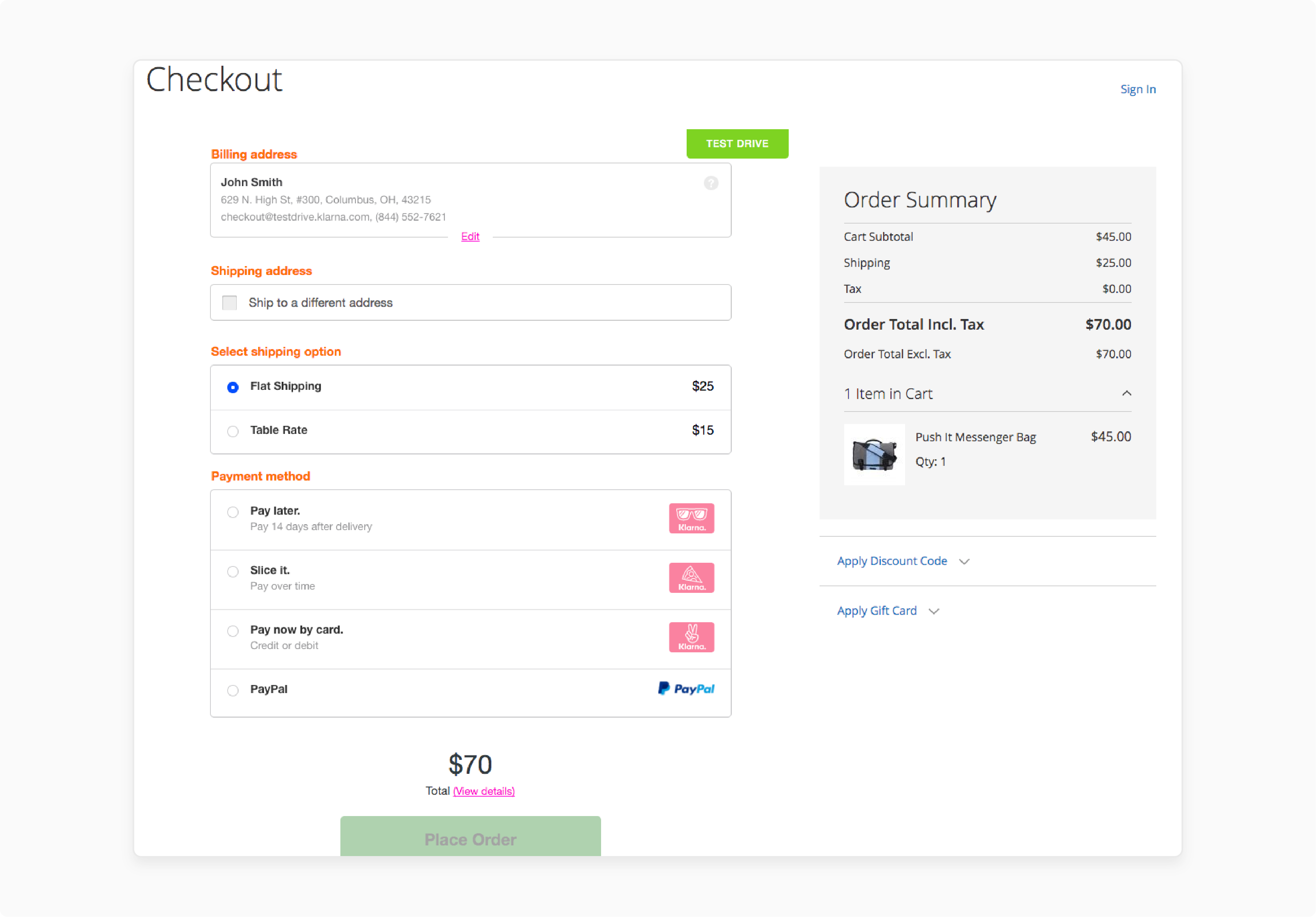

Klarna offers customers many payment plan options at checkout. Shoppers can split purchases into four equal payments over six weeks. The service also provides longer payment terms for larger purchases. Customers choose the payment schedule that fits their budget best.

-

Young adults drive most Klarna usage patterns. These customers prefer spreading costs over time rather than paying upfront. They value financial flexibility and budget management tools.

-

Working professionals also embrace Klarna for larger purchases. They use payment plans to manage cash flow.

-

Afterpay targets younger shoppers who grew up with smartphones. These customers expect instant everything, including payment flexibility.

-

Sezzle serves similar demographics but emphasizes responsible spending. The platform includes budgeting tools and spending limits. Customers receive notifications about upcoming payments and account balances.

-

Merchants must consider the cost structure of these services. BNPL providers charge fees for each transaction processed. These fees are higher than traditional credit card processing. Store owners need to factor these costs into their pricing strategies.

3. Regional and Localized Payment Methods

-

iDEAL dominates the Dutch online payment landscape. Customers connect to their bank accounts for secure transactions. The system eliminates credit card fees and provides instant payment confirmation. Dutch shoppers trust iDEAL more than international payment methods.

-

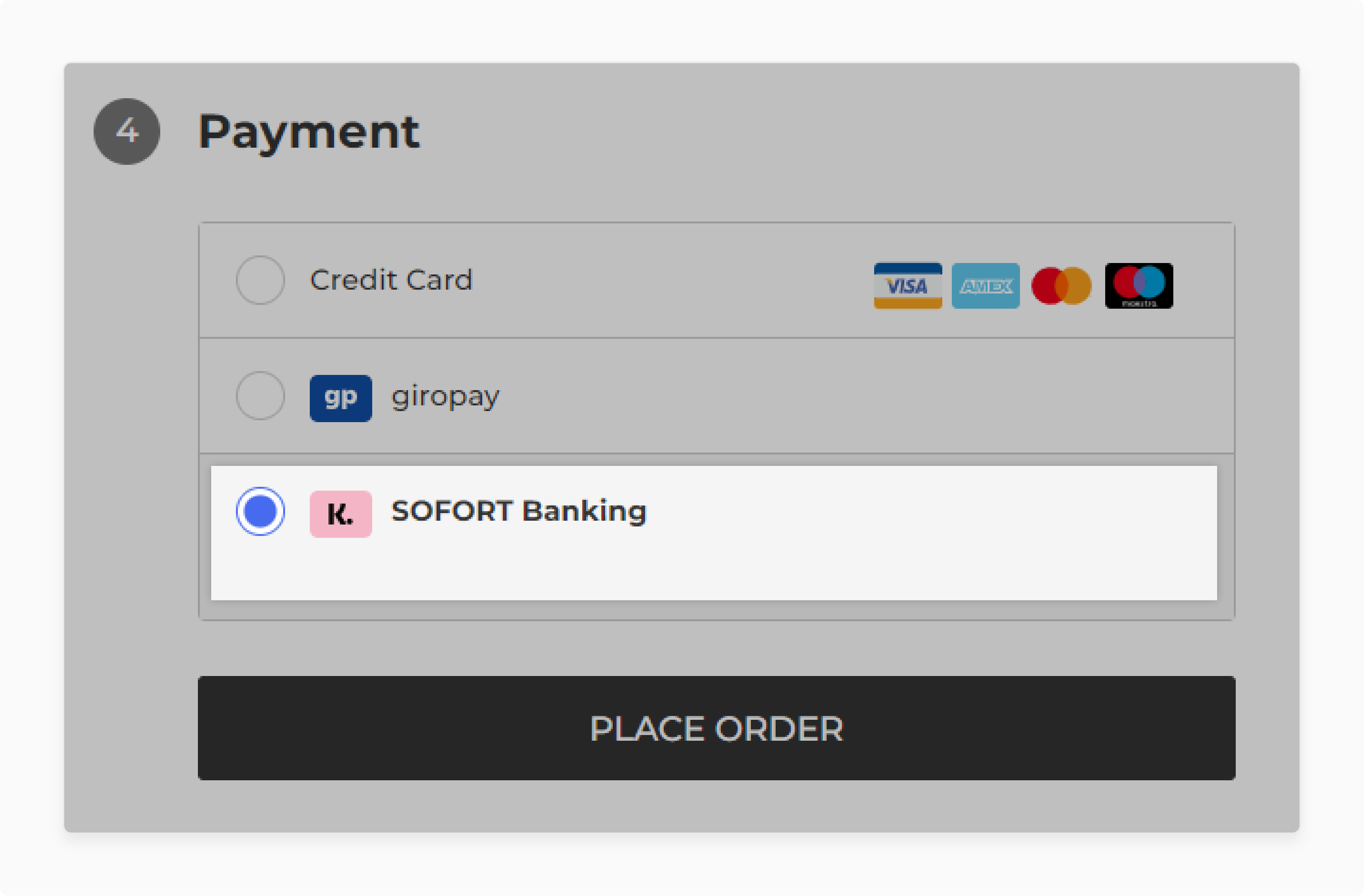

SOFORT serves German-speaking countries across Europe. Customers log into their online banking to make payments. The service works with most European banks and provides real-time transaction processing.

-

Bancontact leads Belgian online payments. The system connects to Belgian bank accounts for direct transfers. Customers authenticate Magento payments using their bank credentials.

-

Alipay powers mobile payments across China and beyond. Customers scan QR codes or tap their phones to pay. The system connects to bank accounts and digital wallets.

-

WeChat Pay integrates payments into China's most popular messaging app. Users send money to friends and pay merchants through the same interface.

-

Each region shows a strong preference for local payment methods. Customers trust payment systems developed in their home countries. International payment methods face adoption challenges against local alternatives.

Troubleshooting Issues with Alternative Magento Payment Methods

Fix Payment Integration Issues Fast

Step-by-step solutions for common Magento payment method problems

| Issue | Troubleshooting Steps |

|---|---|

| Payment methods not showing on checkout | 1. Go to Stores > Configuration > Sales > Payment Methods. Make sure it’s turned on for your store and country. 2. Run php bin/magento module:status to check if the payment tool is active. 3. Clear old data with php bin/magento cache:clean and php bin/magento cache:flush. 4. Turn off extra checkout tools to see if they’re causing problems. |

| Issues with specific payment gateways (e.g., PayPal, Braintree) | 1. Check your login details in Stores > Configuration > Sales > Payment Methods. 2. Make sure the payment service is working. 3. Update the payment tool with composer update. 4. Review Magento error messages in the/var/log directory. |

| Configuration issues after upgrades | 1. Run php bin/magento setup:di:compile to fix the code. 2. Run php bin/magento setup:upgrade to update the system. 3. Use composer why-not to find clashing tools. 4. Refresh files with php bin/magento setup:static-content:deploy. |

| 500 Internal Server Error during checkout | 1. Check /var/log/exception.log and /var/log/system.log for clues. 2. Fix file access with chown and chmod. 3. Raise the memory limit in php.ini. 4. Turn off new tools to find the problem. |

| Cron job failures affecting payments | 1. Run php bin/magento cron:run to test automatic tasks. 2. Check /var/log/cron.log for issues. 3. For tools like Stripe, ensure notifications work. 4. Run php bin/magento cron:run --group="index" to force updates. |

| Payment method not visible in admin order creation | 1. Check if the payment tool allows admin use in its code. 2. Confirm it’s on in Stores > Configuration > Sales > Payment Methods. 3. Clear old data with php bin/magento cache:clean. 4. Turn off extra tools to test. |

| Issues with mobile payment methods | 1. Test on phone simulators to spot problems. 2. Make sure your site works on phones. 3. Look for errors in the browser’s console. 4. Update payment tools for phone support. |

FAQs

1. How much does it cost to add a third-party payment gateway for Magento?

Most payment gateways for Magento solutions charge setup fees between $0-500. It is, besides the monthly fees, which range from $10 to $50. Transaction costs run 2.9-3.5% per sale plus $0.30 per transaction. Enterprise-level gateways may need custom pricing negotiations. Consider the total price, including development time. It averages 10-20 hours for basic integration with Magento setups.

2. Can I use many payment processors on my Magento store?

Magento allows you to enable various payment methods from different processors. You can offer PayPal or Stripe to provide flexible payment options for customers. Each processor operates through separate API connections. This approach helps you serve different customer preferences and geographic markets.

3. How long does payment gateway integration take for a Magento store?

Basic gateway for Magento integration usually takes 1-3 business days. Complex setups involving custom features or many payment types may need 1-2 weeks. The timeline depends on your processor's API complexity and your store's existing configuration. Most modern payment solutions offer seamless integration through pre-built extensions.

4. What should I consider when choosing the right payment gateway for my customers?

Test each processor's geographic coverage and currency support capabilities. Look for solutions that accept payments in target countries and support local payments. Consider transaction fees for international sales for Magento payment gateways. These often differ from domestic rates. Choose processors that offer various payment options popular in each target market.

5. How can I test if my Magento 2 payment setup works before going live?

Most payment processors provide sandbox environments for testing. Create test orders using the provided test card numbers and payment credentials. Verify that successful payments update the order status and failed payments display error messages. Check that your payment action settings (authorize vs. capture) work as intended.

Summary

Magento alternative payment methods bring diversity to the checkout page to speed up sales. In this article, we covered the best types and demographics of alternative methods. Here is a recap:

-

Alternative payment methods extend beyond traditional credit cards.

-

Payment diversity reduces cart abandonment and increases conversions.

-

Regional preferences need localized payment options for success.

-

Digital wallets and BNPL services attract younger demographics.

-

Proper integration and testing ensure smooth payment processing.

Choose managed Magento hosting with alternative payment methods for peak sales.