How to Configure Value Added Tax (VAT) in Magento 2

Want to implement VAT on your Magento 2 products? Setting up VAT in Magento 2 helps you follow tax laws. It makes sure you charge the right tax on goods and services. This tutorial explains VAT and demonstrates the configuration process in Magento 2. Learn to manage tax rates, tax classes, and tax rules to ensure your store complies with VAT regulations.

Key Takeaways

-

Discover the concept of Value Added Tax (VAT) and its significance in Magento 2 for accurate taxation on goods and services.

-

Explore the 5-step process to configure VAT in Magento 2, covering setting up tax classes, zones, rates, and rules.

-

Learn how setting up VAT in Magento 2 offers benefits such as automated tax compliance, enhanced customer experience, and streamlined tax management.

-

Avoid key mistakes when configuring Magento 2 VAT, like ignoring VAT registration thresholds, neglecting tax configuration for shipping, etc.

What is Value Added Tax (VAT)?

Value Added Tax (VAT) is a tax applied on goods and services at each stage of the supply chain where value is added, from production to the point of sale. The amount of VAT that consumers pay is on the cost of the product minus any costs of materials used that have already been taxed.

Different stages in the supply chain, such as manufacturing, wholesale, business-to-business (B2B) transactions, and service provision, might attract varying VAT rates. This complexity means businesses often deal with more than one VAT rate for similar products or services. Compliance with VAT regulations requires businesses to validate VAT numbers and apply the correct rates when charging customers.

VAT laws vary by country, adding another layer of complexity. For instance, in the European Union (EU), VAT for cross-border sales, known as "distance sales," is calculated based on the seller's location. VAT calculations typically depend on the destination of the Magento shipment rather than its origin. This principle ensures that VAT is assessed fairly and accurately, taking into account the location where the goods or services are consumed.

For example, a business based in the Netherlands purchasing from a U.K. store, with the goods shipped to a U.K. address, is subject to U.K. VAT rates. It ensures businesses comply with varying tax laws and regulations.

5 Steps to Configure Magento 2 VAT Tax

This tutorial will demonstrate how to set up a 20% VAT rate for sales to B2C (retail) customers in the U.K. Ensure you're familiar with VAT regulations specific to your region before beginning.

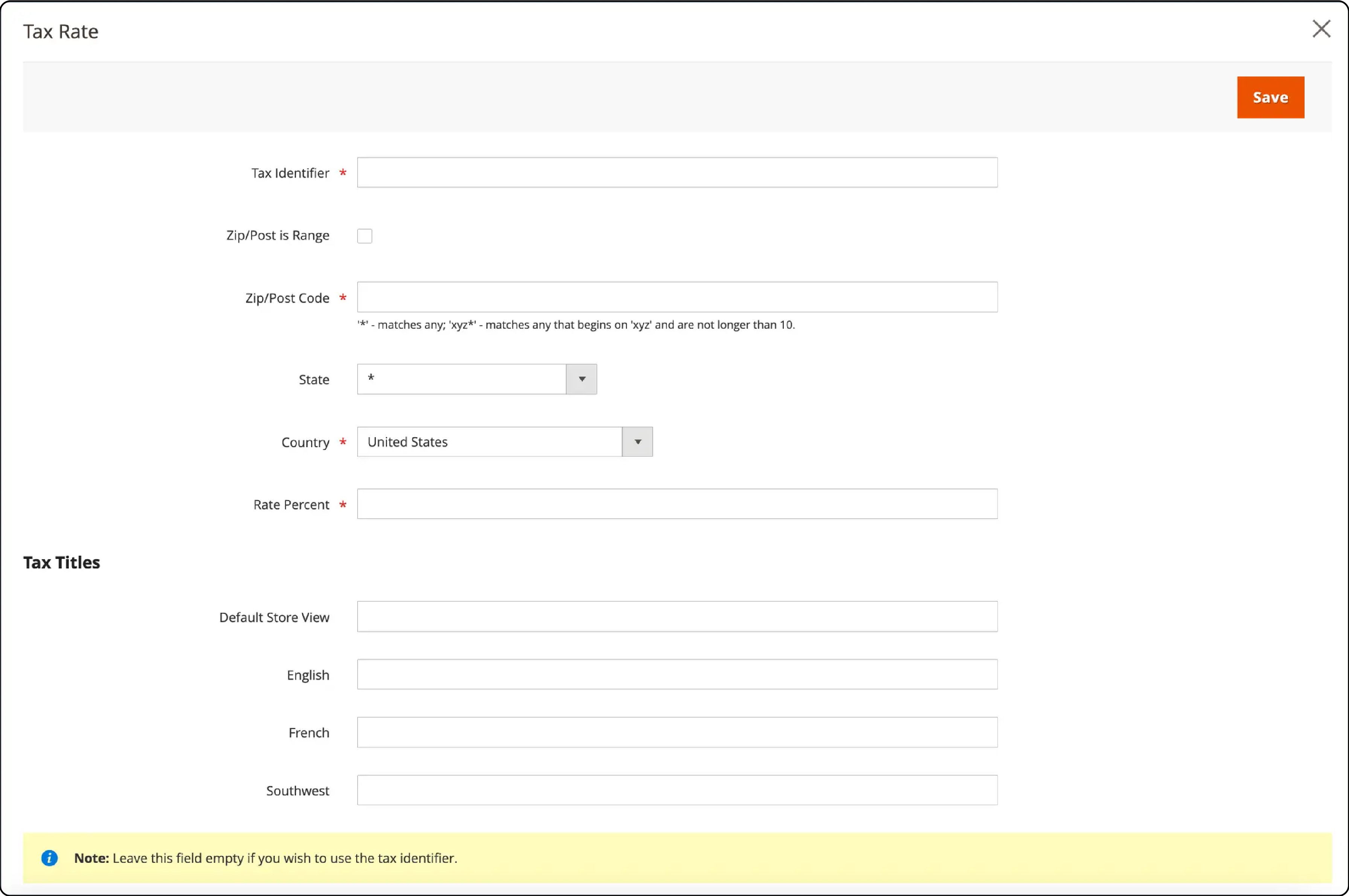

Step 1: Set Up Customer Tax Classes

- Navigate to the Magento Admin sidebar and select Stores > Tax Zones and Rates.

-

Verify the existence of a customer tax class suitable for VAT transactions. For retail transactions, a class named "Retail Customer" is typically used.

-

If a relevant class exists, proceed to add a new tax rate; otherwise:

-

Select Add New Tax Rate.

-

Provide a name for the tax class in the Tax Identifier field. When creating tax rules later, this identifier will help categorize your tax rates.

-

For the tax rate to be applied correctly:

- Check the Zip/Post is Range box to set the zip code range (from/to).

- Select the applicable Country.

- Input the Rate Percent to define the VAT rate.

- After entering all details, click Save Rate to finalize the tax rate.

This tax rate is essential for applying VAT correctly during checkout and sales transactions. Without a defined tax rate, creating effective tax rules is not feasible.

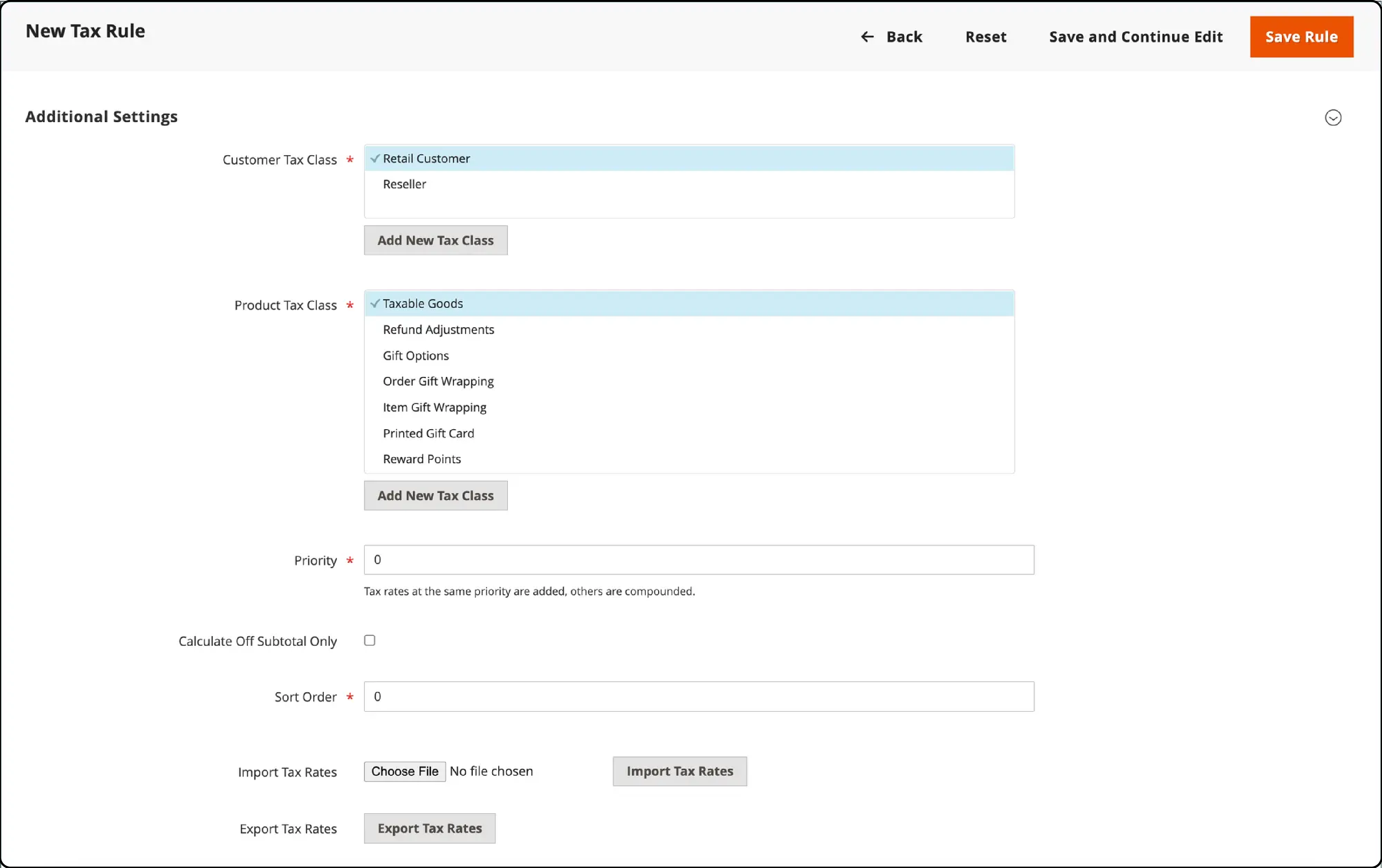

Step 2: Set Up Product Tax Classes in Magento 2

After ensuring customer tax classes are configured, the next step involves establishing product tax classes. These classes are vital for applying the correct VAT rates to products in your Magento 2 store.

-

From the Magento Admin sidebar, navigate to Stores > Taxes > Tax Rules.

-

If your store lacks specific product tax classes for VAT, proceed by clicking Add New Tax Rule.

-

Expand the Additional Settings section. Within this section, you’ll find options to add new product tax classes.

- Click Add New Tax Class under the Product Tax Class section. You'll be creating three distinct classes to cover various VAT scenarios:

- VAT Standard

- VAT Reduced

- VAT Zero

-

For each class, input the appropriate name and confirm by clicking the checkmark. Ensure you click Save Class for each new addition.

-

Once all necessary classes are added, select Save Rule.

These steps enable Magento 2 store owners to diversify VAT applications across different products.

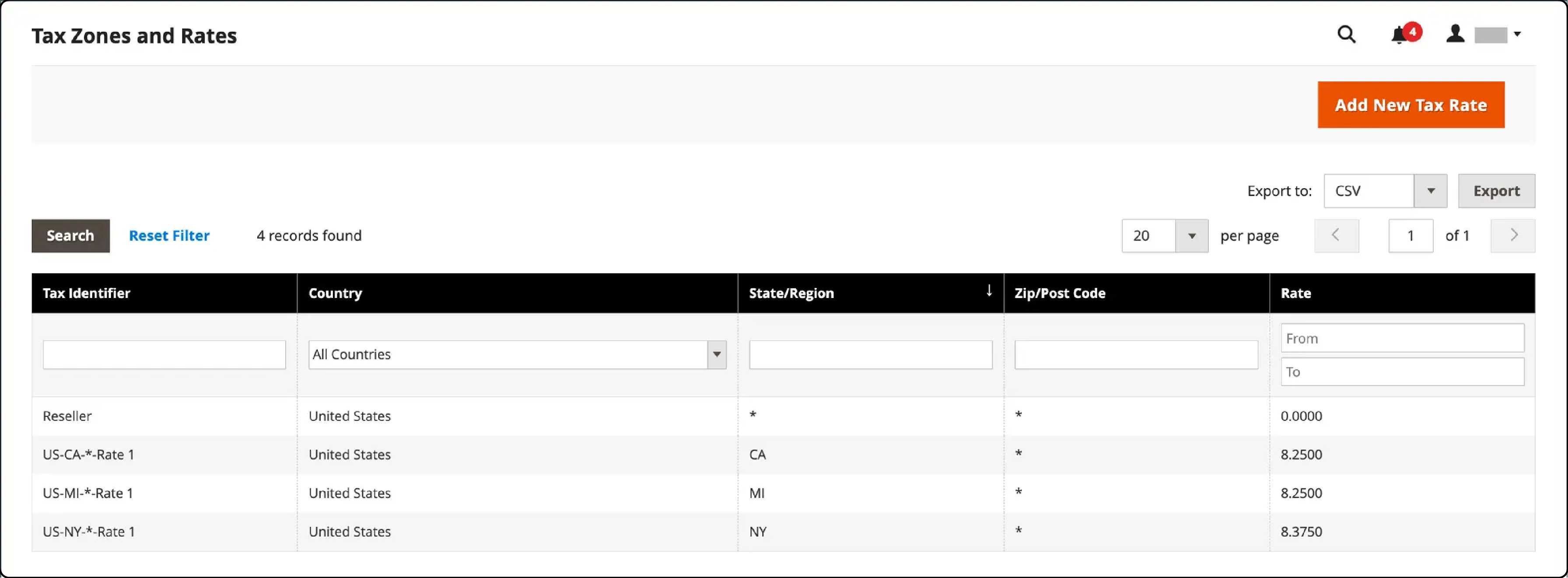

Step 3: Set Up Tax Zones and Rates

-

From the Admin sidebar, select Stores > Taxes > Tax Zones and Rates.

-

Depending on your need, you might want to modify existing rates or add new ones. For this example, you can remove the U.S. tax rates or leave them as they are. To add, click Add New Tax Rate.

- Enter Details for VAT Standard Rate:

- Tax Identifier: Name it VAT Standard.

- Country and State: Choose United Kingdom.

- Rate Percent: Set this to 20.00% for standard VAT.

- Enter Details for VAT Reduced Rate:

- Tax Identifier: Name this VAT Reduced.

- Country and State: Again, select United Kingdom.

- Rate Percent: Set to 5.00% for reduced VAT.

- After defining each rate, ensure you click Save Rate to apply the changes.

Step 4: Set Up Tax Rules

Magento Tax rules combine customer tax classes, product tax classes, and tax rates to determine the VAT applied during transactions.

-

From the Admin sidebar, go to Stores > Taxes > Tax Rules.

-

Create New Tax Rules for both standard and reduced VAT rates:

-

For VAT Standard:

- Name: Enter VAT Standard.

- Customer Tax Class: Select Retail Custome.

- Product Tax Class: Choose VAT Standard.

- Tax Rate: Assign the VAT Standard Rate.

- For VAT Reduced:

- Name: Enter VAT Reduced.

- Customer Tax Class: Select Retail Customer.

- Product Tax Class: Choose VAT Reduced.

- Tax Rate: Assign the VAT Reduced Rate.

- After setting up each rule, click Save Rule to apply the settings.

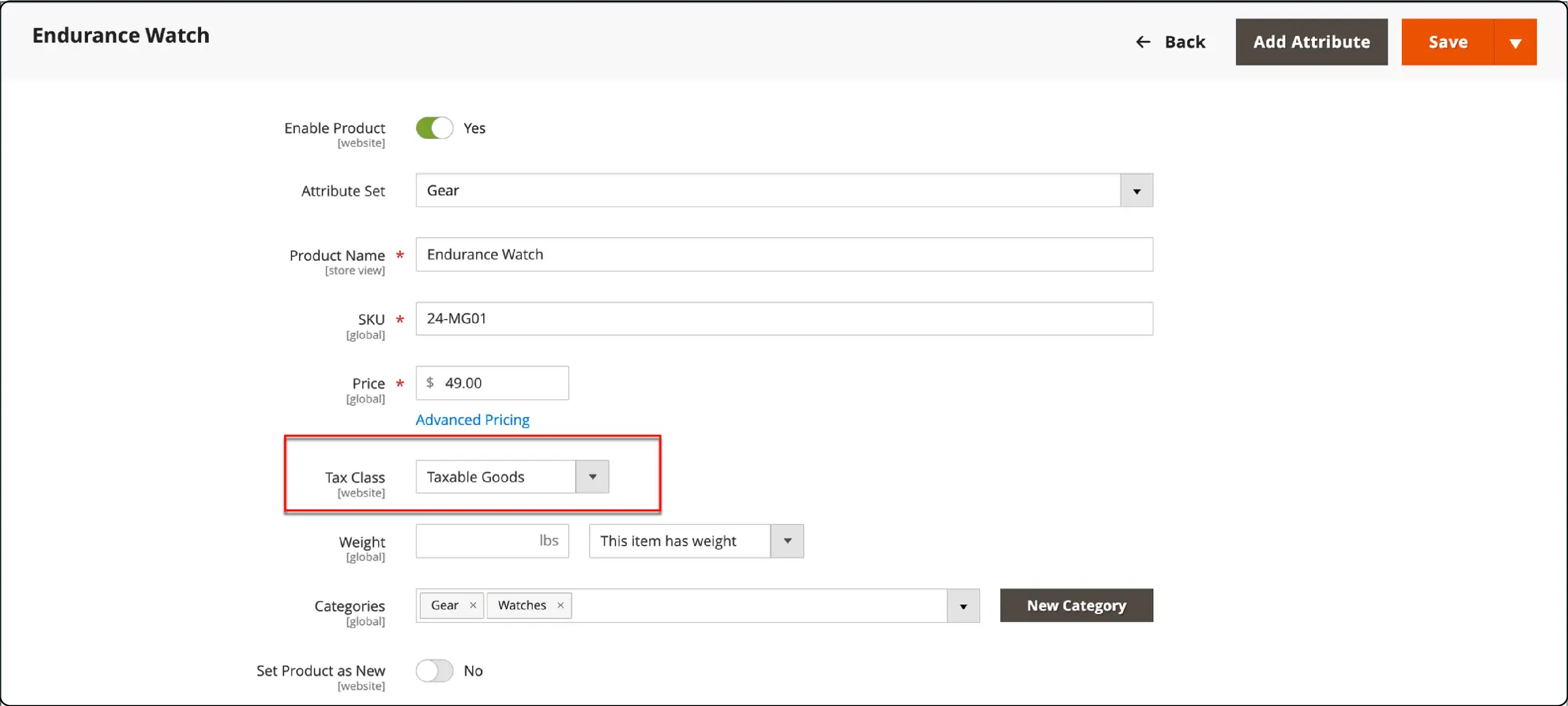

Step 5: Apply Tax Classes to Products

-

On the Admin sidebar, go to Catalog > Manage Products.

-

Choose a product from your catalog to configure by entering its edit mode.

-

On the product's general information page, locate the Tax Class dropdown. Here, assign the appropriate VAT class (e.g., VAT Standard, VAT Reduced).

- After selecting the correct VAT class for the product, click Save to apply your settings.

Benefits of Setting Up Value-Added Tax (VAT) in Magento 2

-

Automated Tax Compliance: Automating VAT calculations reduces the risk of human error, ensuring compliance with the tax laws of different countries. Magento 2's VAT setup automatically applies the correct tax rates during Magento checkout based on the customer's location and the products or services being sold.

-

Enhanced Customer Experience: By accurately calculating VAT at checkout, customers see the final prices, including tax, which creates a transparent and trustworthy shopping experience.

-

Streamlined Tax Management: Magento 2 allows for the configuration of different VAT rates and rules. It simplifies tax management for businesses that sell a wide range of products or services or those operating in multiple countries.

-

Efficient VAT Number Validation: For B2B transactions, Magento 2's ability to validate VAT numbers in real time ensures that transactions are processed in accordance with VAT regulations. It qualifies for tax exemptions where applicable.

-

Improved Reporting and Analytics: With VAT properly set up, Magento 2 store owners can access detailed reports and analytics on taxes collected. It aids in accurate financial planning and tax filing.

Key Mistakes To Avoid When Configuring Value-Added Tax (VAT) in Magento 2

-

Ignoring VAT Registration Thresholds: Different countries have various thresholds for VAT registration. Ensure you're aware of these limits and register for VAT when your sales exceed them. Failing to do so can result in fines and backdated tax payments.

-

Applying a One-Size-Fits-All Approach to VAT Rates: VAT rates vary by country, product type, and sometimes by customer type (B2B vs. B2C). Configuring your Magento 2 store with a single VAT rate across all products and services can lead to inaccuracies in tax collection and reporting.

-

Overlooking VAT Number Validation for B2B Sales: For B2B sales within certain regions, such as the EU, validating a customer's VAT number allows transactions to be VAT-exempt. Neglecting this step can complicate transactions and lead to unnecessary VAT charges for eligible businesses.

-

Not Setting Up Tax Zones and Rates Correctly: Magento 2 allows you to configure tax zones and rates based on the customer's shipping or billing address. Incorrect setup can lead to applying the wrong tax rates, affecting compliance and customer trust.

-

Failing to Update VAT Rates: Tax rates are subject to change. Regularly failing to update VAT rates in your Magento 2 store can lead to incorrect amounts being charged. It results in refunds or extra charges that inconvenience customers and harm your business's reputation.

-

Neglecting Tax Configuration for Shipping: Shipping charges often require VAT to be applied. Overlooking the configuration of VAT on shipping can result in undercharging or overcharging VAT, affecting the accuracy of tax calculations.

FAQs

1. What is the significance of configuring VAT in Magento 2?

Configuring VAT in Magento 2 ensures compliance with tax laws, enabling accurate tax calculation on goods and services sold through your store. It helps in charging the correct tax amount to customers based on their location and the type of products or services purchased.

2. How can I configure VAT for my Magento 2 store?

To configure VAT in Magento 2, follow the step-by-step tutorial provided in the article. It covers setting up customer tax classes, product tax classes, tax zones, rates, and tax rules. These configurations ensure the accurate application of VAT during transactions.

3. What is the role of VAT validation in Magento 2?

VAT validation in Magento 2 ensures that VAT numbers provided by customers during checkout are accurate and valid. This validation is essential, especially for B2B transactions, as it helps in applying for the correct tax exemptions and maintaining Magento compliance with VAT regulations.

4. How does VAT registration impact my Magento 2 store?

VAT registration thresholds vary by country, and it's essential to register for VAT when your sales exceed the specified threshold. Failure to register can result in fines and backdated tax payments. Configuring your Magento 2 store with the appropriate VAT rates ensures compliance with registration requirements.

5. Can I configure different VAT rates for different regions in Magento 2?

Yes, Magento 2 allows you to configure different tax zones and rates based on the shipment destination. This functionality ensures that the correct VAT rates are applied based on the location where the goods or services are consumed rather than the point of origin.

Summary

VAT in Magento 2 ensures accurate tax calculation and compliance with tax laws for goods and services sold through your store. It helps provide transparent pricing and avoid potential fines for non-compliance.

This tutorial covered the process of configuring VAT in Magento 2, including setting up tax classes, tax zones, rates, and tax rules. By following the step-by-step process outlined in this article, you'll be well-equipped to:

-

Navigate the complexities of VAT regulations with ease.

-

Provide your customers with a seamless and transparent shopping experience.

-

Streamline your tax management processes across products and regions.

-

Validate VAT numbers efficiently for B2B transactions.

-

Generate accurate reports and analytics for informed decision-making.

Explore Magento server hosting solutions to optimize your online store's performance and ensure efficient management of VAT-related functionalities in Magento 2.