Magento 2 B2B Company Credit: Features and Benefits

Ready to take complete control of your B2B transactions? Magento 2 b2b company credit helps businesses set credit limits, manage credit, and build stronger customer relationships. This tutorial discovers the benefits of the company credit feature and how to apply and update it.

Key Takeaways

-

Learn how Magento 2 B2B company credit can transform B2B transactions.

-

Discover the features of Magento 2 company credit, from credit limits setting to security measures.

-

Understand the benefits of company credit, including increased sales volume and risk management.

-

Explore steps to apply and update Magento 2 B2B company credit effectively.

-

Differentiate between B2B company credit and traditional consumer credit.

What is Magento 2 B2B Company Credit?

Magento 2 b2b company credit is a feature or extension that allows B2B companies to extend lines of credit for their customers. It is particularly useful for businesses that purchase on credit terms rather than an immediate payment. It helps businesses:

-

Set up credit limits for its customers

-

Define credit terms

-

Manage company credit transactions within the platform.

It is useful for businesses that frequently engage in bulk purchases or recurring orders. It allows flexibility in the B2B transactions. It helps businesses through the Magento 2 administrative interface track:

-

Outstanding credit balances

-

Store credit limits

-

Payment histories.

It streamlines the B2B purchases and enhances the overall customer experience. It enables customers with approved credit to place orders without making immediate payments.

Features of Magento 2 B2B Company Credit

1. Credit Limits Setting

B2B businesses can set credit limits for individual customers or customer groups based on their:

-

Trustworthiness

2. Credit Terms Definition

Businesses can also define credit terms, specifying the duration within which payments must be made.

For instance, they may set a 30-day payment term. This means that customers have 30 days from the date of purchase to settle their invoices.

3. Credit Approval Workflow

Magento 2 may incorporate a credit approval workflow. It is where requests for credit accounts or increases in credit limits undergo review and approval processes.

It ensures that credit is extended responsibly and is in line with the company's risk management policies.

4. Credit Monitoring and Management Dashboard

The platform provides a dashboard or interface where businesses can:

-

Monitor customer accounts

-

View outstanding credit balances

-

Track payment histories

-

Identify any overdue payments.

It centralizes customer credit management tasks and facilitates timely decision-making.

5. Automated Notifications

The Magento 2 store admin can send automated notifications to:

-

Remind customers of upcoming payment deadlines

-

Alert businesses to overdue payments.

These notifications maintain communication with customers and encourage prompt payment. They also reduce the risk of default.

6. Payment Processing Integration

Integration with payment processing systems streamlines payment collection and reconciliation processes. This integration ensures that transactions are accurately recorded and reconciled with financial records.

7. Adjustments and Reporting

Businesses have the flexibility of exceeding credit limits based on changes in:

-

Financial status

-

Other relevant factors.

Furthermore, comprehensive reporting capabilities provide insights into:

-

Credit utilization

-

Payment trends

-

Overall credit risk exposure.

8. Security Measures

Magento 2 may incorporate several security measures, such as:

-

User authentication

-

Role-based access control

-

Encryption of sensitive financial data.

It helps mitigate the risk of fraud or misuse.

Benefits of Magento 2 B2B Company Credit

1. Enhanced Customer Relationships

Magento 2 store credit options can strengthen relationships with customers. It is because they get flexibility in payment methods and terms. It can lead to increased loyalty and repeat business.

2. Competitive Advantage

Company credit differentiates a business from competitors that only accept immediate payments. It may attract customers who prefer credit terms. It helps the company capture a larger share of the market.

3. Streamlined Sales Process

Credit terms established within the Magento 2 platform make the sales process more efficient. Sales representatives can focus on closing deals rather than negotiating payment terms.

It leads to faster order processing and higher customer satisfaction.

4. Improved Cash Flow Management

Extension of credits might be risky at times. Credit allows businesses to maintain cash flow by receiving payments over time rather than all at once. It helps stabilize cash flow and supports ongoing operations and investments.

5. Increased Sales Volume

Credits help businesses increase their sales volume. This is because customers may be more inclined to make larger purchases or order more frequently when they have the option to pay later.

6. Better Inventory Management

Businesses can optimize their inventory management processes with:

-

Increased sales volume

-

Predictable payment schedules.

It will help them forecast demand more accurately. It ensures they have the right products in stock to meet customer needs.

7. Insight into Customer Behavior

The credit management features in Magento 2 provide valuable insights into customer behavior, such as:

-

Credit utilization.

The data helps businesses make informed strategic decisions. It also helps them identify opportunities for growth or areas of risk.

8. Risk Mitigation

Magento 2's b2b company credit feature includes tools for:

-

Assessing creditworthiness

-

Setting credit limits

-

Monitoring payment behavior.

It helps mitigate the risk of non-payment. It also allows businesses to manage credit risk proactively.

9. Efficient Credit Management

The platform's centralized dashboard and automated notifications streamline credit management tasks. It also reduces administrative burden. It minimizes the likelihood of overlooked payments or credit issues.

10. Integration with Financial Systems

It enables the synchronization of credit-related data with accounting software and financial systems. It ensures accurate reporting and facilitates reconciliation processes.

Difference Between B2B Company Credit and Traditional Consumer Credit

| Aspect | B2B Company Credit | Traditional Consumer Credit |

|---|---|---|

| Context | Credit is extended between businesses engaged in commercial transactions. | Credit is extended from businesses to individual consumers for personal purchases. |

| Parties Involved | It involves businesses (creditors) and other corporate entities. | Businesses (creditors) and individual consumers (debtors) are generally involved. |

| Nature of Transactions | It involves larger volumes and higher values compared to consumer transactions. | Generally smaller in scale and involve purchases for personal consumption. |

| Terms and Conditions | Customized payment terms that are negotiated between businesses. | Typically, standardized terms are regulated by consumer protection laws. |

| Risk Assessment | It involves evaluating their business financials, payment history, and viability. | Considers factors such as personal credit score, income, employment history |

Steps to Apply and Update Magento 2 B2B Company Credit

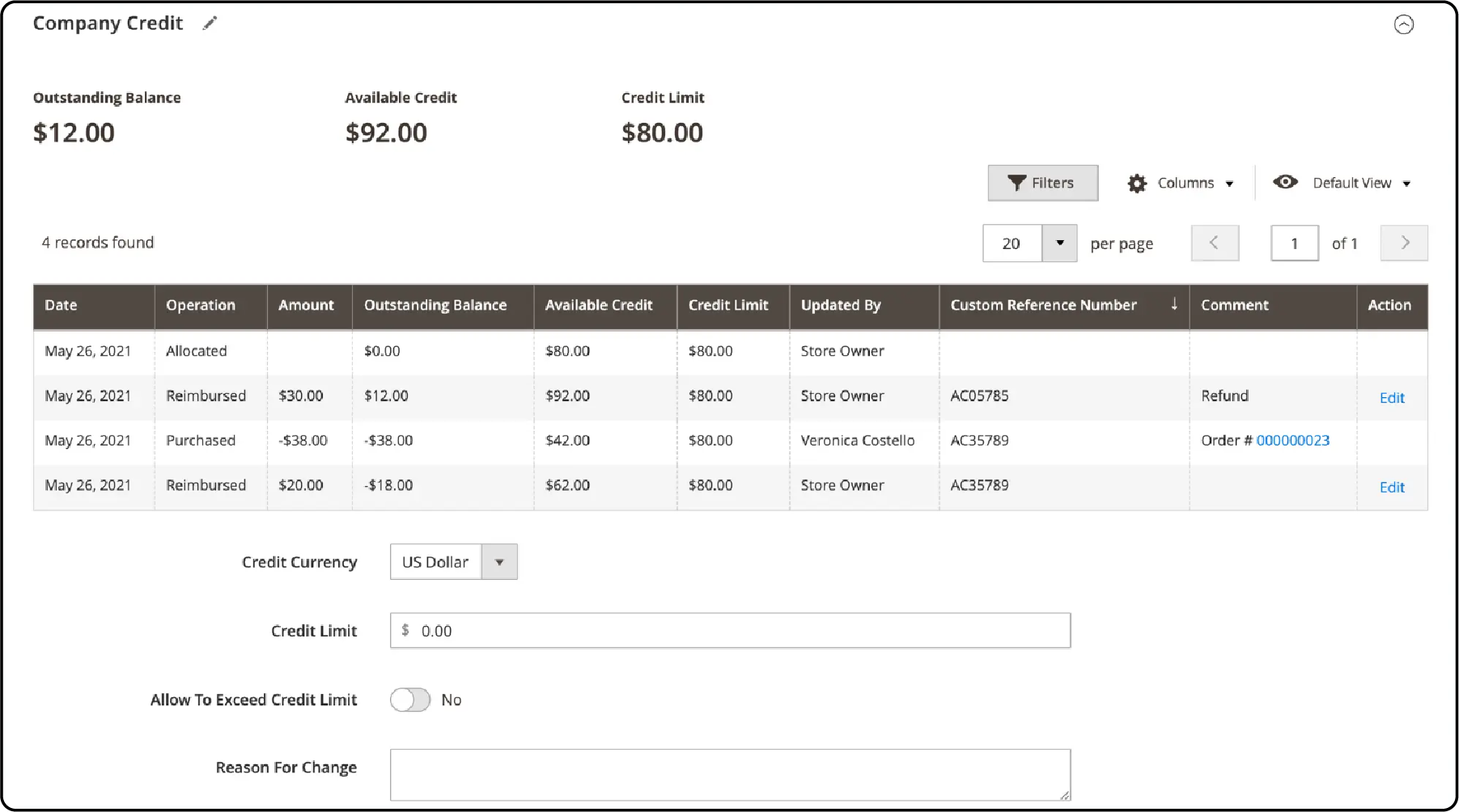

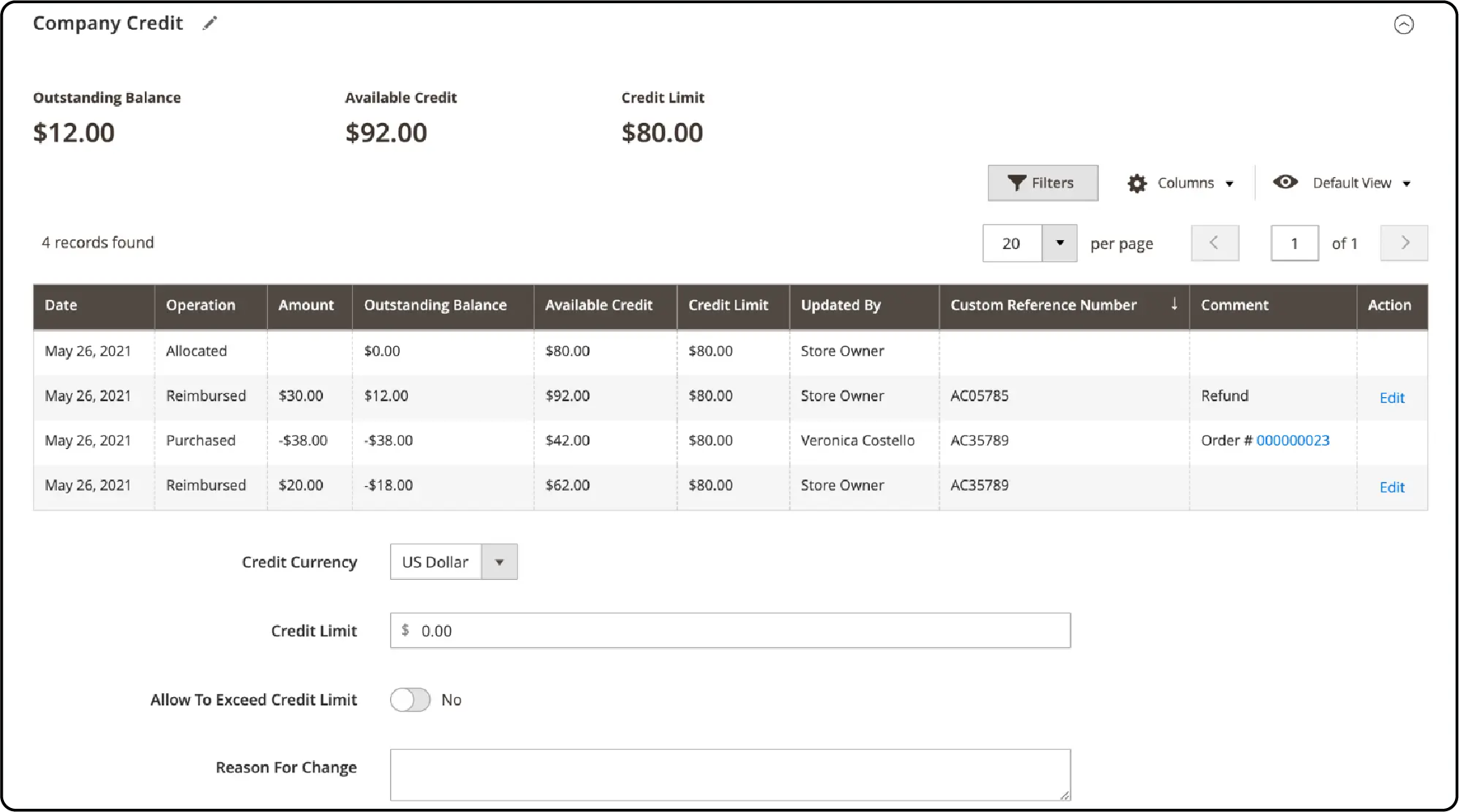

1. Update Credit Information

-

Navigate to the Admin sidebar and go to Customers > Companies.

-

Locate the desired company in the grid and open it in Edit mode.

-

Expand the Company Credit section.

-

Input the new value for Credit Limit in the credit limit tab.

-

Adjust any other necessary values as required.

-

Once updates are complete, click Save to apply the changes.

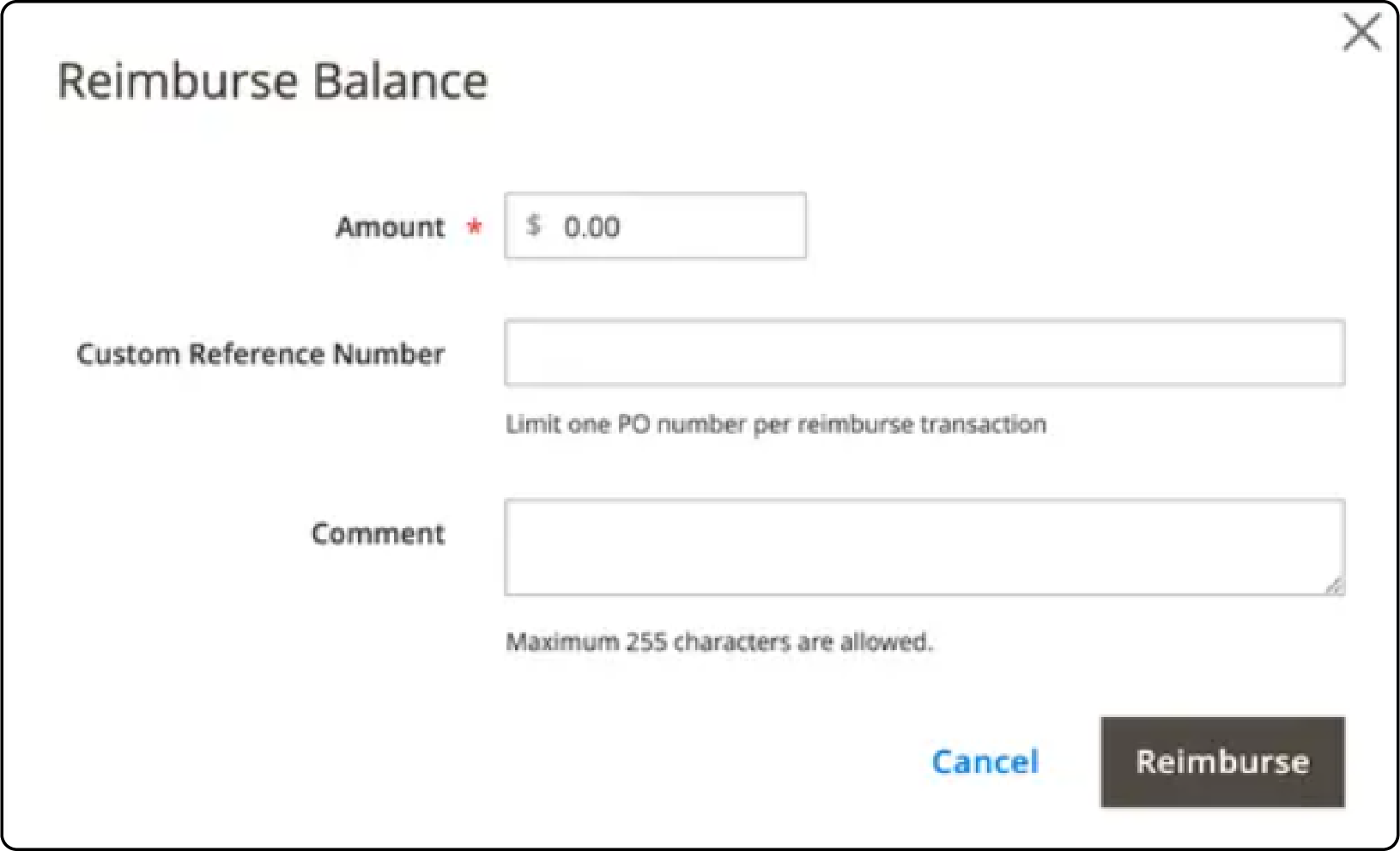

2. Apply Payment to Company Account

-

Go to Customers > Companies from the Admin sidebar.

-

Find the company record in the list and open it in Edit mode.

-

Click on Reimburse Balance, which is located at the top of the page.

-

In the dialog box, enter the payment information:

-

Specify the Amount of the payment (can be positive or negative).

-

Add a Custom Reference Number for reference purposes, if applicable.

Only one custom reference number can be entered per reimbursement. To apply the payment to multiple POs, create a separate reimbursement for each.

-

Enter a Comment to describe the reimbursement if needed.

-

Click on Reimburse to finalize the transaction.

The company's outstanding credit balance and available credit will be recalculated. The Company Credit history will be updated accordingly.

3. Edit a Reimbursement

- Open the company profile in Edit mode.

-

Expand the Company Credit section.

-

Locate the reimbursement transaction in the grid and click Edit.

- Make any necessary changes to the Custom Reference Number and Comment fields.

-

Note that the reimbursement amount cannot be modified.

-

Click Save to save the changes.

FAQs

1. How does the company credit module work within Magento 2?

The company credit module is an extension integrated into Magento 2. It enables B2B companies to extend credit lines to their customers. It operates by allowing companies to set credit limits and manage credit applications.

2. What benefits does the company credit extension offer for Magento 2 users?

The company credit extension for Magento 2 streamlines the ordering process for B2B customers. It also encourages repeat purchases and strengthens customer loyalty.

3. Can the company store credit extension for Magento 2 be customized?

The company credit extension for Magento 2 is highly customizable. Businesses can tailor credit policies, such as credit limits, payment terms, and approval workflows.

4. Is the Magento 2 b2b company credit extension compatible with Adobe Commerce?

The Magento 2 b2b company credit extension is fully compatible with Adobe Commerce. Businesses using Magento Open Source or Adobe Commerce can leverage company credit to offer credit facilities.

Summary

Magento 2 b2b company credit transforms businesses aiming to optimize their B2B transactions. It also uncovers several other points, including:

-

It allows businesses to extend credit to customers, set credit limits, and define payment terms.

-

Magento 2 offers several features, from credit limit settings to automated notifications.

-

The numerous benefits of company credit include improved customer relationships and sales volume.

-

B2B company credit is better than traditional consumer credit in several ways.

-

Businesses can apply and update company credit information through the steps outlined.

Upgrade your B2B transactions with Magento company credit and enhance your Magento store's performance with managed Magento hosting.